Note: To sign up to be alerted when the morning email is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer wish to receive the emails.

I normally don’t write my morning email on the weekends but I’m making an exception today because I’m being hammered on Twitter by a cabal of young technicians and I’m not going to take it. But first I want to talk about a brilliant article by Randall Forsyth in Barron’s this morning about how last week’s DoorDash (DASH) and Airbnb (ABNB) IPOs plus Tesla’s (TSLA) inclusion in the S&P are reminiscent of 1999. I am going to start by quoting him at length:

Maybe this time is different. Those words, supposedly the most dangerous to utter in the investing realm, came to mind amid the frenzied pops in the highly anticipating IPOs of the past week.

They recalled the wild IPOs at the end of the last century, when the public’s enthusiasm for all things Dot Com had investors paying crazy prices for new stocks that often lacked earnings, revenue, or, in some cases, actual operations….

What is different this time is that the current highflying IPOs are coming from innovative companies that have become major businesses, nurtured by their private market investors while attracting throngs of fans who wanted to become shareholders as well as customers. So they clamored for DoorDash (DASH) and Airbnb (ABNB), sending their shares soaring in their day of trading by 86% and 113%, respectively, over their respective IPO prices.

Another blast from that past is Tesla’s (TSLA) 50%+ jump since Standard & Poor’s announced last month the electric vehicle stock’s inclusion in the S&P 500 index.. That recalled the 64% jump in then dominant internet search company Yahoo! in December 1999 ahead of its addition to the benchmark index, just a few months before the Nasdaq’s peak – Randall Forsyth, “From Airbnb to Tesla, It’s Starting to Feel Like 1999 All Over Again. It May End The Same Way”, Barron’s, December 12

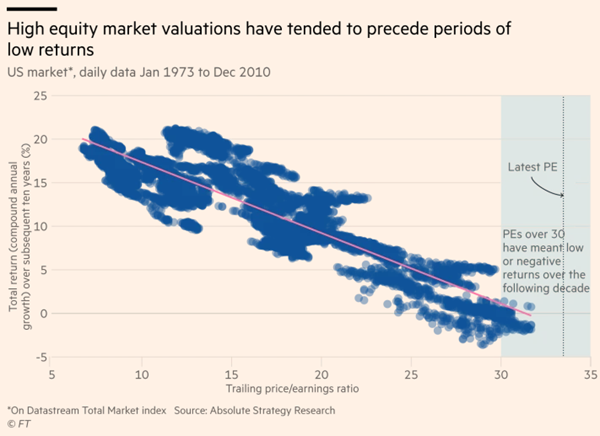

I’ve said it before and I’ll say it again: This is a massive bubble. Take a look at this chart from The Financial Times (via Sentiment Trader) comparing trailing P/E ratios with 10 year forward returns.

Note two things: First, the annotation: “PEs over 30 have meant low or negative returns over the following decade”. Second, note that the Latest PE is higher than anything we’ve seen in the last 50 years.

I’ve been pointing this out methodically, stock by stock, everyday in my morning emails: Almost everything is substantially overvalued and trading off of the narrative of a post-COVID resumption of the bull market that began in March 2009, not off of what’s actually happening with businesses and the economy right now. I’m not saying that the vaccine isn’t a hugely bullish development. I’m saying that the move since Pfizer’s announcement on Monday November 9th – on top of the move from the March 23rd lows to that point – has more than fully priced in such a scenario. Recall Sir John Templeton and Warren Buffett’s famous quotes:

The point of maximum pessimism is the time to buy and the point of maximum optimism is the time to sell – Sir John Templeton

Be greedy when others are fearful and fearful when others are greedy – Warren Buffett

We’re there folks: This is the point of maximum optimism, as I’ve titled sections four times in recent morning emails, and investor sentiment is frothier than ever.

Now I’m going to discuss the cabal of young Twitter technicians that are attacking my investment skill and character. After returning from dinner last night, I expected to find The Chart Report in my inbox but it wasn’t there. When I checked the internet, there it was. So I checked The Chart Report’s Twitter and discovered that I had been blocked and obviously removed from its email list.

This was disappointing and infuriating because nobody has promoted The Chart Report to my 55,000 followers on Stocktwits, as well as my smaller following on Twitter, than me. In fact, I believe StockTwits Founder Howard Lindzon started reading The Chart Report because of my constant praise.

Indeed, as recently as Wednesday night (12/9), I tweeted that the core of my daily market analysis routine was corporate earnings reports, The Wall Street Journal and The Chart Report, writing “Nobody scours Fintwit for the best TA [Technical Analysis] like @PDununwila [The Chart Report’s Editor]” (Source: Top Gun Financial Twitter, Wednesday, December 9, 6:23pm). High praise indeed! Nevertheless, Patrick, or whoever makes these decisions at The Chart Report, decided to block me.

What have I done? It all started with a skeptical tweet I wrote on April 29 about a chart posted by Ian McMillan (@the_chart_life).

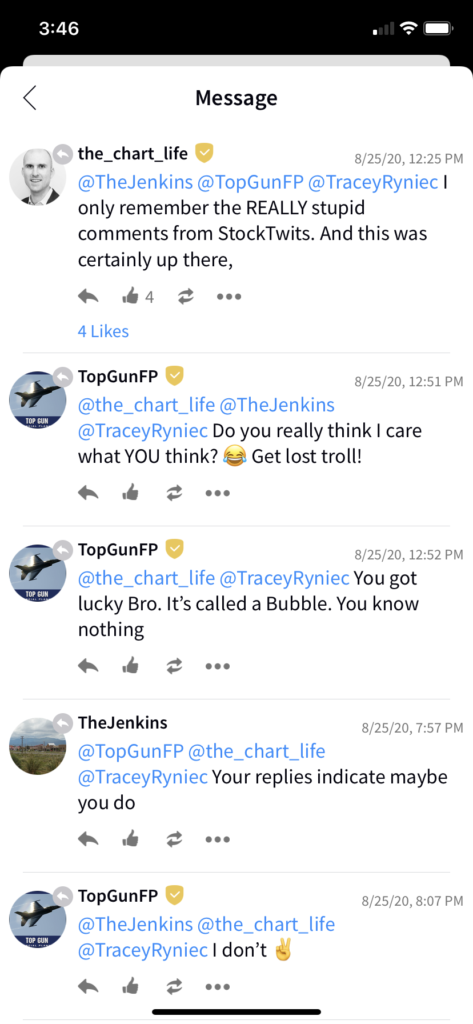

Note that I didn’t attack him personally or use any vulgarity. I simply disagreed with him. Is disagreement in the markets not okay? Well, apparently it isn’t for McMillan who was clearly infuriated by the tweet and blocked me only to unblock me 4 months later in order to declare victory and call me “REALLY stupid”.

Calling me “REALLY stupid” was out of line since all I did was disagree with him.

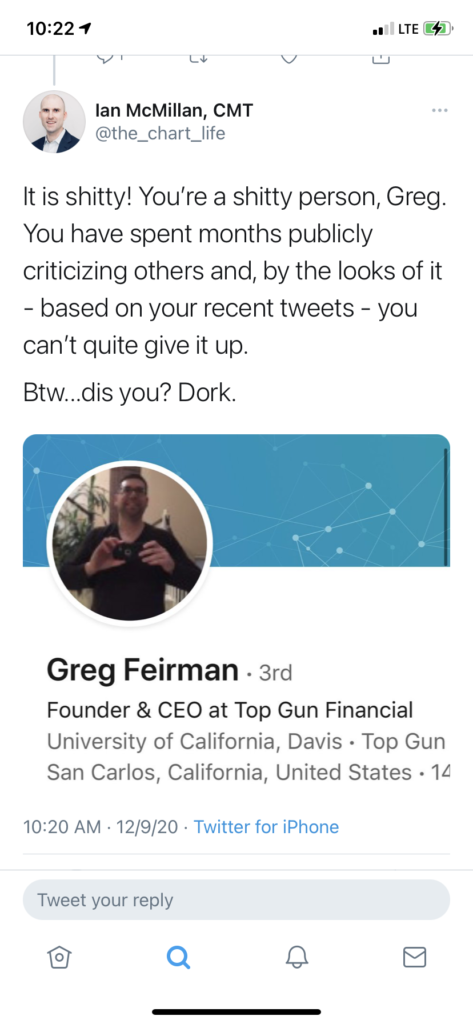

Last week, I got into it with a couple of other technicians on Twitter, Dan Russo and Aaron Jackson, who were also on the attack and McMillian unblocked me to chime in with more vitriol.

Am I supposed to just sit back and take this? Hell no I’m not going to do that! I discussed the Twitter beef in yesterday’s morning email (Section 2: “My Twitter Beef With The Technicians”) and fantasized about taking it to McMillan on the basketball court in my daily morning workout Instagram post since he also called my basketball “an embarrassment”. Clearly one of those two things caused Patrick Dunuwila, or whoever makes these decisions at The Chart Report, to block me.

Winners focus on winning. Losers focus on winners – The Chart Report’s Quote of the Day yesterday

It’s pretty clear that the winners here are McMillan and his cohort, who have been “right” about the market, and I’m the loser who has been wrong. At the end of the day, the market will decide who the winners and losers are and The Chart Report has this one wrong.

Because yesterday (December 11) McMillan tweeted a chart almost identical to the one he did on April 29 calling for a breakout in the QQQ based on the “2.618 Fib extension” to $428.

Folks: The QQQ is not going to $428 – 42% higher than yesterday’s $302 close. I was so happy to see this because it means I was correct when I replied to his calling me “really STUPID” on August 25th with: “You got lucky Bro. It’s called a bubble. You know nothing.” Turns out he’s just a kid drawing lines.