Yesterday, ECB left unchanged their key policy rates. Updating my central banks’ policy charts,

First, current policy rates for major advanced economies:

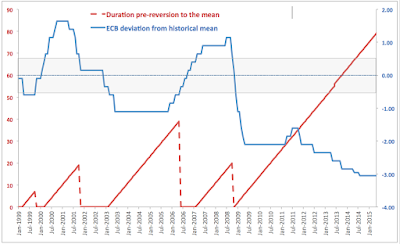

Next: duration and magnitude of rates overshooting (target range set outside mean (pre-crisis period, Euro coverage) +/-1/2 STDEV)

We are now into 80th consecutive month of interest rates statistically outside the mean range, with magnitude of deviation of some 3.05% down on the mean. This implies mean-reversion (increase in the rates) of between 2.70-3.4%.

Meanwhile, 12 mo Euribor margin over policy rates is up to 0.119% in Jul (to-date) compared to 0.113% in June. Corporate rates for new loans (>1mln Euro and 1-5 years duration) margin over ECB rate was up at 2.28% in May compared to 2.03% in April. May was the month when direction of Euribor margin diverged from direction of corporate loans margin, implying increase in banks margins.

Overall, the above shows that pressure on rates reversion to the mean is building up, while banks margins were improving (though we only have data through May on this). Nonetheless, banks margins are down on 2012-2014 averages, implying that more of the costs of any mean reversion in policy rates under current conditions will have to be absorbed by the borrowers.

Good thing, ECB is in no rush to get ahead on rates increases, yet…