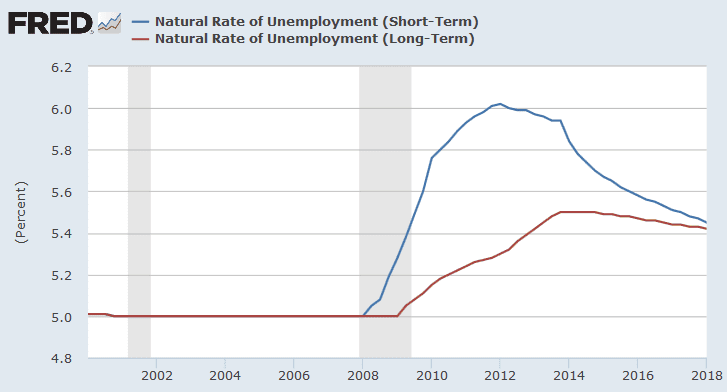

It is commonly known that the CBO projects potential output, but they also have 2 measures for the natural rate of unemployment… a Short-term & a Long-term rate. (link)

The description at FRED economic data says…

“The natural rate of unemployment (NAIRU) is the rate of unemployment arising from all sources except fluctuations in aggregate demand. Estimates of potential GDP are based on the long-term natural rate. (CBO did not make explicit adjustments to the short-term natural rate for structural factors before the recent downturn.) The short-term natural rate incorporates structural factors that are temporarily boosting the natural rate beginning in 2008. The short-term natural rate is used to gauge the amount of current and projected slack in labor markets, which is a key input into CBO’s projections of inflation.”

In the description we see that potential GDP is based on the Long-term NAIRU… while slack in the labor markets is measured by the Short-term NAIRU. Therefore, potential GDP shows more slack than the labor market shows. Does that sound confusing? Well, one just needs to know which measure is being used to determine slack.