For four years the Nikkei’s performance has been flat as a pancake, but recent price action suggests that the time of boredom is over. A technical breakout looks to support the agenda of Japan’s new Prime Minister and higher prices for the Japan ETF.

Look at Japan and you see decades of economic contraction, which triggered dozens of financial stimulus packages. The new Prime Minister Shinzo Abe has vowed to continue the legacy of money printing.

Shinzo Abe announced Friday a $225 billion package of public works and other projects just after the Japanese government approved yet another emergency stimulus plan worth $116 billion.

Japan’s government debt is now about 230% of GDP.

Such fire hose financial dousing failed to buoy the Nikkei in the past, but this time might be different. Why?

Shinzo Abe has bullish technicals on his side, at least for now.

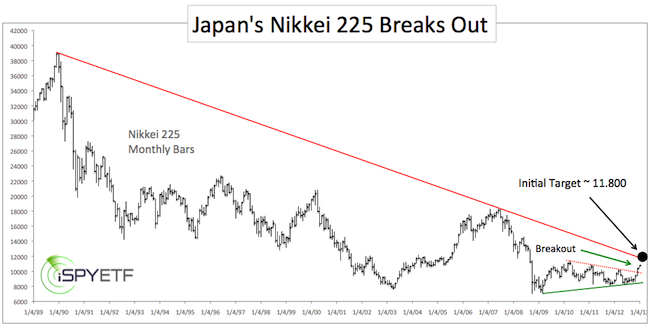

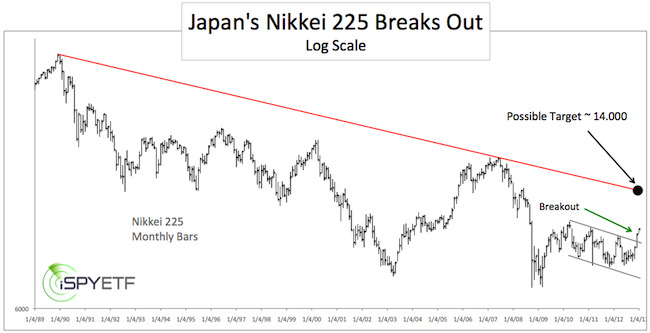

The Nikkei 225 just broke above multi-month trend line resistance and out of a multi-month trend channel (log scale, second chart).

As long as the Nikkei remains above trend line or channel resistance (now support), Japanese stocks will likely rally to their next resistance level. Where’s that?

The first chart pegs red trend line resistance around 11,800, about 9% above current trade.

The log scale chart (second chart) shows the same trend line around 14,000, about 30% above current trade.

A move above trend line resistance around 11,800 is needed to unlock the much higher target around 14,000.

Obviously, there will be pullbacks along the way, but the trend for the next few months looks to be up.

ETFs with exposure to Japan (Japan ETFs) include the iShares MSCI Japan ETF (EWJ) and Ultra MSCI Japan ProShares (EZJ), a double leveraged long ETF.