Paul Krugman argues that we need to look at the cyclically-adjusted budget deficit. And it doesn’t even matter if we have a humongous cyclically-adjusted deficit, as long as the national debt is not rising as a share of GDP. And even then it’ s not really a deficit problem, it’s a lack of health care financing reform problem:

So CBO is now out with its latest report on automatic stabilizers. It estimates that in fiscal 2013 these stabilizers will amount to $422 billion, accounting for just about half of a projected $845 billion deficit. So the cyclically adjusted deficit will be $423 billion.

How does this compare with the deficit consistent with fiscal sustainability? Well, there’s about $11.5 trillion in federal debt in the hands of the public. A reasonable, indeed fairly conservative guess is that nominal GDP will in future grow by 4 percent per year, half from real growth and half from inflation. This means that the sustainable deficit is 4 percent of $11.5 trillion, or $460 billion. Hey, we’re there!

. . .

Yes, late this decade deficits will start to rise again thanks to rising health costs and an aging population, yada yada. But I have yet to hear a coherent argument about why the long-term problem of paying for the benefits we want — which will eventually have to be resolved through a combination of cost savings and revenue increases — should constrain our fiscal policy right now, in the midst of what remains a terrible economic slump.

These are all defensible arguments (although I’d feel more comfortable if he’d been making them during the Bush administration.) But I have a nagging feeling that he might be underestimating the challenge ahead of us. Before making that argument, let me say that I agree with Krugman’s claim that the recession is currently a much more pressing problem, and that we need more demand stimulus (although obviously I’d prefer the Fed to do the job–partly for reasons that will later become clear.)

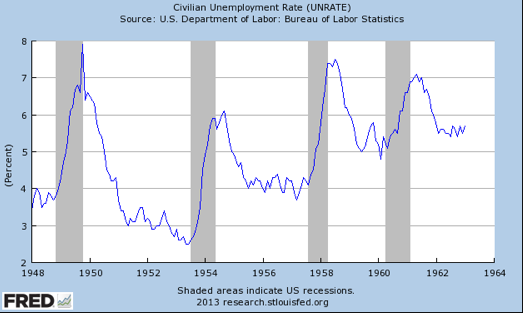

One of my nagging doubts has to do with the nature of the modern business cycle. Krugman sometimes points to the 1950s as a sort of golden age, where income was much more equal that today. But it was also different in terms of the frequency of business cycles; there were three during the Eisenhower administration alone:

I doubt there’ll be any recessions during Obama’s 8 years of office, at least if you attribute the 2007-09 recession to Bush. But in another sense Obama might preside over 8 years of continuous recession–with unemployment staying stubbornly high.

Does that affect Krugman’s argument? I’m not quite sure. We’ve never gone more than 10 years without a recession, and it’s already 5 years since the 2008 recession, with no end in sight for high unemployment. If we have another recession in 2018, and the deficit gets massively larger, how reassuring will Krugman’s “cyclical deficit” argument seem? If the debt/GDP ratio levels off in good times and rises in bad times, are we building a (debt) stairway to heaven?

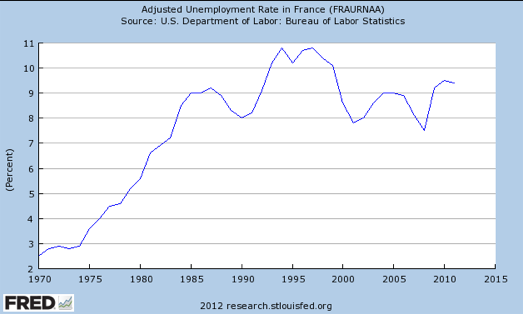

Now let’s go from one extreme to the other, from the Eisenhower administration to modern France:

As you can see France never really recovered from the two oil shock recessions. They’ve had nearly 30 years of unemployment fluctuating around the 8% to 10% range (it’s currently 10.5%) Or maybe they did recover and what actually happened is the natural rate of unemployment rose to 9%. They’ve been cycling around a new and much higher natural rate.

Why did this happen? The progressive answer (lack of AD) doesn’t really work, as other European countries with similar AD policies have far lower natural rates. ”Big government” is probably too simplistic, as some other European countries with big government have much lower unemployment. Still, I’m more sympathetic to the supply-side explanations, which look at a wide range of labor market distortions.

I’m not predicting that we’ll follow in France’s footsteps, indeed I expect the unemployment rate to fall well below 7% if we return to 26 weeks maximum UI. But I do think we’ve got serious structural problems, a combination of slightly higher natural rate of unemployment, more disability, and lower productivity growth (for reasons explained by Tyler Cowen and Robert Gordon.) I lived through an earlier period where we were continually being surprised by bad news on the supply-side, and wouldn’t be surprised if it happened again.

Overall, I don’t think we are Eisenhower America, nor do I think we are France, rather somewhere in between. If anything, I might be even more optimistic than Krugman about the persistence of low government bond yields, so I don’t see any imminent debt crisis ahead. On the other hand I also think it might be harder to keep debt at a manageable level than Krugman assumes, as his “cyclically adjusted deficit” concept was actually developed for a 1950s-type business cycle, where you eventually returned to the old trend line.

Why have the last three recoveries been so slow? Some people talk about factors like “financial problems”. But that confuses real and nominal factors. The RGDP recoveries have been slow because the NGDP recoveries have been unusually slow (compared to the 1950s, or just about any other decade.) So the real question is; why have the NGDP recoveries been so slow? It might be partly intentional—the Great Moderation and all. Fast recoveries might trigger another recession. But I think it’s also partly mistakes in monetary policy. Obviously in this case the zero bound played a role, but the deeper explanation is that real interest rates have been steadily falling since 1983, from 7% to less than zero. And this is precisely when the slow recoveries started. The Fed isn’t easing as much as it thinks it’s easing in each recovery, because they have continually underestimated how much the (Wicksellian) equilibrium real rate of interest has fallen. Thus they’ve overestimated how much monetary stimulus they’ve provided. It’s all John Taylor’s fault. (Just kidding.)

PS. My previous post on this topic was called “Staircase to Heaven.” I really am getting senile.