Note: To sign up to be alerted when the morning email is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer wish to receive the emails.

To free up some time for some administrative and other work I need to take care of before year end, I am writing my Monday morning blog this morning (Sunday morning). The next three weeks are likely to be pretty slow and I don’t anticipate having much new to say from what I already have to say tomorrow (Monday) morning.

The only way in which a human being can make some approach to knowing the whole of a subject, is by hearing what can be said about it by persons of every variety of opinion, and studying all modes in which it can be looked at by every character of mind. No wise man ever acquired his wisdom in any mode but this; nor is it in the nature of human intellect to become wise in any other manner

He who knows only his own side of the case knows little of that. His reasons may be good, and no one may have been able to refute them. But if he is equally unable to refute the reasons on the opposite side, if he does not so much as know what they are, he has no ground for preferring either opinion… Nor is it enough that he should hear the opinions of adversaries from his own teachers, presented as they state them, and accompanied by what they offer as refutations. He must be able to hear them from persons who actually believe them… he must know them in their most plausible and persuasive form – John Stuart Mill, On Liberty

I read those quotes as a 19 year old sophomore at UC – San Diego and they changed my life. It has been the cornerstone of my personal epistemology ever since: To understand an issue, you must look at it from all angles and perspectives. You especially must search out, understand from the inside and be able to refute the best that can be thought and said on the opposite side of your opinion on an issue.

Well, happily, I discovered what I believe to be the strongest bull case yesterday in an article by Rothko Research on Seeking Alpha titled “Letter To Equity Bears: Do Not Underestimate The Force Of Liquidity” (Wednesday December 9). I can do no better than to quote from it at length:

- In the past cycle, the Fed has become very sensitive to a sudden tightening in financial conditions, especially when equities start to fall aggressively

- Another $5 trillion USD [Rothko Research is based in London] are expected to resume in the coming months, sending US equities to new all time highs

- Any bear retracement in the near to medium term could be seen as a good opportunity to buy the dip.

- It is not a good time to try to short equities

One crucial thing that we have learned over the past 12 years is that the Fed has become very sensitive to a sudden tightening in financial conditions, especially when equities start to fall aggressively….

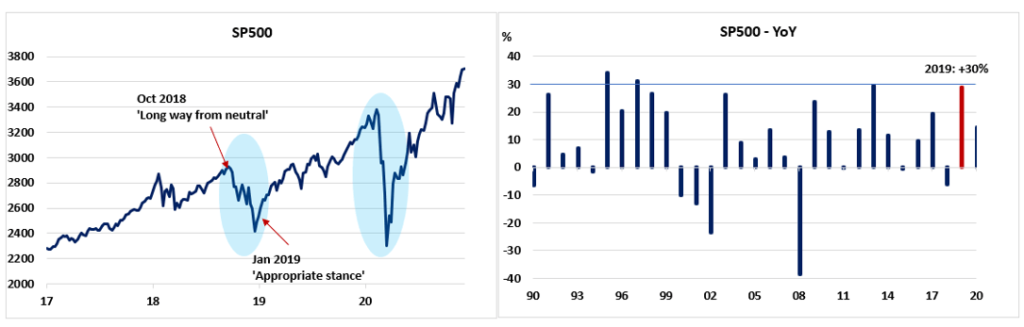

One good example was during the selloff in the end of 2018; the 225 bps rate hike combined with the $700 billion USD of Quantitative Tightening (QT)… led to a significant retracement in US equities in the last quarter of 2018. The S&P fell by 20%, which “forced” Powell to reverse the Fed’s policy from “a long way from neutral” in October 2018 to “appropriate stance” in January 2019.

Despite the Fed’s pivot, many well known investors were saying the rebound in stock prices in the first quarter of 2019 was was a “bear rally”…. 2019 ended up being one of the best years for equities in the past three decades, with the S&P up nearly 30%. Why did investors underestimate the force of monetary liquidity after 10 years of sample data?

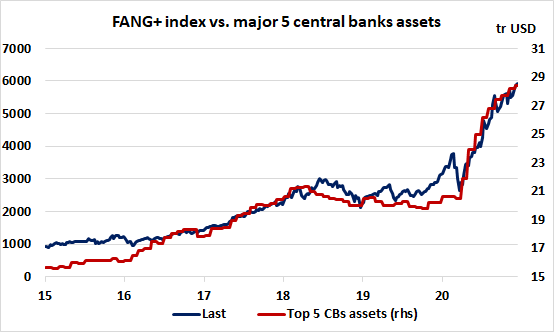

In April, we wrote an article entitled “The Equity Recovery Can Last For A While” where we mentioned that stocks could diverge quite significantly from fundamentals amid the massive Fed intervention and the strength of the FANG stocks in the COVID-19 environment. [The chart below] shows the strong co-movement between the total assets of the 5 major central banks and the FANG+ index; we can notice that the titanic rise in central bank assets has “perfectly” matched the strong rebound in the mega-cap growth stocks in the past 8 months.

