By Arthur P. Steinmetz, President and Chief Investment Officer and Brian Levitt, Senior Economist

Periodically we will highlight trends in active, high-conviction investing. This piece talks about the short-term and long-term performances of active and passive strategies

The most famous debates in U.S. history have typically ended with a clear winner. Lincoln beat Douglas, Kennedy bested Nixon (at least according to those who saw the debate on television), and Reagan defeated Carter. Similarly the perennial passive management vs. active management debate has been one sided with the proponents of passive management having all but declared total victory. The media will tell you that there’s little point to even holding the debate; passive investing’s results speak for themselves. But is the debate really that one sided?

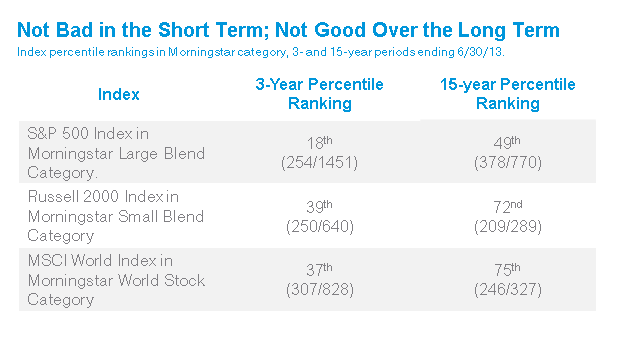

As I point out in Active Investing: The Case for a High Conviction Approach, it’s not. Over select short-term time periods, passive strategies may outperform. Common large-cap, small-cap and global benchmarks ranked reasonably high in the respective Morningstar categories over the three years ending June 30, 2013. Take a look over 15 years, however, and the story is completely different.

Source: Morningstar, based on the firm’s percentile rankings, 6/30/13. