Supply shortages…

That’s what is fueling the market right now.

Oil companies are making out like bandits…

Natural gas prices are skyrocketing…

And commodities like lithium, cobalt, and aluminum have soared to new heights.

But it’s not all sunshine and roses for some industries.

The auto industry has seen its production plummet due to the global semiconductor shortage…And top automakers are saying it’s not going to end anytime soon.

But semiconductors and commodities aside…

There’s one resource that no one is talking about.

And it could have a massive impact on the world as we know it.

It’s used in everything from medical devices and cryogenics to space travel and even powering the internet. It’s a major element in a number of key supply chains.

In fact, it’s even listed as a critical material to U.S. economic and national security.

It’s a non-renewable resource…and our supply is running dangerously low.

The New York Times says…

While CNBC warns…

And the BBC highlights…

Say what you will about the space race, web3, or the metaverse…

A helium shortage not only stops those innovations in their tracks…It could also derail the technology we’ve all become accustomed to.

Streaming services…

Cell phones…

Electric cars…

Nothing may be possible without it.

And if you thought nuclear fusion was going to save the planet from rising emissions…

Without this noble gas, you can kiss that dream goodbye, as well.

Helium: The Most Important Resource No One is Talking About

Many people see helium as just the stuff inside birthday balloons…But that isn’t even the tip of the iceberg.

It’s actually a key component in the tools you and I use every single day.

In fact, if you’re reading this right now – it’s because of helium.

That’s because it is a key ingredient in computer chip manufacturing.

It’s also a vital element in telecommunications.

Helium is what has allowed us to go from that annoying 56kb dial-up internet connection to…

This:

This is significant because, without helium, some of the biggest companies in the world might not even exist.

Netflix…

Google…

Even Amazon.

Bid farewell to your Sunday afternoon binge-watching sessions…

And definitely forget about ordering that really cool-looking kitchen tool that popped up in your Facebook newsfeed a few minutes ago.

But we’re just getting started.

Helium is also used in MRIs, space travel, nuclear fusion, and much, much more.

And as I mentioned earlier; it’s running out.

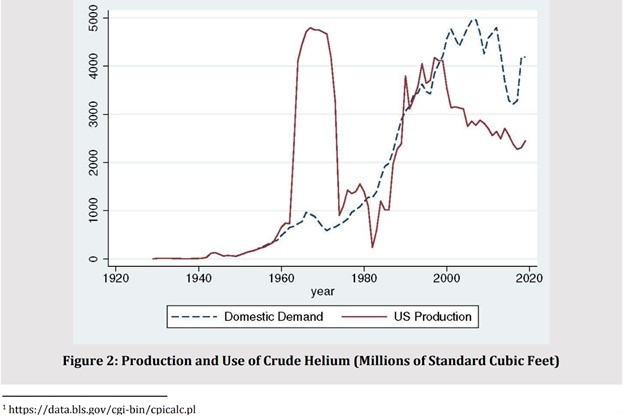

Growing demand from Big Tech and other innovative industries has created a massive supply imbalance…

And, in turn, paved the way for a fast-moving growth opportunity for any exploration and development company that can show potential for significant new helium discoveries.

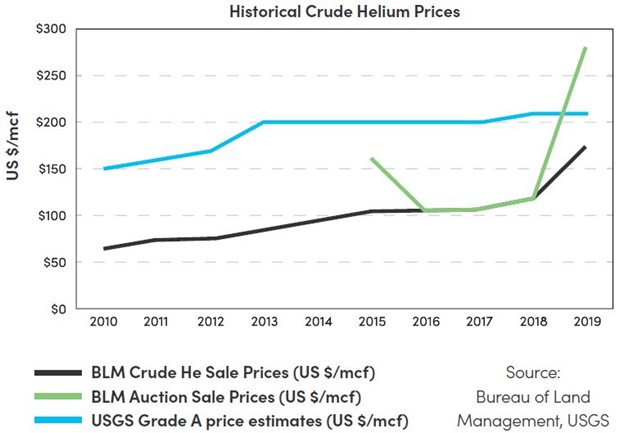

In 2019 alone, helium prices soared by 135%, hitting $280/Mcf…

And today, refined helium is selling for $600-650.00 USD per mcf.

