Note: To sign up to be alerted when the morning blog is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer wish to receive the emails.

The most important event of the week was the Fed Decision on Wednesday afternoon. While the Fed did not make any policy changes (the Fed Funds Rate continues at 0% as well as $120 Billion/Month in asset purchases) they did start to talk about inflation raising the possibility of tapering asset purchases and raising interest rates down the road. That was enough to create a dramatic reaction in financial markets.

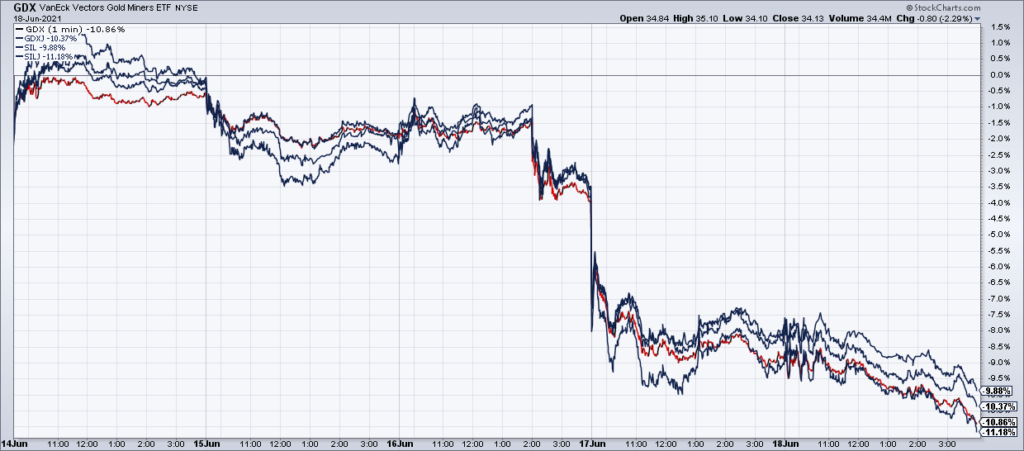

While this led to some volatility in the stock and bond markets, from Top Gun’s perspective the main impact was in the precious metals miners. As you can see in the chart above, the GDX, GDXJ, SIL and SILJ all got taken to the woodshed. Thursday was one of the worst days in Top Gun’s history and no bounce materialized Friday. While painful, I didn’t sell any of our large positions due to the fact that the Fed didn’t actually do anything. They simply said they might do something in the distant future. Whether they will or won’t will depend on market conditions down the road. Therefore, I think this was a big overreaction and I would have bought more had I not already had full positions.

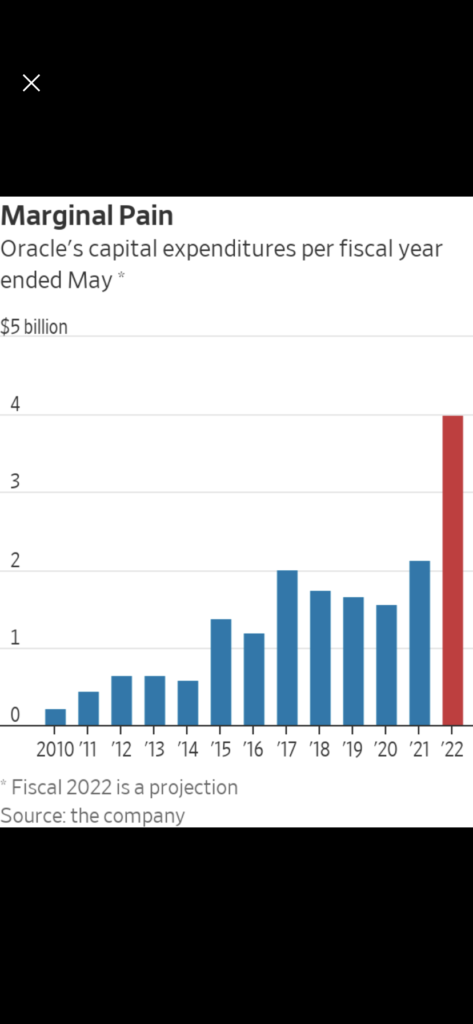

A number of Top Gun’s stock holdings also reported earnings last week, starting with Oracle (ORCL) on Tuesday afternoon. ORCL’s results for its quarter ended May 31, 2021 were stellar with revenue +7.5%, its best growth since 2012, and net income +19.7%. The problem for many shareholders was that ORCL decided to double down on cloud capital spending in their new fiscal year aiming for about $4 billion from $2.135 billion in FY21:

We believe that now is the right time to increase our investment to capture market share. As such, we expect to roughly double our cloud CapEx spend in FY 2022 to nearly $4 billion. We are confident that the increased return in the cloud business more than justifies this increased investment and our margins will expand over time – CEO Safra Catz on the conference call Tuesday afternoon

As the Wall Street Journal’s Dan Gallagher put it:

Oracle has a lot of catching up to do. Even $4 billion a year in capital expenditures is unlikely to close the that gap much. Microsoft, Amazon and Alphabet Inc.’s Google spend many times that amount annually.

Spending money to make money is a long established part of the cloud game, but it entails risks for investors who might have thought Oracle could grow while playing it safe (Dan Gallagher, “Oracle’s Cloud Bill Is Coming Due” [SUBSCRIPTION REQUIRED], Thursday June 17

While ORCL’s shares were down about 8% on the week, I have no problem investing for the long term growth of the business. The cloud is a secular growth story and ORCL is by far the cheapest way to play it. I have no intention of selling my shares.

