The Fed announced a new policy of Flexible Average Inflation Targeting back in August 2020. Over the next few months, the Fed failed to provide a clear and consistent interpretation of what the policy actually entails. More recently, it has become clear that FAIT is intended to be asymmetric. But some features of the policy remain unclear, such as when it began.

Jerome Powell gave a speech explaining the new policy in August 2020, and this is naturally the place to look for an official explanation. But Powell’s explanation is vague and unclear:

We have also made important changes with regard to the price-stability side of our mandate. Our longer-run goal continues to be an inflation rate of 2 percent. Our statement emphasizes that our actions to achieve both sides of our dual mandate will be most effective if longer-term inflation expectations remain well anchored at 2 percent. However, if inflation runs below 2 percent following economic downturns but never moves above 2 percent even when the economy is strong, then, over time, inflation will average less than 2 percent. Households and businesses will come to expect this result, meaning that inflation expectations would tend to move below our inflation goal and pull realized inflation down. To prevent this outcome and the adverse dynamics that could ensue, our new statement indicates that we will seek to achieve inflation that averages 2 percent over time. Therefore, following periods when inflation has been running below 2 percent, appropriate monetary policy will likely aim to achieve inflation moderately above 2 percent for some time.

Let’s break that down into 4 smaller chunks:

We have also made important changes with regard to the price-stability side of our mandate. Our longer-run goal continues to be an inflation rate of 2 percent. Our statement emphasizes that our actions to achieve both sides of our dual mandate will be most effective if longer-term inflation expectations remain well anchored at 2 percent.

This suggests that the policy was intended to be symmetric. (That was also my view.) Under an asymmetric policy where the Fed only offsets inflation undershoots, inflation (and inflation expectations) would average more than 2%.

However, if inflation runs below 2 percent following economic downturns but never moves above 2 percent even when the economy is strong, then, over time, inflation will average less than 2 percent. Households and businesses will come to expect this result, meaning that inflation expectations would tend to move below our inflation goal and pull realized inflation down.

In these two sentences Powell seems to accuse the previous Fed of an asymmetric policy that allowed below 2% inflation but not above 2% inflation. He correctly points out that if policy is asymmetric, then inflation will not average 2% over time. And that’s bad! So why would anyone think Powell was now advocating an asymmetric policy?

To prevent this outcome and the adverse dynamics that could ensue, our new statement indicates that we will seek to achieve inflation that averages 2 percent over time.

This sentence pretty clearly implies that the policy is intended to be symmetric. He’s already explained why an asymmetric policy is bad, and then follows that up by stating that the new policy seeks an average inflation rate of 2%, with no mention of asymmetry. And the term “average” has a pretty clear meaning, more consistent with the symmetric interpretation. Case closed?

Not quite. The final sentence gives an example of how FAIT might work in practice:

Therefore, following periods when inflation has been running below 2 percent, appropriate monetary policy will likely aim to achieve inflation moderately above 2 percent for some time.

This could be interpreted in two ways. He might be merely using this case as an example, as during August 2020 inflation was running below target and the Fed intended to offset that low inflation with higher than 2% inflation in the future. That would be consistent with the symmetric interpretation. Or he might be signaling that the policy is asymmetric, but that would directly contradict his earlier statements that inflation will continue to average 2% over time.

It is now clear that the Fed intends for inflation to average above 2% over time, but I defy anyone to get that interpretation from Powell’s August 2020 statement.

A few months later, Richard Clarida gave his own interpretation to FAIT:

The new framework is asymmetric. That is, as in Bernanke, Kiley, and Roberts (2019), the goal of monetary policy after lifting off from the ELB is to return inflation to its 2 percent longer-run goal, but not to push inflation below 2 percent. . . .

I believe that a useful way to summarize the framework defined by these five features is temporary price-level targeting (TPLT, at the ELB) that reverts to flexible inflation targeting (once the conditions for liftoff have been reached).

This interpretation is clearly different from Powell’s earlier explanation. Recall that Powell said:

Therefore, following periods when inflation has been running below 2 percent, appropriate monetary policy will likely aim to achieve inflation moderately above 2 percent for some time.

In contrast to Powell, Clarida is saying that the Fed will only offset below 2% inflation that occurs at the zero lower bound. When not at the zero bound, the Fed will revert to ordinary inflation targeting, the exact same policy regime that was in place prior to 2020. Clarida’s interpretation is actually more consistent with maintaining an average inflation rate of 2%, because inflation usually runs below target when the economy is at the zero lower bound. (But not always, as we saw in 2021.)

Even TPLT would have been a slight improvement over previous Fed policy, as long as the new policy is pre-emptive. That is, as long as the Fed tightens as appropriate during the catch-up period to keep the expected future price level on target. But Powell didn’t just adopt FAIT in 2020; he also abandoned the policy of pre-emptive moves to prevent inflation overshoots. Now the Fed would wait until excessive inflation was actually occurring before tightening. When combined with FAIT, that’s a recipe for disaster (as Frederic Mishkin recently noted.)

John Williams also described an asymmetric FAIT, but emphasized that he was not describing the actual Fed policy, just his preference:

I should be clear from the start that the goal of my presentation is to engage in the broad academic and central bank discussion on monetary policy strategies, and that this is not, and should not be interpreted as, a description of the Federal Reserve’s new policy framework or the practical application of AIT to real-world situations.

Clarida offered a similar disclaimer. So what is the actual policy?

You might be saying to yourself that the problem is with me. “Sumner is a dummy; the public understood that the policy would be asymmetric.”

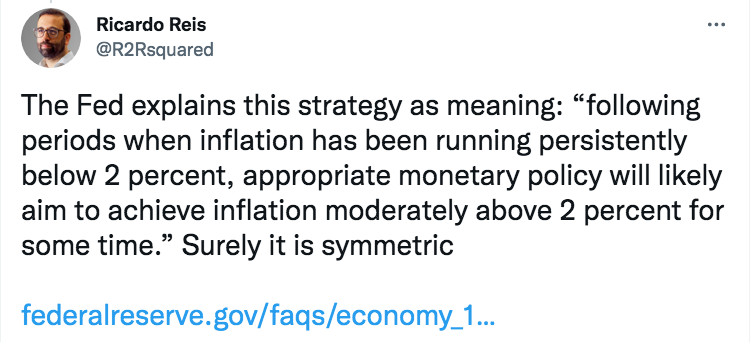

Well, apparently “the public” does not include prominent economists such as Ricardo Reis.

Nor does it include Fed economists writing articles in Fed publications explaining the policy to the general public. This is from a 2021 Dallas Fed paper by Enrique Martínez-García, Jarod Coulter and Valerie Grossman:

By comparison, average inflation targeting means that policymakers would consider those deviations and can allow inflation to modestly and temporarily run above the target to make up for past shortfalls, or vice versa. [Emphasis in original]

So now it’s symmetric again. But by early 2022, it was asymmetric again. What a mess!

Even today, it’s not clear if the new Fed policy applies at all times, or only at the zero lower bound.

PS. You might recall that Communication Breakdown appeared on the first Led Zeppelin album. But that album contains another song that better describes my feelings about Fed communication.

And why stop there? After all, Powell used to play guitar in a rock band. Maybe he was inspired by “How Many More Times”, or “Good Times, Bad Times.” What would Powell think of these lyrics?

Your love is not credible.

It’s a time inconsistent thing.

I need a commitment mechanism.

Baby, I need a ring.

PPS. Larry Summer’s view of FAIT: