Note: To sign up to be alerted when the morning email is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer wish to receive the emails.

Friday was an absolute breakout to new ATHs-fest (All-Time Highs). The S&P closed at a new all time high just below 3,700 (3,699) (Source: Turvey Twitter).

The Russell tacked on another 2.37% and closed just below 1900 (1892) (Source: Krupinski Twitter).

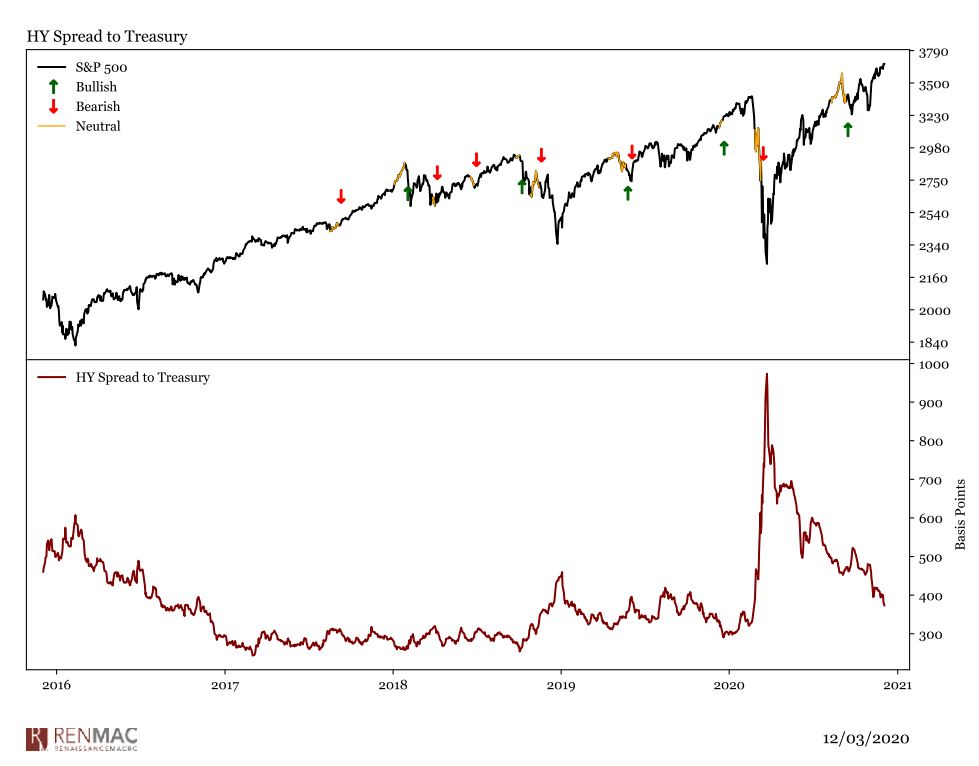

Junk bonds (Source: RenMac Twitter) and regional banks are super strong (Source: MicroSectors Twitter).

Of course, if the indexes are breaking out, so are a lot of individual stocks. Here are a few examples from Friday: Uber (UBER), Starbucks (SBUX), Texas Roadhouse (TXRH) and Micron (MU) (Source: 2kaykim Stocktwits).

Rolling out vaccination is likely to take many months, and the process will be complicated, confusing and almost certainly controversial – Dr. Tom Frieden

All these breakouts and new ATHs are based on the premise of a 2021 normalization due to the containment of COVID by the vaccines. However, a smooth rollout, while priced in, is not a lock. On the front page of Saturday’s WSJ Review section, Dr. Tom Frieden, former Director of the Centers for Disease Control and Prevention, laid out an excellent roadmap for what the vaccine logistics could ideally look like as well as what could slow down the process (“The Vaccine Solution – If We Handle It Right” (SUBSCRIPTION REQUIRED), Dr. Tom Frieden, WSJ, Saturday December 5).

Here are a couple of variables that could effect the containment of COVID via vaccination:

First, We don’t know how long the vaccines will provide immunity for.

Two, we may discover rare but serious side effects as we roll out the vaccine to millions of people, not just the tens of thousands in the studies.

Third, can the companies manufacture enough of the vaccines quickly enough?

Frieden concludes: “We are still in for a cruel winter. If all goes well, vaccination could tame the pandemic in the US by the middle of 2021.” In other words, this is likely to be a much slower process than the currently euphoric market expects.

