Money isn’t created equal, just as economic growth isn’t created equal. There’s real organic growth and there’s artificial growth. The same is true for money. Although the system is flush with money, it’s lazy money.

What is ‘lazy money?’

Lazy money doesn’t move. It keeps to itself and doesn’t spread the love. Lazy money is like a couch potato, it plops itself down and stays down.

Today’s U.S. money supply is lazy, it has no motility or (to use Wall Street jargon) velocity.

What is money velocity?

The velocity of money is the frequency at which one unit of currency is used to purchase domestically produced goods and services within a given time period.

In simple terms, money velocity measures how often one dollar is used to buy goods and services. Decreasing money velocity means that there are fewer transactions between individuals in an economy.

Lower money velocity means that each dollar is touching fewer lives. To illustrate:

A dollar earned by an employee, spent in a restaurant, paid in wages to a waiter, who uses it to buy an iPod does more for the economy than a bailout dollar given to banks (NYSEArca: KBE), where it’s kept as a stagnant number on the balance sheet or dumped into stocks (NYSEArca: VTI).

What’s the velocity of money right now or how lazy is the dollar?

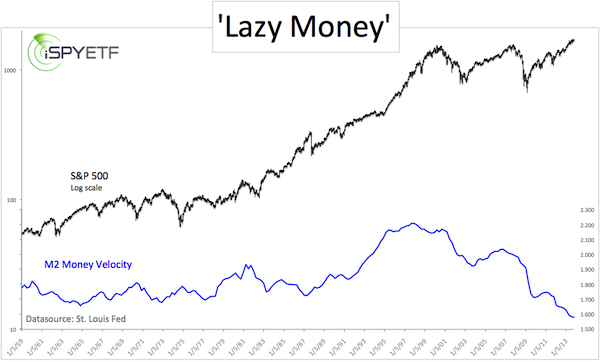

The chart below plots the S&P 500 against velocity of M2 money stock. M2 velocity data goes back to 1959, so does the chart.

The S&P 500 ETF (NYSEArca: SPY) is obviously at an all-time high, but M2 Money velocity has been in a bear market since 1998 and has never been lower.

Here’s my theory. The Federal Reserve prints money and gives it to select financial institutions (NYSEArca: XLF), which park it in stocks and reap fat returns. Banks no longer need to lend. The stock market is where money goes to grow and velocity goes to die.

The conclusion is one you’ve heard before: QE benefits stocks more than the real economy and Fed-printed money isn’t benefiting the economy as much as ‘organic’ money.

If you were to liken the different ‘types of money’ to food; QE money would be considered junk food. Wasn’t there a documentary (Super Size Me) that showed what a diet of junk food does to a human body?

Bernanke likes Wall Street Fat Cats and we won’t have to deal with artery-clogging side effects of the QE junk diet. This will be up to Janet Yellen, Bernanke’s successor to be.

Based on the market’s reaction, investors believe that Janet Yellen will continue Bernanke’s legacy of QE junk food (there are even rumors she’ll super size the banks’ portion).

President Obama went out of his way to praise his nominee’s financial acumen.

In fact, best case scenario the President spread his praise on too thick, worst case scenario he flat out lied about Yellen’s ability.

You can read the glaring conflict between fact and the President’s misleading praise right here: Did Obama Lie About Yellen?

Simon Maierhofer is the publisher of the Profit Radar Report.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE Newsletter.