Any way you slice it, it was a big bet.

I’m talking about the legendary wager Warren Buffett made with hedge fund manager Ted Siedes a decade ago.

You may recall this $500,000 gamble. It went like this: if hedge funds could beat the S&P 500 over a decade, Siedes would win. If not, Buffett would win.

The result: the index crushed the funds Siedes chose, prompting him to concede defeat last May.

He went down fighting, though, writing that it was the hedge funds’ global focus that caused them to underperform, not the prevailing “wisdom” that stock picking is little more than gambling.

That poured gas on a debate that’s gotten heated in the last couple years. Thanks to steady returns from the S&P 500, many people think you can’t beat buying a low-cost index fund, like the SPDR S&P ETF (SPY), and simply tracking the market.

There’s just one problem: they’re completely wrong. And below I’m going to show you 5 funds that have done exactly that, including two showing a dead-giveaway signal that they’ll keep on doing so.

First, if you’ve been reading my columns on ContrarianOutlook.com, you know I’ve written at length about the many funds that crush the S&P 500.

It’s like shooting fish in a barrel! Right now there are 2,410 closed-end funds, ETFs and mutual funds that have beaten the index in the last decade. That’s a lot of funds doing the supposedly impossible!

In fact, there are so many funds beating the S&P 500 that you can build a fund portfolio that will stand up to major downturns while also beating the S&P 500 in good years, like the current one.

The secret is to piece together a diversified collection of specialty funds that takes advantage of their managers’ astute stock-picking skills.

That means picking a tech fund run by people who really get tech, for example, or a municipal-bond fund managed by pros who get first access to the best, highest quality “munis.” Or maybe a small-cap fund run by analysts who live and breathe emerging industries.

If you can do that, odds are you’ll cobble together a fund portfolio that beats the market.

And if you’re worried about fees, don’t be: all of our incredible 2,410 have earned their keep, crushing the index with fees included. (Click here for my analysis of the many things most investors get wrong about fund fees.)

5 Superstar Funds

Now let’s get on to 5 funds that are some of the best performers in the world, thanks to their killer management teams. They all specialize in a particular sector or asset class, so our first fund, T. Rowe Price’s Global Technology Fund (PRGTX), is managed by financiers with a lot of special knowledge on all things tech.

Similarly, the Prudential Jennison Health Sciences Fund (PHSZX) uses its analysts’ scientific expertise to bet on emerging drug makers and other biotech mavens. Then there are the Fidelity Select Software & IT Services Portfolio (FSCSX) and Columbia Seligman Communications and Information Fund (SCMIX), which do the same for their own areas of tech and telecom, respectively.

Finally, we’ll round our portfolio out with a cross-sector fund focusing on small, emerging and fast-growing US companies: the Brown Capital Management Small Company Fund (BCSIX).

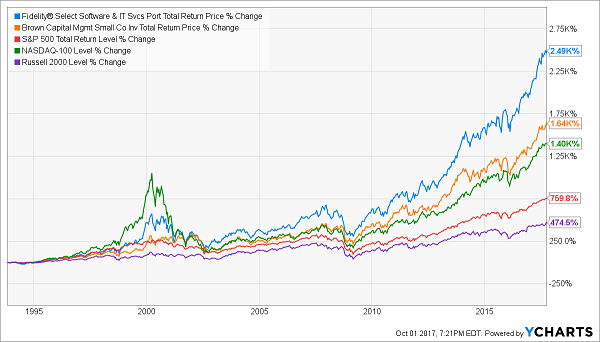

When we put these funds together, we get a track record that crushes the S&P 500. It also beats the small cap index, represented by the iShares Russell 2000 ETF (IWM), and the tech-only Nasdaq 100, tracked by the PowerShares QQQ Fund (QQQ).

Both of these indexes, while beating the S&P 500, are still far behind our sector-only picks over the last decade, and still slightly behind the more diversified Brown Capital fund:

A Clear Win for Active Management

In short, by taking advantage of their managers’ sector-specific skillsets, these specialty funds delivered much more wealth than you would have pocketed by just following the index. As lazy as passive investing is, it also produces lazy results—but these specialists’ harder work resulted in bigger returns.

Here’s where things get really interesting: of these 5 funds, the oldest are Fidelity’s FSCSX and Brown Capital’s BCSIX, which go back to 1992. With a track record of more than 25 years, both of these funds have easily beaten the supposedly unbeatable S&P 500 over a very long period of time:

2 Funds Custom-Built for the Long Haul

Note how these funds also trounced their indexes—the Russell 2000 for BCSIX and the Nasdaq 100 for FSCSX. No matter how you look at it, they’ve delivered market-beating returns for over a generation, no matter what the conventional wisdom says about how tough it is to beat the market.

The big question, of course, is can FSCSX and BCSIX keep beating the market?

To get a sense of the answer, we need to look at whether their trailing annualized returns have gotten worse over time. A quick look at this chart shows that this isn’t the case:

A Model of Consistency![]()

While noisy, the stable pattern of this heartbeat-type chart indicates that each fund is still earning roughly the same annualized returns as it did back in the 1990s—in fact, there’s no noticeable decline in returns, although the Fidelity fund looks like its annualized gains are down from the mid-nineties. Don’t be fooled! That’s only because the chart above starts with a rapid upswing. In reality, annualized returns have stayed incredibly stable for decades.

This chart tells us we aren’t seeing the funds’ performance deteriorate versus some past glory days—and their ability to beat the S&P 500 hasn’t gone anywhere.

Clobber the Market and Pocket a 7.4% Dividend Too!

These 5 funds are all run by top-notch pros, but that’s still not enough to get them on my personal buy list.

Why?

Because they pay zero dividends!

And steady CASH payouts are too important to ignore, especially when it comes to saving for—and living in—retirement.

Which is why I’m pounding the table on 4 other funds that are throwing off a fat 7.4% average dividend yield now!

You read that right: a payout nearly 4 TIMES what the millions of folks sitting on index funds like SPY are forced to settle for.

Even better, all 4 of these income titans are ridiculously CHEAP now. In fact, my team’s latest analysis points to massive 20%+ price upside in the next 12 months as the herd realizes what it’s missing here and piles in.

And that massive 20% spike comes on top of our gaudy 7.4% payout!

For a limited time, I’ll give you access to ALL of my research on these powerhouse funds with no obligation whatsoever. Simply CLICK HERE to discover their names, tickers, buy-under prices and everything you need to know before you buy.