Prospective returns are low on everything – Howard Marks (SUBSCRIPTION REQUIRED), Barron’s, Saturday December 5

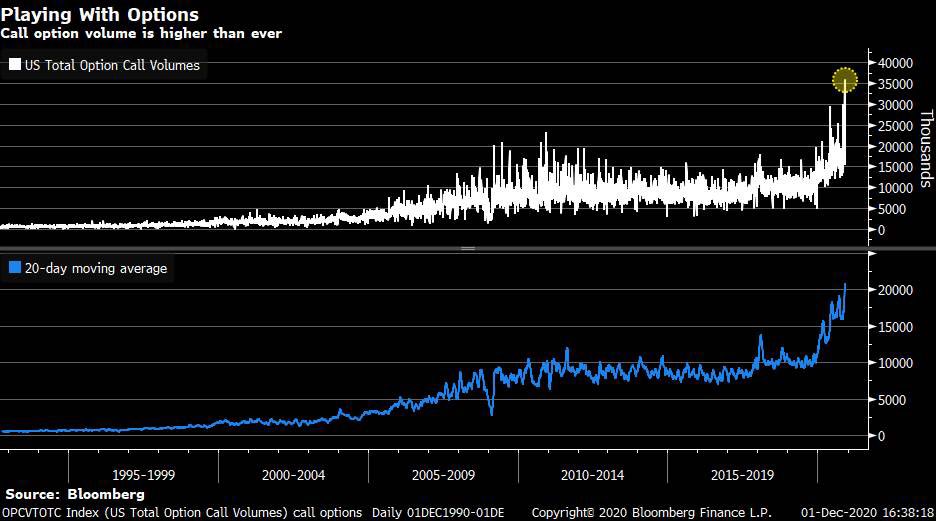

Sentiment is absolutely euphoric right now. Investors are buying calls like never before (Source: Sonders Twitter).

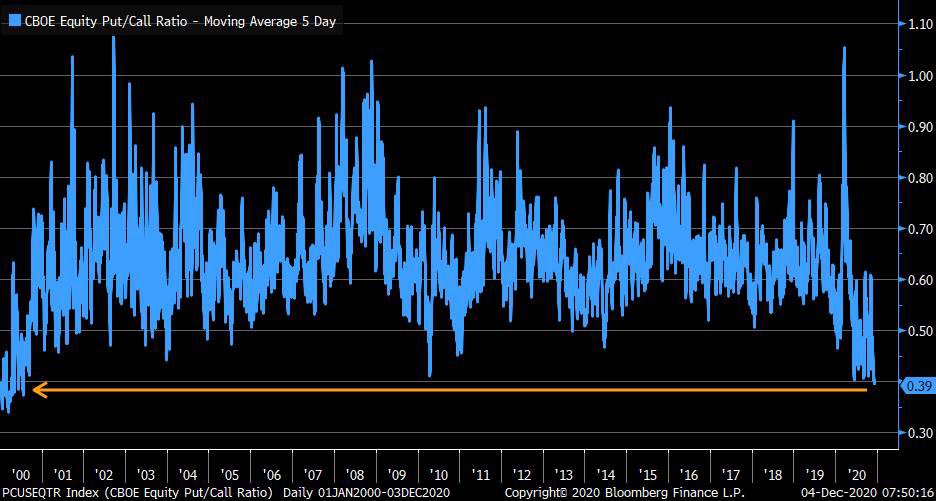

The other side of the coin is that investors see little need for insurance in the form of puts with the CBOE Put/Call Ratio’s 5 DMA at 2000 levels (Source: Sonders Twitter).

Of course, with almost every stock exploding higher, nobody is short (Source: Chris Brown, Aristides Capital).

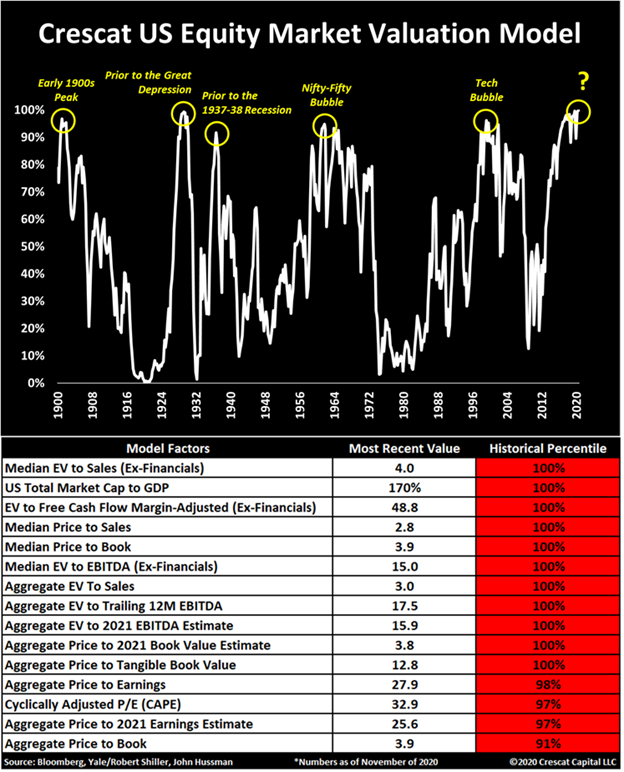

All this with valuations in bubble territory (Source: Crescat Capital November Letter).

While I recently concluded that shorting is extremely hard and rarely makes sense (see the section “To Short Or Not To Short”, Top Gun Financial, November 20), I believe this is an exception and is the shorting opportunity of a lifetime.