Here’s a matter of national importance. Chocolate prices are on the rise. The world’s largest chocolate manufacturers warn that the world is running out of cocoa. Is it really true, or just hype?

Here is an issue of national importance: A chocolate shortage.

“The world could be heading toward a global shortage of chocolate” – Time

“Cocoa shortage worries chocolate lovers” – NBC News

“Worlds largest chocolate manufacturer warns of potential cocoa shortage” – The Independent

“Is a chocolate shortage on the way” – USA Today

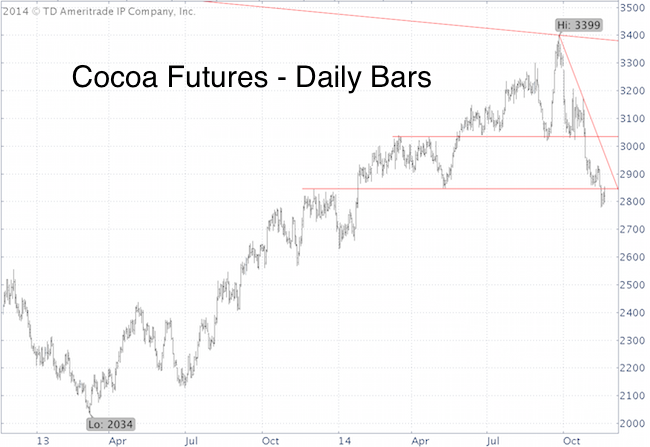

The price of cocoa soared 67% from March 2013 to September 2014.

Mars, the makers of M&M’s and Snickers, announced in July it would raise prices by an average of 7%.

However, since September, cocoa prices have fallen 17%.

Is this drop an opportunity to invest in cocoa or is the cocoa shortage all hype?

There are legitimate reasons for cocoa demand to outstrip supply:

- Dry weather in West Africa. Africa is responsible for 70% of the world’s production

- Deadly fungi like frosty pod and witches’ broom

- A growing taste for chocolate by emerging countries

- Ebola

We’ve seen a number of commodity ‘shortages’ in recent years. There was corn (ethanol as alternative fuel source) and wheat. Both are trading at or near multi-year lows today.

Based on the current media hype, I wouldn’t be surprised to see a bit more cocoa weakness.

The chart says that cocoa prices need to exceed 2,845 (that’s $2,845 a ton) and the descending red trend line to break the most recent down trend.

There are two cocoa ETF/ETNs:

- iPath Dow Jones-AIG Cocoa Total Return Sub-Index ETF (NYSEArca: NIB)

- iPath Pure Beta Cocoa (NYSEArca: CHOC)

Perhaps the Federal Reserve will unleash a quantitative eating program to increase liquidity. After all, Wall Street is a big consumer of cocoa, especially around the holidays.

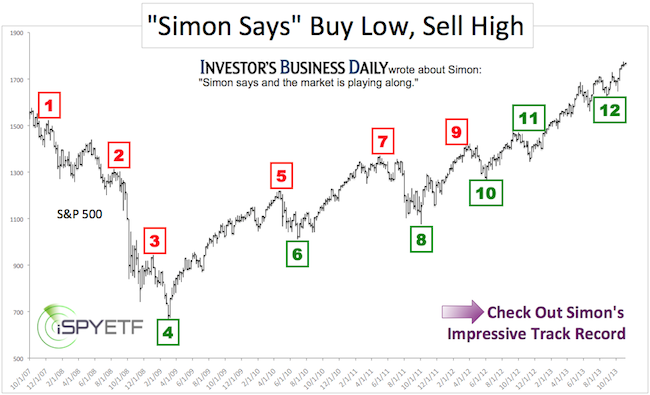

Simon Maierhofer is the publisher of the Profit Radar Report. The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.