The headlines on today’s CPI jump of 0.4% are all over the map. If you want a slant one way or another you can find it.

For example:

- Reuters says U.S. consumer prices post largest gain in more than two years.

- Bloomberg says U.S. Consumer Prices Fall Short of Expectations at 0.4%

In reality, this is pretty much an expected jump due to rising gasoline prices.

The above Bloomberg headline is all the more interesting because the Bloomberg Consensus Estimate was nearly spot on at 0.5%.

I have been mocking economists’ estimates for most of the year, but it seems to me they got this one correct. The entire consensus range was reasonable for a change.

From Bloomberg Econoday:

Just about all the readings in the May consumer price report point to very soft price pressures with the overall monthly gain, at plus 0.4 percent, and the ex-food ex-gasoline core gain, at only plus 0.1 percent, at or near the low-end of the Econoday forecasts.

The 0.4 percent overall gain may look a bit high compared with prior months including April’s 0.1 percent rise, but it reflects an unsurprising jump in energy costs specifically gasoline which jumped 10.4 percent in the month. But energy prices are still very low, confirmed by the year-on-year rates which for all energy products are down 16.3 percent and for gasoline, down 25.0 percent (no misprint).

But the look at the year-on-year rates shows one element of pressure, a plus 1.7 percent rate for the core. This is down from 1.8 percent in April but is still skating a bit close to the 2.0 percent hawk barrier at the Fed. The overall year-on-year rate, however, is as benign as can be at zero percent.

Components of note include a second month of declines for apparel, down 0.5 percent in May after falling 0.3 percent in April which is not good news for the nation’s retailers. Education & communication also fell, down 0.1 percent. Showing pressure is a 2.7 percent rise for transportation that reflects a jump in airfares. This follows, however, a 0.3 percent dip in transportation for April. Food costs and housing costs show no increase in May.

The lack of pressure through most of this report gives the Fed plenty of waiting time before raising rates, especially given what have been even more benign rates in the more closely watched PCE index.

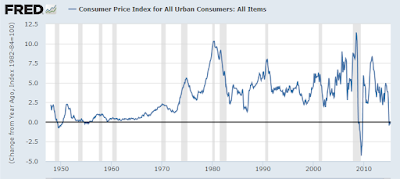

Year-Over-Year CPI

Debt Deflation Dynamics

Year-over-year prices are benign, but the CPI ignores asset inflation in stocks, land, homes, bonds, etc. On that basis, inflation is hardly benign.

Moreover health-care is hardly benign, and probably under-reported. Finally, one can and should question food substitution and other anomalies that suppress the stated rate.

The real problem though is asset inflation. When various bubbles pop, rate hikes by the Fed are going to come much slower than economists expect.

Even after the housing bust, few economists understand the dynamics of debt-deflation, bubbles popping, and the overall burden of debt itself.

Round after round of counterproductive QE created asset bubbles, but most economists (including the Fed) will not see the problem until those bubbles pop.

Mike “Mish” Shedlock

http://globaleconomicanalysis.blogspot.com