By Walter Kurtz, Sober Look

The media has given a great deal of attention to Spain’s extraordinarily high unemployment rate, which has exceeded that of the US during the Great Depression (see post). But how did Spain get from 8% unemployment in 2008 to 25% now?

The latest work from the NY Fed shows that two factors made Spain’s labor force different from the rest of the Eurozone (including Greece).

1. Before the financial crisis almost 13% of Spain’s labor force was in construction. That compares to roughly 8% in the Eurozone and under 6% in the US. The housing bubble and regional infrastructure “pet projects” (funded by cheap sovereign and regional debt financing) in Spain provided a great deal of support to the labor market. Just as a reference point, the US lost 29% of total construction jobs from the peak (45% of residential construction jobs). If the US had double the percentage of jobs in construction as Spain did, the results would have been devastating.

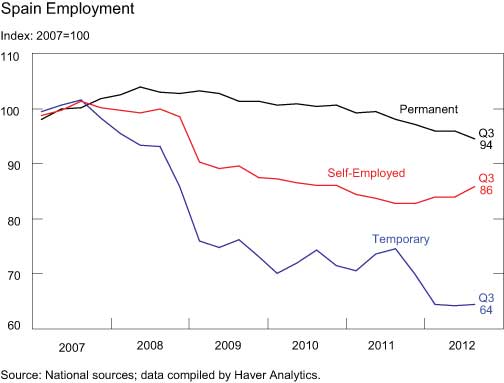

2. Spain had a uniquely large temp labor force, with some 32% of employees working under a temporary contract in 2007. Europe as a whole was half that. That allowed companies in Spain to quickly reduce staff by cutting temporary employees (a great deal of the temp employment was actually in construction). The layoffs provided Spanish firms with flexibility but also contributed to a much more rapid reduction in labor force than elsewhere in Europe.

Source: NY Fed

The hope is that Spain’s labor force “flexibility”, due to the nation’s large temp labor force, should work well in recovery, as firms feel more comfortable taking on temp staffing.

NY Fed: – Spain’s employment experience relative to the rest of the euro area illustrates the cost to the economy of firms having such a high level of flexibility in how they manage workers. Going forward, the hope is that the benefits of such a flexible labor market will also become apparent as firms are quick to hire once the economy starts to make a meaningful recovery.

It may be a while however before we see signs of recovery, particularly given the poor state of the banking system (see story from Reuters).