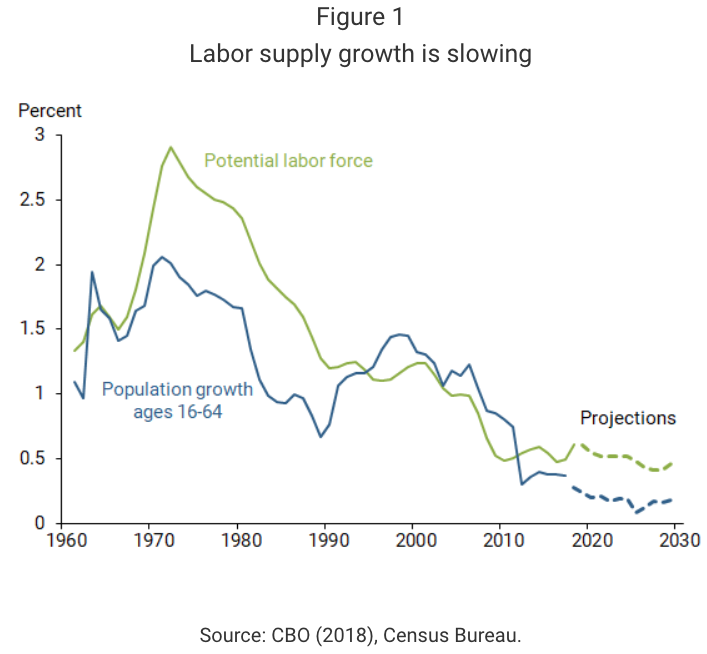

Five years ago, I suggested that the new normal was 3% NGDP growth, which included 1.2% RGDP growth and 1.8% rise in the GDP deflator. A few years later I realized my growth forecast was a bit too low, and raised it to 1.5%. Now the San Francisco Fed has come out with a new article suggesting that 1.6% growth is the new normal. This includes the CBO’s estimate of 0.5% growth in the labor force going forward and the 1.1% average rise in productivity since 2004.

In fact, RGDP growth has averaged 1.67% over the past 12 years. That’s during a period where the unemployment rate has actually fallen somewhat, so it’s not “cyclical”. And bond markets are signaling slow growth ahead.

My initial estimate of 1.2% was too low because I forgot to include rising employment levels among baby boomers who were over 65. The SF Fed piece has a nice graph, which shows that the growth rate of the labor force rises from 0.2% to 0.5%, once you include the old people who continue working:

Caroline Baum points out that there are two ways that growth could pick up:

And it appears that, short of some new, new thing that ushers in the next productivity wave or comprehensive immigration reform that encourages labor-force growth through initiatives such as a start-up visa, the new normal will be with us for a while longer.

Since we don’t know why productivity growth was so high during 1995-2004, I’m reluctant to say that it could not happen again. But I’m a market monetarist, so I’ll go with the bond market. The most likely outcome is that developed countries will continue on this slow growth track for quite some time.

And no, monetary policy cannot fix the problem, as we learned in the 1970s. We need supply-side policy reforms. A good place to start next Monday is replacing all taxes on capital income with consumption taxes on the rich plus a carbon tax. Then on Tuesday repeal all zoning and occupational licensing laws. On Wednesday we should triple the rate of immigration. On Thursday repeal all rent controls. On Friday replace minimum wages with low wage subsidies. Saturday we should slash public spending (and tax subsidies) on health and education to Singaporean levels. Then take a breather on Sunday.

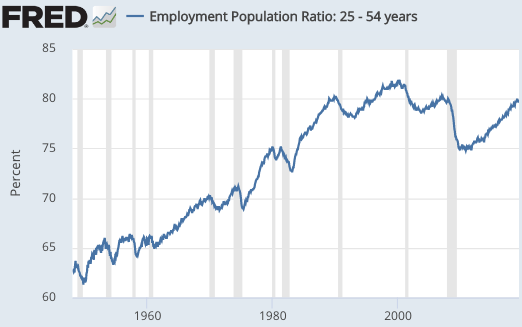

PS. The prime age employment ratio has risen from 75% during the recession, back up to the pre-recession level of 80%. I expect it to level off in the low 80s. We need more immigration or productivity for fast growth.