The next Top Gun holding to report earnings last week was grocery chain Kroger (KR). ID Sales excluding fuel of -4.1% beat analyst expectations of -6.6%. Because last year was the COVID hoarding period, KR’s sales were bound to take a hit. Their two year ID Sales excluding fuel stack was +14.9%.

KR guided full year ID Sales excluding fuel to -4.0% to -2.5% and Adjusted EPS to $2.95 to $3.10. At Friday’s close of $38.75, that gives KR a forward P/E of 13, extremely cheap for this market. And I like the grocery space in the stagflationary macro environment I see emerging in the near future.

The lone bright spot in our portfolios last week was gun maker Smith & Wesson (SWBI) which reported earnings Thursday afternoon and whose stock was +17.22% on Friday. Revenues grew 67% to $323 million and Adjusted Diluted EPS surged to $1.71 from 50 cents a year ago for the $1 billion market cap company. Again, like almost all of my positions, there is a macro reason that I own SWBI. It is a play on increasing social breakdown and escalating violent crime. My premise is that people will buy guns to protect themselves from this and that has proven to be true in the wake of COVID and George Floyd.

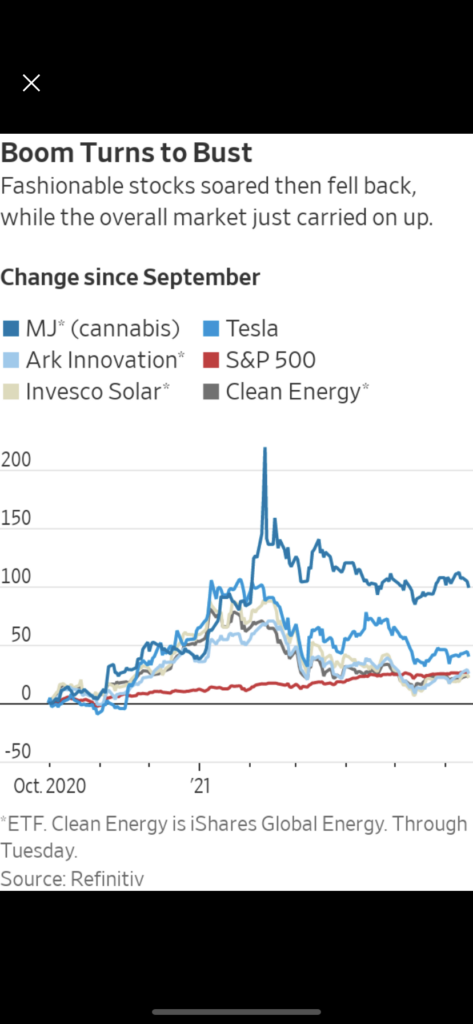

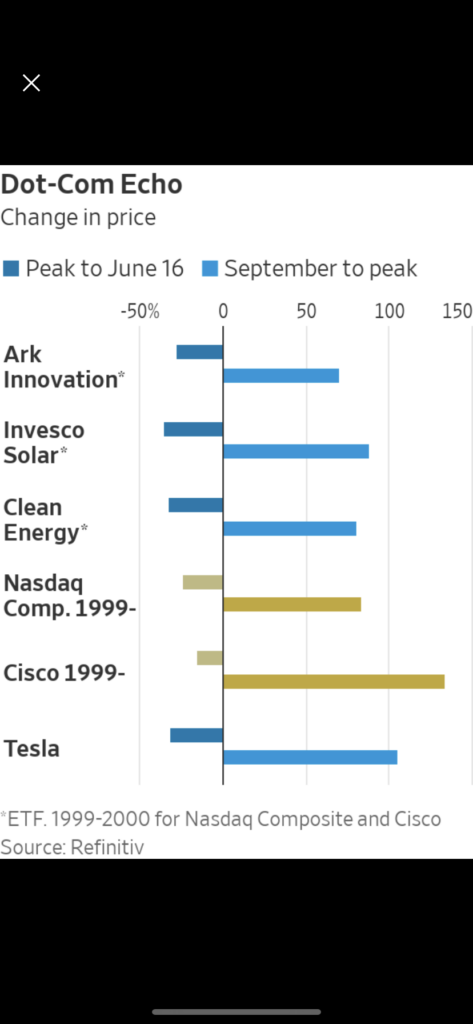

Lastly, I want to flag an excellent article from the always interesting James Mackintosh in Friday’s WSJ (“Risky Assets and Bubble Stocks Have Deflated Just Like in 2000” [SUBSCRIPTION REQUIRED], James Mackintosh, WSJ, Friday June 18) in which he compares certain aspects of the market since September 2020 to the similar period in 1999-2000.

Mackintosh points out that a number of mini bubbles in the market in things like the Ark Innovation ETF (ARKK), the Invesco Solar ETF (TAN), the Blackrock Clean Energy ETF (ICLN), the Marijuana ETF (MJ) and Tesla (TSLA) peaked in February after tremendous runs and have now sustained losses of from a quarter to a third, similar to the correction in the NASDAQ as a whole in 2000. During this first deflation of the Dot Com Bubble, the S&P held up well, as it is now, but ultimately the NASDAQ crash slowed the economy and dragged the S&P down 50% by the 2002 low.

Mackintosh thinks something similar can be avoided this time around since the frothy sectors of the market are so much smaller than the NASDAQ in 2000, have raised and spent less money than the dot coms and employ fewer people. In addition, the 10 year treasury yielded 7% in 2000 providing an attractive alternative to stocks compared to the 1.5% it currently yields. Nevertheless, the parallel is apt and the article well worth reading.