There are lagging economic indicators and there are economic correlations. Copper is said to have a PhD in economics, but obviously QE is more powerful than a PhD. Nevertheless, iron prices and the Steel ETF confirm copper’s bearish message.

Last week we looked at the ailing U.S. manufacturing sector. Today we’ll look at a closely related commodity that’s often overlooked: Iron.

Iron ore is a key building ingredient for the global economy. Iron ore is used to make steel. Steel is needed for construction of commercial buildings, construction equipment, bridges, ships, cars, appliances, etc.

A strong global economy (or even a recovering economy) should show strong (or strengthening) demand for iron, but that’s not happening.

The benchmark Australian iron ore price has dropped from $158 a ton in February to $110 in June. That’s a tough environment for steel producers.

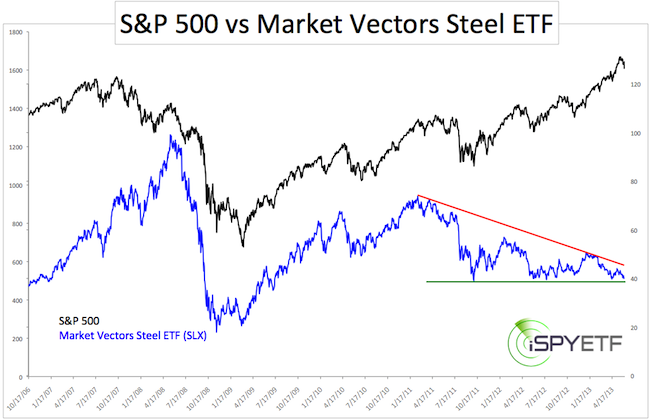

The Market Vectors Steel ETF (SLX) has been tumbling from lower highs to lower lows for the past couple of years.

The Steel ETF absolutely doubts the economic recovery as the chart below shows. The chart plots the Market Vectors Steel ETF (SLX) against the S&P 500 going back to October 2006, when SLX started trading.

The correlation is not perfect, it never is, but the discrepancy between SLX and the S&P 500 since 2011 is obvious.

SLX is stuck in a triangle with support at 39.50. A drop below 39.50 would likely cause further selling for SLX.

Does this bearish non-confirmation mean that stocks will drop tomorrow? No, but it’s another piece of data that highlights the limits of quantitative easing.