Wow! What a tour de force – and Rothko has been spot on!

However, as a bear, I have a couple issues with the argument. First, how much of this is now priced in given current valuations and the sentiment environment? (See yesterday’s “Shades of 1999”). Second, a close look at the above chart shows the 5 major central banks increasing their assets by $8 trillion just in 2020. Rothko talks about another $5 trillion over the next two years. So the rate of change in central bank asset accumulation is clearly slowing. Putting these together, I think Rothko was right in April but their thesis is now played out.

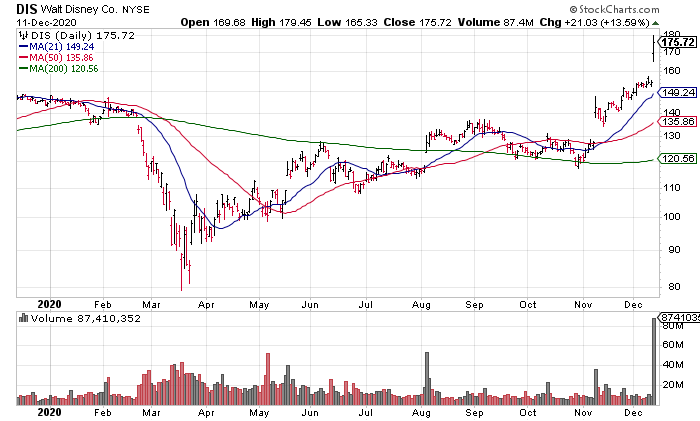

The long quote from Randall Forsyth to lead “Shades of 1999” gave you a feel for the sentiment environment. Now I’d like to zero in on Disney (DIS) stock as a case study of the mania now at play in the stock market. On Thursday (12/10) afternoon, DIS announced that they now had 86.8 million paying Disney+ subscribers and expected 230-260 million by the end of their fiscal year 2024. Investors sent the shares up 13.59% on 8x average volume – by far the highest volume day in the last 12 months.

The problem is that while those paying subscriber numbers are great, content costs will be extremely high and DIS doesn’t expect the unit to be profitable until the end of fiscal year 2024. Let me quote the WSJ’s ace technology reporter Dan Gallagher:

Disney’s streaming push won’t be cheap. The company is sticking with its prior goal of having its direct to consumer business profitable by the end of fiscal 2024, despite now projecting a much larger subscriber base by that time. Disney expects to eventually release 100 shows and movies for streaming each year, many of them Marvel or Star Wars shows that won’t be cheap. But investors have been effectively cutting Disney a blank check for streaming lately, sending the stock up 24% since mid-October – Gallagher, “Disney’s May Finally Make Netflix Sweat”, WSJ, December 12

So, while the Disney+ paying subscriber news is great, profitability is still 4 years away but investors couldn’t care less. The stock is now extremely technically extended at 46% above its 200 DMA and extremely expensive at 31x peak fiscal year 2019 adjusted earnings of $5.76 (Source: DIS FY4Q Earnings Release). In other words, all this good news is more than #PricedIn and the bad news – not profitable for 4 more years – is being ignored.

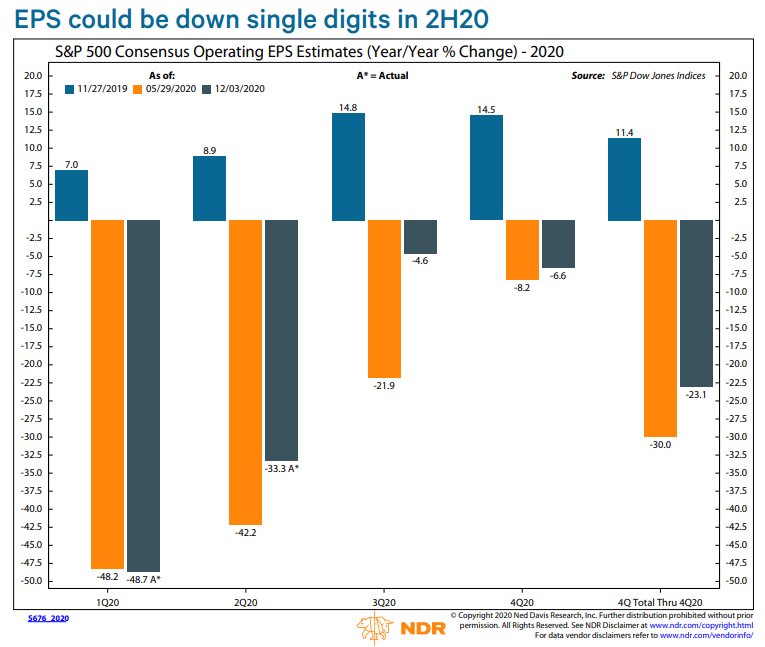

Next, I want to discuss a terrific Twitter thread from Ed Clissold, Chief US Equity Strategist at Ned Davis Research. Ed surprised me in Tweet #2 (of 6) showing that S&P Operating Earnings are down only 4.6% year over year in the 3Q as of 12/3.

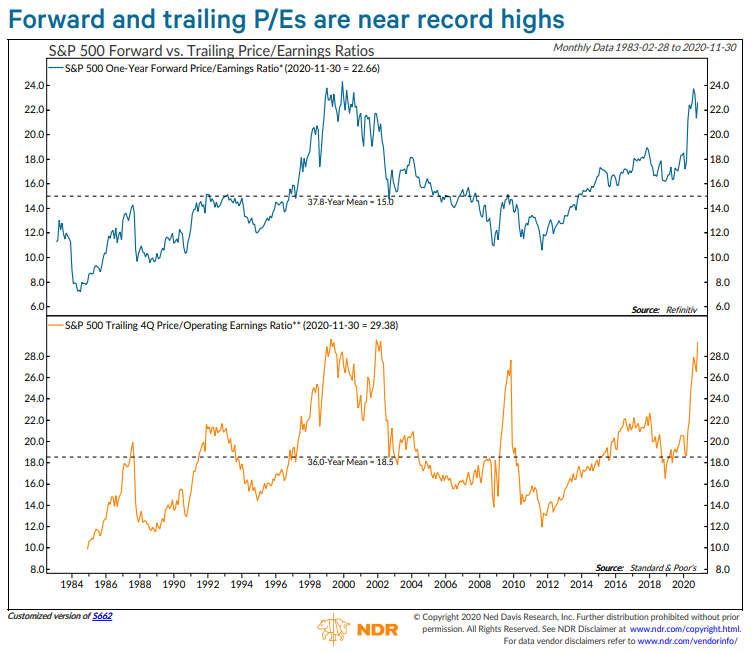

Having reviewed so many repots that I found unimpressive, this number caught me off guard. However, Tweet #6 on valuation is also important. Here’s what Ed wrote on that score: “P/Es reveal that there is little room for error if earnings don’t recover [in 2021]”.

In Tweet #5, Ed writes that analysts are calling for a 37.5% increase in EPS in 2021. In sum, we have an equity market priced for perfection.

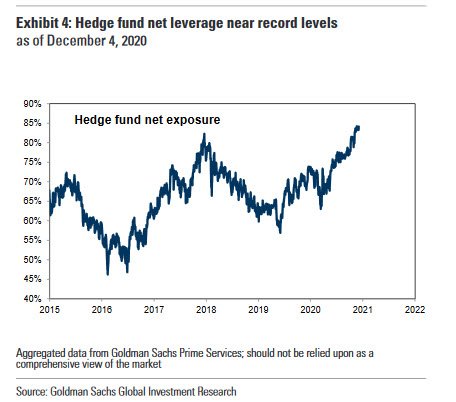

Nevertheless, the trend continues to be up and hedge funds are showing signs of FOMO (Fear Of Missing Out) with their highest Net Exposure since at least 2015.

(Chart Source: Callum Thomas Stocktwits, Saturday December 12, 12:59pm PST)

In sum, I believe Rothko was brilliantly right in April but may be wrong now after a 64% move in the S&P since March 23rd, while earnings are coming in stronger valuations have already more than priced that and a terrific 2021 in and signs of mania abound. All of this combines to lead me to believe that 2021 represents “The Shorting Opportunity of a Lifetime” (Section 3, Monday Morning Blog, Top Gun Financial, Monday December 7).

Before concluding, let me just say a brief word about the last three weeks of the year. There are only two earnings reports of any interest to me next week (FDX & DRI) and likely none the following two weeks. In other words, it is likely to be very slow going until 2021.

(Chart Source: eWhispers Stocktwits, Saturday December 12, 3:26am PST)