In the US, labor compensation is about 52% of nominal gross domestic income (or NGDP.) Another 26% is capital income, 15% is depreciation and 7% is indirect business taxes such as sales and excise taxes. (Income taxes are of course a part of labor compensation, and corporate income taxes are a part of capital income.)

I don’t recall ever seeing an economist propose targeting aggregate nominal labor compensation (NLC), and I’m not exactly sure why. The purpose of this post is to figure out where that sort of policy target is likely to fail. Because no one is proposing NLC targeting, it’s presumably a bad idea. I am especially interested in how it compares to inflation targeting, NGDP targeting, etc. By the way, don’t be fooled by the fact that NLC is only 52% of NGDP. Depreciation is extremely inertial, and hence of little interest in business cycle analysis. Sales taxes tend to follow the economy. The two key components are labor and capital income, and NLC is 2/3rds of that aggregate.

Let’s start with one stylized fact that almost everyone accepts. Nominal hourly compensation looks very sticky. That doesn’t mean it is sticky, just that it tends to be much less volatile than NGDP. My NLC targeting proposal is based on the assumption that hourly wages would not become more volatile if NLC was targeted (indeed I’d expect wages to become less volatile.)

If hourly comp remained fairly stable, and the Fed targeted NLC, then total hours worked would also become relatively stable. However RGDP might still be somewhat volatile, if productivity was unstable. And even if RGDP was stabilized, inflation might become more unstable.

So I can think of three arguments against stabilizing NLC:

1. The Lucas Critique—as soon as you start targeting NLC, negotiated wages would become very unstable.

2. When hours work stabilize, there would still be output instability due to productivity shocks.

3. Inflation might become more unstable.

Are there other potential problems?

FWIW, here’s my intuition on the three possible problems:

1. I can’t imagine why stabilizing NLC would make hourly wages more unstable. It might, I just don’t see the mechanism. I’d expect the opposite.

2. I view instability in hours worked (i.e. unemployment) as THE business cycle problem. It’s the sine qua non of old Keynesian economics. I see no reason to assume that variations in output for any other reason are suboptimal. In other words, the RBC model is probably the appropriate way to think about output variations not caused by involuntary unemployment.

3. If inflation is the proper way to measure the welfare cost of nominal instability (and I doubt it is) then surely core inflation is more useful that headline inflation. I can’t imagine any welfare costs flowing from fluctuations in flexible food and energy prices. And isn’t core inflation closely linked to wage inflation? Which leads back to point one.

In other words, I have a hard time imagining where a NLC target would fail. Hours would become more stable, and core inflation would remain well behaved. There’s probably enough wage flexibility in the long run to accommodate gradual changes in the labor force associated with declining birthrates, etc. I actually find it easier to visualize a NGDP target failing than a NLC target failing, especially for small un-diversified economies. For the US, I’d expect a NLC and NGDP target to produce very similar results. If one were highly effective, the other would be too.

Then why even bring up the NLC target? Because it’s easier to visualize the “musical chairs model” using NLC shocks than NGDP shocks. It simplifies things, as you no longer have to model the impact of changes in NGDP on NLC. You model the growth rate of the total revenue used to compensate labor (monetary policy), assume nominal hourly wages are sticky, and you end up explaining employment. What could be simpler?

PS. Back in 2013 Miles Kimball and Matt Rognlie had a very good discussion of the relative plausibility of sticky-wage and sticky price-based models. Both make excellent points, but Matt’s defense of the sticky-wage assumption is as good as I’ve ever seen. I’d like to think that if I were 30 years younger and 30 IQ points higher I would have made similar arguments.

PPS. Between mid-2008 and mid-2009, NGDP (actually NGDI) fell by 2.9%, NCL fall by 3.8%, capital income fell 2.4%, business taxes fell by 2.3% and depreciation fell by 0.2%.

PPPS. One area where NGDP targeting might be better than NLC targeting is financial market stability. NGDP is the total income available to repay nominal debts. As noted earlier, however, the two are highly correlated.

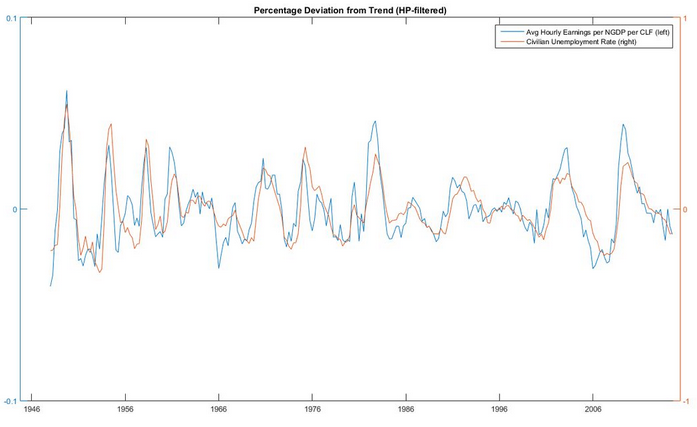

Update: Commenter Rob sent me a graph with unemployment compared to W/(NGDP/Labor Force). He smoothed it using the Hodrick-Prescott filter.