All while production is slowing…

Now, more than ever, helium is a low-volume, high-value commodity.

But it doesn’t trade like one.

You see, there are no ETFs to bet on helium…and no commodity market.

Even helium companies themselves are few and far between.

Many of the top producers aren’t even public because they’re so profitable.

But one small-cap explorer is poised to change that.

The Small Company Making Big Moves In The Helium Space

Avanti Energy Inc. (TSX:AVN.V; OTCMKTS:ARGYF) is a little-known helium explorer looking for oversized returns in the coming years.

Recently, the explorer announced that it had completed initial open-hole logging and drill stem testing on its first two helium wells on its 100%-operated Greater Knappen project…

And to say that the results were promising…would be an understatement.

This could be just the beginning for Avanti, as well.

The Greater Knappen property is 69,000 acres…and estimates suggest it could potentially hold as much as $1 billion worth of helium.

To put this opportunity into perspective, Avanti Energy’s entire market cap is just $82 million at the time of writing.[RG1]

Already, just a few miles away from the Greater Knappen property, a competitor is producing as much as 55,000 cubic feet of helium per day.

And the company is seeing payback on their well investments in as little as six months’ time.

To us, that’s not just impressive, it’s inspiring.

Avanti’s helium reserves could be even better, with a possible helium concentration of as high as 2%, while its competitor’s concentration rate is 1.4%.

What that means is that Avanti’s exploration costs could see a return in as little as THREE months if its exploration and development efforts are commercially successful.

At the moment, these wells are projected to cost just $1.5 million to drill…and could potentially run for 10 or even 15 to 20 years!

If achieved, that would be an incredible return on investment, especially considering the fact that helium demand is set to rise even more in the coming years.

Think about this…a single space launch uses about $12 million worth of helium…

Elon Musk’s SpaceX alone is planning a total of 52 launches this year.

And that’s nothing compared to NASA, the single biggest buyer of helium.

NASA consumes approximately 75 million cubic feet annually to cool liquid hydrogen and oxygen for rocket fuel.

Between tech innovation, the future of energy, and the red-hot space race, the helium market is set to increase by 11% every year through 2037.

That’s a lot of market to grab for a small-cap like Avanti Energy Inc (TSX:AVN.V; OTCMKTS:ARGYF).

An Experienced Team Of Exploration And Production Experts

We believe the team behind Avanti Energy is second to none.

In this industry, experience is everything – and these guys are veterans.

In fact, some of the team members were involved in the early stages of the discovery of the Montney Formation, one of the premier natural gas formations in North America.

Avanti CEO, Chris Bakker, has more than 20 years of experience in oil and gas working as a commercial negotiator for major facilities and pipelines in the Monteny gas play.

We expect his expertise to truly shine in the world of land acquisition, exploration, and drilling. And this is exactly what he’s already doing with Avanti: locking down highly prospective land.

President of the company, Rob Gamley, is not only well connected, but he’s also a trusted advisor and board member for other companies in the resource space.

Genga Nadarju, Vice President – Subsurface of Avanti, has another 20 years of experience in oil and gas.

And their Senior Geophysicist, Richard Balon, has 30 years under his belt in the Western Canadian Sedimentary Basin alone.

Add in Director – Geoscience Dr. Jim Wood, Ali Esmail, and Kevin Morrissette, and you’re looking at a well-rounded, veteran team of industry heavyweights.

Combined, this veteran team has over 100 years of experience in the resource space, and if their latest drilling results indicate anything to us, it’s that they know what they’re doing.

Avanti Is Turning Heads

Avanti Energy Inc (TSX:AVN.V; OTCMKTS:ARGYF) is making waves in the helium space, thanks to its experienced leadership.

With a solid newsflow and better-than-expected drilling results, analysts are eyeing a major opportunity in this up-and-comer.

Beacon Securities, for example, noted that Avanti “now has a contiguous land block that may support several years of drilling.”

“If successful, numerous development wells would follow with production in H2/22 once facilities are configured and installed,” Beacon notes, adding that “critical mass” has been achieved with Avanti, which now has a “key asset on which its world-class technical team can explore.”

With Avanti’s current market cap sitting at about $80M, if the its exploration and drilling efforts are commercially successful, the company’s valutation could significantly increase by this time next year. [RG2]

And we think it makes sense to be bullish on Avanti.

Imagine if you had the opportunity to spend $1,500 on an asset that could pay itself off in only three months…

And continue to give you $500 per month for the next 10 or more years.

In just a decade, you might have already seen a return of 3,900% on your initial investment.

That sort of potential is exactly what Avanti is looking for with its $1.5 million wells.

Remember, Avanti Energy Inc. (TSX:AVN.V; OTCMKTS:ARGYF) only has a market cap of around $80 million right now…[RG3]

And it might be sitting on as much as $1 billion in potential helium…the resource literally powering our future.

This may just be the beginning of Avanti’s story…

But we think it’s only going to get a lot more interesting from here.

Other companies looking to capitalize on the commodity boom:

Bloom Energy (NYSE:BE) is a company that has been working on clean energy solutions for the world. The company was founded in 2001 and their mission statement is to “bring affordable, renewable power to homes and businesses everywhere.” Their main product is called Bloom Box, which converts natural gas into electricity with a cleaner process than traditional methods. They have recently signed contracts with major companies such as Google, Wal-Mart, FedEx and Staples.

Bloom Energy’s goal is to provide cheaper rates for both residential and commercial customers while also being environmentally friendly by using less fossil fuels. Their next steps are expanding globally so they can help as many people as possible get access to affordable power sources.

Another thing to consider in the fuel cell race is that Bloom Energy is targeting different markets than some of its competitors. They make large fuel cells for commercial buildings, whereas Plug and Ballard are mainly materials-handlers who supply forklifts, buses, trucks – similar vehicles with small transportation needs. This is key because it’s still a largely untapped market that Bloom can get in on early.

Canada’s renewable energy push is gaining speed, as well. Boralex Inc. (TSX:BLX) is one of Canada’s premier renewable energy firms. It played a major role in kickstarting the country’s domestic renewable boom. The company’s main renewable energies are produced through wind, hydroelectric, thermal and solar sources and help power the homes of many people across Canada and other parts of the world, including the United States, France and the United Kingdom.

Maxar Technologies (TSX:MAXR) is one of the leading space companies on the planet, founded nearly 20 years ago. Maxar has a variety of services, including satellite development, space robotics, and earth observations. One of their most well-known products is the Canadarm2 robotic arm for the International Space Station (ISS). The ISS has been operational since 1998 with more than 100 missions to date. Maxar Technologies has had a history of partnering with NASA to maintain the ISS’s systems as well as providing them with new technologies such as the Canadarm2 robotic arm. is a moon-bound tech stock to keep an eye on. While space firm specializes in satellite and communication technologies, it is also a manufacturer of infrastructure required for in-orbit satellite services, Earth observation and more.

More importantly, however, Maxar’s subsidiary, SSL, a designer and manufacturer of satellites used by government and commercial enterprises, has pioneered research in electric propulsion systems, lithium-ion power systems and the use of advanced composites on commercial satellites. These innovations are key because they allow satellites to spend more time in orbit, reducing costs and increasing efficiency.

As demand for energy continues to explode in a post-pandemic China, CNOOC Limited will likely be one of the biggest winners in this boom. It’s the country’s most significant producer of offshore crude oil and natural gas and may well be one of the most controversial oil stocks for investors on the market. A label that has nothing to do with its operations, however.

Recently, U.S. regulators announced their intention to de-list Chinese companies from the New York Stock Exchange, going back on their announcement just a few days later. The sustained negative press surrounding Chinese companies, however, has put CNOOC in an uncomfortable position for investors. While many analysts see the company as significantly undervalued, it is still struggling to gain traction in U.S. markets. Though that could be changing as Biden works to ease tensions with China

Magna International (TSX:MG) is a really interesting and roundabout way to get in on the explosive commodity market without betting big on one of the new hot stocks tearing up among the millennials right now. More than a decade ago, Magna International was already making major moves in the battery market, investing over half a billion dollars in battery production while the market was still in its infancy. At the time, electric vehicles as we know them had barely hit the scene, with Tesla launching its premiere car just two years prior.

Magna’s massive investment in batteries, however, has paid off in a big way. Since its controversial bet of yesteryear, the company has seen its valuation soar by tens of billions of dollars, and it has solidified itself as one of the leaders in the increasingly competitive battery business.

Westport Fuel Systems (TSX:WRPT) isn’t necessarily a resource play, but it is an important company to watch as new fuels and new forms of energy take the spotlight. Especially as the world races to leave behind traditional gasoline and diesel-powered vehicles. That’s because, while it is a manufacturing play at heart, it offers a particularly unique way to gain exposure to the alternative fuels market. As a key manufacturer of the hardware needed to build natural gas and other alternative-fueled cars, Westport is definitely a company to watch in this scene.

Westport Fuel has been making major moves in the market over the past year, and its efforts are finally coming to fruition. Since May 2020, the company has seen its stock price rise by 322%, and with more potential deals like the one it has just sealed with Amazon to provide natural gas-powered trucks to its fleet, the stock has even more room to run in the coming years.

By. Michael Kern

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Forward-Looking Statements

This publication contains forward-looking information which is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ from those projected in the forward-looking statements. Forward looking statements in this publication include that prices for helium will significantly increase due to global demand and use in a wide array of industries and that helium will retain its value in future due to the demand increases and overall shortage of supply; that Avanti will able to successfully pursue exploration of its licenses and properties; that Avanti’s licenses and properties can achieve drilling and mining success for commercial amounts of helium; that indications of potential for economic helium in Avanti’s initial wells will predict future results; that Avanti will be able fulfill its obligations under its licenses and in respect of its properties; that Avanti will be able acquire the rights to the helium on its prospective helium properties; that the Avanti team will be able to develop and implement its helium exploration models, including their own proprietary models, that may result in successful exploration and development efforts; that historical geological information and estimations will prove to be accurate or at least very indicative of helium; that high helium content targets exist on Avanti’s projects; and that Avanti will be able to carry out its business plans, including timing for drilling and exploration. These forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Risks that could change or prevent these statements from coming to fruition include that demand for helium is not as great as expected; that alternative commodities or compounds are used in applications which currently use helium, thus reducing the need for helium in the future; that the Company may not fulfill the requirements under its licenses for various reasons or otherwise cannot pursue exploration on the project as planned or at all; that the Company may not be able to acquire the helium rights on its properties as contemplated or at all; that the Avanti team may be unable to develop any helium exploration models, including proprietary models, which allow successful exploration efforts on any of the Company’s current or future projects; that Avanti may not be able to finance its intended drilling programs to explore for helium or may otherwise not raise sufficient funds to carry out its business plans; that geological interpretations and technological results based on current data may change with more detailed information, analysis or testing; and that despite promise, results of the recent drilling and exploration may be inaccurate or otherwise fail to result in locating or developing any commercial helium reserves on the Avanti properties, and that there may be no commercially viable helium or other resources on any of Avanti’s properties. The forward-looking information contained herein is given as of the date hereof and we assume no responsibility to update or revise such information to reflect new events or circumstances, except as required by law.

DISCLAIMERS

PAID ADVERTISEMENT. This communication is a paid advertisement and is not a recommendation to buy or sell securities. Oilprice.com, Advanced Media Solutions Ltd, and their owners, managers, employees, and assigns (collectively “Oilprice.com”) has been paid by Avanti fifty thousand US dollars for this article to provide investor awareness advertising and marketing for TSXV:AVN. The information in this report and on our website has not been independently verified and is not guaranteed to be correct. This compensation is a major conflict with our ability to be unbiased. This communication is for entertainment purposes only. Never invest purely based on our communication.

SHARE OWNERSHIP. The owner of Oilprice.com owns shares of Avanti and therefore has an additional incentive to see the featured company’s stock perform well. Oilprice is therefore conflicted and is not purporting to present an independent report. The owner of Oilprice.com will not notify the market when it decides to buy more or sell shares of this issuer in the market. The owner of Oilprice.com will be buying and selling shares of this issuer for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

NOT AN INVESTMENT ADVISOR. Oilprice.com is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation, nor are any of its writers or owners.

ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

RISK OF INVESTING. Investing is inherently risky. Don’t trade with money you can’t afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any stock acquisition will or is likely to achieve profits.