– Is the apparent calm of the West a signal of latent instability?

– Increasing symptoms of instability in West as proposed by Nassim Taleb

– Wider public and mainstream press believe “experts” have everything under control

– Black Swan approaches and we may be experiencing “the calm before the storm”

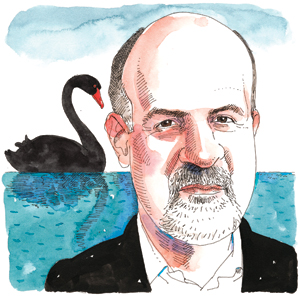

Western countries are increasingly displaying symptoms of instability as described by Nassim Taleb, the author of the The Black Swan, ever since the publication of an essay written with Gregory Treverton entitled “The Calm Before the Storm.”

The piece was published in the January/February edition of Foreign Affairs – the official magazine of the Council on Foreign Relations.

In their essay, Taleb and Treverton highlight five characteristics that could help identify states that – while appearing stable on the surface – may actually be quite fragile.

“Fragility”, they write, “is aversion to disorder”. Under this criterion they view Italy as a stable state.

The five characteristics they view as major factors in instability are:

– centralised decision making,

– lack of economic diversity

– high levels of debt and leverage

– absence of political variability

– lack of track record in surviving shocks

“Italy, paradoxically, shows no signs of fragility. It is effectively decentralized and has bounced back from perennial political crises. It also experiences a great deal of harmless political variability, cycling through 14 prime ministerial terms in the past 25 years.”

With regards to centralised decision making the article points to the autocratic Arab states which while appearing strong on the surface quickly succumbed to the “Arab Spring” uprisings before degenerating into chaos – albeit compounded by external influences.

“Although centralization reduces deviations from the norm, making things appear to run more smoothly, it magnifies the consequences of those deviations that do occur. It concentrates turmoil in fewer but more severe episodes, which are disproportionately more harmful than cumulative small variations.

In other words, centralization decreases local risks, such as provincial barons pocketing public funds, at the price of increasing systemic risks, such as disastrous national-level reforms.”

“On the other hand, Switzerland – often viewed as a model of stability -is composed of multiple smaller semi-autonomous states.”

Other states they look at are Middle Eastern, African and China.

Recent events would suggest that EU is increasingly centralising authority and decision making in Brussels. Indeed, Greek Prime Minister Alexis Tsipras recently stated that Greece’s creditors had made it clear that bailed-out countries had no right to self determination.

In terms of economic diversity, the authors warn of the risks associated with over-reliance on a particular sector such as tourism and on a single commodity or industry. The cite Botswana’s over-reliance on the diamond trade and Japan’s car manufacturing sector.

Over-reliance on any sector has obvious implications. “Specialization makes a state more vulnerable in the face of random events.”

An African country that is completely reliant on cocoa production, for example, is vulnerable to the predations of large confectionary corporations who can demand unreasonably low prices leading to hardship, poverty and civil unrest.

The U.S. is slightly vulnerable in this regard having relocated the bulk of its manufacturing sector overseas in recent years although it remains well diversified.

The entire western world is incredibly vulnerable to the third factor – over-indebtedness – which is described as “the single most critical source of fragility.”

Since the 2008 crisis – caused by excessive debt – global debt has increased by one third. In May the McKinsey Institute reported that total global debt was now around $199 trillion – $27,204 for every person alive today.

The U.S. is particularly vulnerable in this regard. It’s total Federal debt is over $18 trillion while its GDP is estimated to be $17.71 trillion. At the same time its unfunded liabilities are estimated to be a more than a staggering $100 trillion – a sure source of instability as these payments come due.

According to the authors, political variability contributes to stability “by responding to pressures in the body politic”. While western leaders like to promote the notion of political pluralism it is clear from the consistently low levels of participation of voters at election time that the people who live with the consequences of their decisions that the public do not generally see credible alternatives.

It becomes increasingly apparent that decisions are made by lobby groups and vested interests only to be rubber stamped by governments of varying persuasions.

How the fifth characteristic pertains to the western world is more difficult to identify.

What constitutes a major shock and what constitutes a survival of a shock? Can the Western world be said to have experienced a major shock in the post war period prior to the 2008 crisis? Can they be said to have survived that shock when in reality they appear to be on life-support? It is true that the powers that be have done a remarkable job at averting the day of reckoning but does that constitute a track record of surviving shocks?

The authors believe that exposure to any one of these factors is a symptom of instability. They add that exposure to multiple factors presents an exponential increase in risk.

The wider public and the press seem unjustifiably complacent at this time. It seems likely that the seemingly unending “recovery” is simply the calm before the storm.

The article in Foreign Affairs can be read here

Must read guide: 7 Key Gold Must Haves

MARKET UPDATE

Today’s AM LBMA Gold Price was USD 1,115.75, EUR 1,047.58 and GBP 739.09 per ounce.

Yesterday’s AM LBMA Gold Price was USD 1,153.20, EUR 1,046.89 and GBP 745.27 per ounce.

Yesterday, gold fell $2.70 to $1,155.20 an ounce and silver slipped $0.12 to $15.38 an ounce. Gold in Singapore for immediate delivery traded sideways as did gold in Switzerland.

Silver for immediate delivery was 0.2 percent lower at $15.41 an ounce, dropping for a third day. Spot platinum climbed 0.5 percent to $1,031.51 an ounce, while palladium advanced 0.6 percent to $656.95 an ounce.

Breaking News and Research Here