Small cap stocks tend to outperform large cap stocks starting in mid-December. After an incredible second half of December, stocks hit a wall and started to tumble and investors’ guts are being tested.

The December 15 article “Small Caps – The December ‘No Guts No Glory’ Trade?” identified buy levels for the iShares Russell 2000 ETF (NYSEArca: IWM).

Small cap stocks have a tendency to outperform large cap stocks for a fairly short period of time starting in mid-December.

Executing this trade took guts this year around, because the first half of December was pretty rough for stocks.

Nevertheless, in the middle of the month stocks bounced back strongly and the Russell 2000 started outperforming the S&P 500.

The chart below plots the SPDR S&P 500 ETF (NYSEArca: SPY) against the iShares Russell 2000 ETF (NYSEArca: IWM).

The Russell 2000 peaked on December 31, but the price action going into this high didn’t look right.

The December 30 Profit Radar Report warned that: “The Russell 2000 is near it’s all-time high, but RSI is lagging severely. We are closing out the IWM trade for a 5.3% gain.” We closed all are long equity position out at the same time.

Small caps (IWM) are holding up better than large caps (SPY), but we are glad to be out of stocks in general.

A more detailed 2015 S&P 500 forecast is available here: Initial 2015 S&P 500 Forecast

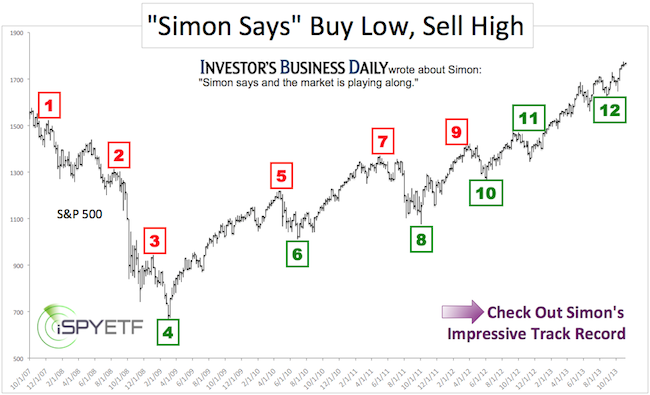

Simon Maierhofer is the publisher of the Profit Radar Report. The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.