Nobody in his right mind would by a car based solely on color or a stock based just on EPA. Surely you’ve heard of the U.S. GDP, but nobody really talks about how much the entire United States of America is actually worth. That’s a number worth knowing.

GDP is the best known and most misunderstood acronym in economics. There’s an advance GPD estimate, a second GDP estimate, and the third estimate.

Even the third estimate is subject to periodic revisions (every year in July and/or every 5 years).

Fact is, the GDP number you hear today may be entirely different from the final revised figure, yet the financial media can’t wait to report the latest obsolete GDP digits.

U.S. Assets More Important than GDP?

The United States Gross Domestic Product for 2012 was $15.68 trillion.

Judging a country only by its GDP is like buying a car based on its color or a stock only based on its EPA.

GDP is like a country’s income statement, but where’s the balance sheet?

Only the balance sheet tells us about assets, liabilities, and the actual worth of the country. No bank would approve a corporate loan without a balance sheet.

How Much is the United States of America Actually Worth?

Every quarter the Federal Reserve releases the Z.1 Financial Accounts of the United States Report.

The report is about 170 pages long and somewhat cryptic in nature (we don’t expect anything less from the Federal Reserve).

The Z.1 report is essentially a balance sheet capturing all the assets of the United States of America.

But for some reason the Federal Reserve publishes only balance sheets for some sectors of the economy and makes us dig for the rest.

If you are willing to dig though, you can find the approximate value of all U.S. assets.

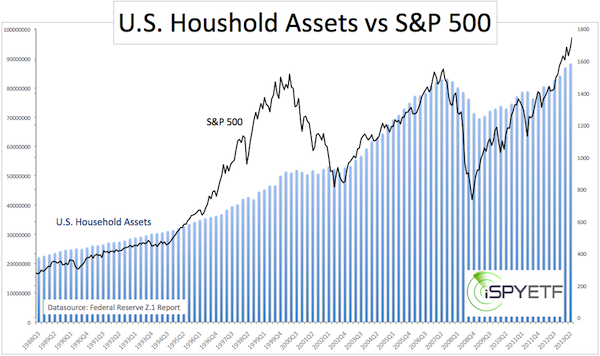

The first charts shows the asset value of all U.S. household and nonprofit organizations (blue columns) along with an overlay of the S&P 500 (SNP: ^GSPC).

Total U.S. household and nonprofit assets amounted to $88.37 trillion as of September 2013.

This includes real estate holdings (NYSEArca: IYR), deposits, savings, and money tied up in stocks, mutual funds and ETFs like the S&P 500 SPDR (NYSEArca: SPY), QQQ (Nasdaq: QQQ), Dow Diamonds (NYSEArca: DIA), etc.

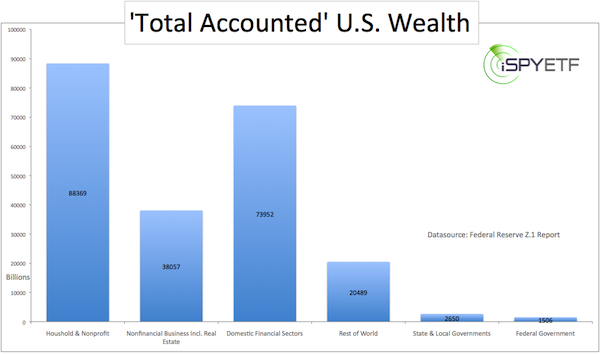

The Z.1 report also provides asset figures for nonfinancial businesses, the domestic financial sector (commercial banks, insurance companies, pension funds, etc.), state and local governments, the federal government and holdings of foreign owners).

The second chart shows the assets of the various segments covered by the Z.1 report.

Total U.S. assets amount to about $225 trillion.

The Z.1 report does not disclose tangible holdings (such as real estate) owned by the financial sector, state and local governments, federal government and foreigners.

In fact, foreign ownership of U. S. assets has exploded. More American’s are essentially sending their rent checks to their landlord overseas.

According to Warren Buffett, that’s problematic for the U.S. economy. Here’s what Mr. Buffett said ten years ago:

“I’m about to deliver a warning … our country’s net worth is now being transferred abroad at an alarming rate. A perpetuation of this transfer will lead to major trouble.”

Which foreign countries ‘own’ American and their alarming buying rate is discussed in detail here:

U.S. Assets are Falling in the Hand of Foreign Investors at Record Pace

Simon Maierhofer is the publisher of the Profit Radar Report. The Profit Radar Report uses technical analysis, dozens of investor sentiment gauges, seasonal patterns and a healthy portion of common sense to spot low-risk, high probability trades (see track record below).

Follow Simon on Twitter @ iSPYETF or sign up for the iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.