[There’s a much better China post just put up at Econlog.]

Here’s a typical news story about China:

Red-handed: China province admits faking economic data

A Chinese official has admitted his province falsified its economic data for years, state media said Wednesday, vindicating long-held suspicions that China has been cooking the books.

So why do I believe the Chinese GDP data? Lots of reasons:

1. This headline refers to provincial data. For years, if not decades, the Chinese central government has admitted the provincial data is inflated. For any given year, if you take an average of provincial GDP growth rates you end up with a figure that is substantially above the national growth rate. How is that even possible? The answer is simple; the national government knows the provincial data is inflated (as provincial officials are given promotions based on success in boosting GDP) and hence the national figures are developed using a completely different data set.

2. How plausible is it that Chinese GDP would keep growing at the same astronomical rate, year after year? Not very, but that’s not what the data shows. RGDP growth has slowed from over 14% in 2007, to 10.6% in 2010, to about 6.7% today. In contrast, US GDP growth has stayed right around 2% every single year since 2010. It’s true that quarter-to-quarter changes in China are small, but that’s partly an artifact of their smoothing technique (reporting year over year figures) and partly due to China’s size and high degree of diversification. Also keep in mind that if the level of Chinese growth were inflated by, say, 13.7% every single year, due to reporting biases, then the growth rate would not be distorted at all. You need increasing distortions to consistently inflate growth.

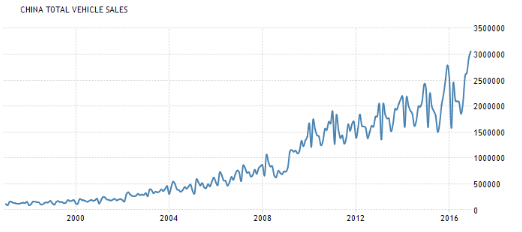

3. Everywhere you look, you see micro level data that tells a story of extraordinary growth. China going from a trivial part of the global economy, to a place that absorbs almost 1/2 of global output of key commodities. A place where auto sales have exploded:

Note that these figures would be almost impossible to fake, as they are also available broken down by company. Would Ford, GM and VW be telling their stockholders completely phony stories of massive auto sales growth in China?

Note that these figures would be almost impossible to fake, as they are also available broken down by company. Would Ford, GM and VW be telling their stockholders completely phony stories of massive auto sales growth in China?

Everywhere you look you see a similar story, an explosion of urbanization. Infrastructure built at a phenomenal rate. The China I visited in 2009 was a completely different country from the China of 2002. Here’s an example:

To appreciate the extent of China’s high-speed rail ambitions, take Mr Gu’s dreams and multiply them many times over. Less than a decade ago China had yet to connect any of its cities by bullet train. Today, it has 20,000km (12,500 miles) of high-speed rail lines, more than the rest of the world combined. It is planning to lay another 15,000km by 2025 (see map). Just as astonishing is urban growth alongside the tracks. At regular intervals—almost wherever there are stations, even if seemingly in the middle of nowhere—thickets of newly built offices and residential blocks rise from the ground.

Ditto for the world’s largest expressway system, built almost overnight. Enormous growth in subways, airports and other types of infrastructure.

Yes, there are sectors like steel and coal that have recently struggled, but there are also sectors growing faster than average, such as services, which is now more than 1/2 of GDP.

Obviously I don’t know that RGDP growth in China is exactly 6.7%, but I also don’t know the exact growth rate in India, the US, and especially in Ireland. All GDP data is flawed. But when you look at the spectacular changes occurring in China, a figure of 6.7% seems very reasonable.

PS. The Economist article on China’s high-speed rail is excellent, with the first half devoted to its successes and the second half to its wasteful excesses. They consistently have some of the most balanced pieces on China. If you simply read China bulls or China bears, you will have no idea what’s actually going on in the country.