I managed to catch up with my friend, Harry Dent, the other day, the guru on all things demographic (click the following link for his site www.hsdent.com/). Regular readers of this letter are well aware of the enormous headwind impeding all assets classes caused by the retirement of 80 billion baby boomers, which started in earnest at the beginning of 2012. With only 65 million Gen Xer’s of the following generation to buy their assets, prices could only head southward, as they have for the past six years.

My question for Harry was “When does the headwind turn into a tailwind?” That would indicate when demographics shift from a barrier to asset price appreciation to an accelerant. Of course, Harry had the answer on the tip of his tongue: 2023. That is the year when baby boomers cease to be a drag on the economy, safely ensconced in nursing homes, wondering if their diapers will get changed on time.

That will leave 65 million Gen Xer’s chased by 85 million millennials trying to buy their assets, triggering a 13-year boom. A labor shortage will ensue, driving up wages, boosting consumer spending, and igniting another real estate boom.

Globally, the picture is a little more complicated. Demographically, China and Europe will become dead weight from 2036, cutting into growth at home. The US will then experience a 12 year echo boom from 2045, taking growth rates back up. There are exceptions. Rapid population growth and rising standards of living are expected to keep India strong all the way to the late 2060’s.

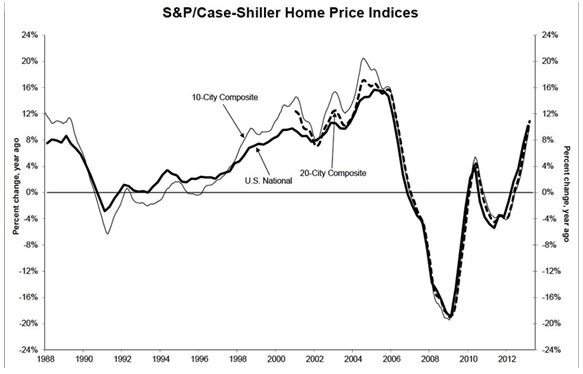

The biggest question of the decade for investors will be when the markets start to discount the great economic boom starting in 2023. Look at the last cycle for some clues. While the first baby boomer hit retirement age on January 1, 2012, the financial markets started to roll over five years in advance, in 2007, while the less liquid real estate market topped out six years ahead of schedule, in 2006. Check out the Case-Shiller chart below to see that I’m right.

This timing suggests that you should buy your new home in 2017, and load your portfolio with high beta risky stocks in 2018. But that is only if history repeats itself. Until then, try not to go broke.