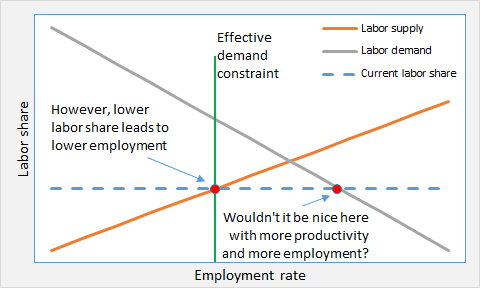

More on the labor-market model using labor share. I want to look at productivity to make the case that the labor supply curve is actually the effective demand limit in the model. (link to previous article)

Start with the equation…

labor share = real wage/productivity

We have all seen that over the years, real wages have not kept pace with productivity. OK… we have seen the fall in labor share.

As productivity increases, labor share falls. We move down and to the right on the labor demand curve. More labor is demanded with productivity increases. Labor is relatively cheaper. More productivity would imply more employment from a demand perspective.

Yet what happens on the labor supply side? More productivity will lead to less labor being supplied. Labor is cheaper and some people choose not to supply their labor at a lower price. They may choose to be employers of labor instead.

But there is a flip-side to the labor-market model above. The flip-side is the consumption market. The labor supplied in the model above becomes the consumption demand in the consumption market. Lower labor share becomes lower demand for consumption. The upward sloping labor supply curve reflects the demand constraints from lower labor share. That is the effective demand limit.

For example, let’s say that labor share is dropping and labor demand increases to the right beyond the crossing point of supply and demand. Let’s say that increased employment gives increased production. More employment means more consumption, right? Labor demand would be happy right? Isn’t labor supplying all that the firms desire? And still, more people are being employed. Isn’t this what Krugman, Baker and others want? Don’t they want more employment in spite of the lower labor share? Are they not envisioning an unemployment rate to the right of the labor supply curve? Well, their logic implies that labor share would increase if employment was pushed beyond its natural limit. Well, ok… but the model above shows that as labor share increases, less labor would be demanded and we would return to the crossing point of supply and demand anyway. Thus, there is an effective demand limit upon employment.

In the above model, the labor supply curve is actually the effective demand limit curve.

You will not be able to have a “free-market” situation where labor is supplied to the right of the labor supply curve. Why?

Firms would be producing beyond the capacity of labor to purchase the production. Profit rates would start to drop and firms would back off from hiring the relatively cheaper labor. Production would have to decrease either by reversing productivity gains or by paying higher real wages relative to productivity. (see labor share equation above) Either way you would return to the labor supply curve. A lower unemployment rate would not manifest, unless it was war-time or some forced-labor type economy.

So productivity has its effective demand limit. Krugman and others do not see this yet.

In a related article by Yang Liu, she talks about the higher unemployment and labor shortage in China. She asks the question of how you can have labor shortage and higher unemployment together. Her answer revolves around matching efficiencies. But the model above explains the conundrum too.

China has been pushing productivity to higher and higher levels. Labor share there has fallen tremendously over the years. Basically real wages have not kept up with the productivity gains. No surprise there. So what is going on? As Chinese productivity continues to increase, China is pushing down and to the left on the labor supply curve. Unemployment will tend to increase (at least not decrease). But also you will see more people leaving the labor market. As she says in her article, there is great demand for labor. Well, yes, when labor share is low, labor demand is greater. But there is an effective demand limit in China too. There must also be many firms that are not hiring which balances in the aggregate the firms that want to hire. For all that the Chinese firms would love to have endless cheap labor, they have hit the effective demand limit of their labor supply. Profit rates will decline if they push further. This coincides with the United States currently hitting its own effective demand limit, since the United States is a large part of the Chinese economy.

My view is that China and the United States are going to trip over the effective demand limit. They are simply trying to push employment beyond labor supply’s effective demand limit. They do not see the limit. But with each passing day, they will see it within the next 9 months.