The answer is, they both love senior leveraged loans…

The amount of US leveraged senior secured debt outstanding has risen sharply this year. According to LCD this market is now some $630bn in size.

| Source: LCD (the fluctuations include new loans/refinancings as well as partial or full prepayments) |

Yet that doesn’t seem to be enough. While the M&A activity has picked up this year (Heinz, Dell – see story), the volumes are not nearly sufficient to feed retail investors and CLO managers.

Reuters: – Retail money keeps flooding into loan funds, marking 66 straight weeks of heavy inflows, according to Lipper data. Loan funds pulled in $1.3 billion in the week ended September 18, during which the Fed surprised the markets with its plan to keep on buying $85 billion of bonds weekly to keep rates low and boost economic growth.

Loan fund inflows accelerated over the summer on expectations that the U.S. central bank was about to reduce those bond purchases this month, keeping interest rates rising. Issuance of collateralized loan obligations (CLO), another key source of demand for leveraged loans, at $57 billion so far this year already topped last year’s issuance.

This demand continues to keep loan valuations elevated. In spite of the recent selloff across fixed income markets, the leveraged loan index has been pushed to new highs.

| Source: LCD |

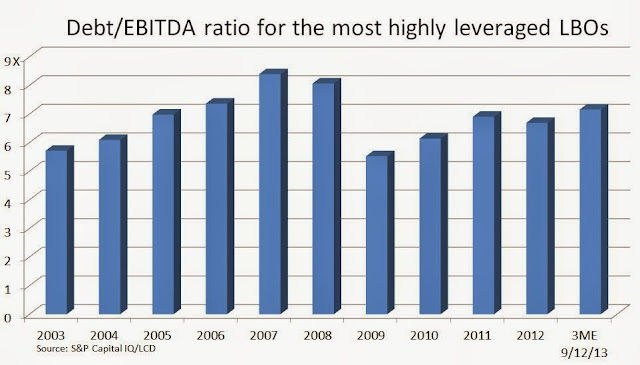

At a recent CLO conference nobody seemed to be too concerned about this. Participants just complained about not getting enough new allocations from the banks running loan syndication. But there are some troubling signs in this market. While leverage on new deals remains well below the 2007 levels, it is starting to creep up as buyers are willing to accept higher risk.

|

| Source: Forbes |

Other loan “features” are beginning to look more like 2007 as well.

Reuters: – Conference attendees did note more risky leveraged loan features including payment-in-kind (PIK) toggles, dividend limitations and looser terms cropping up as more investors hunger for relatively higher-yielding assets.

But CLO managers insist that the credit environment remains benign and none of this is a problem.

John Popp (manages CLOs for Credit Suisse): – “At the end of the day, we’re most concerned about being paid back, and our outlook from a fundamental credit perspective remains quite benign at present.”

All is well – until someone isn’t “being paid back” …

From our sponsor: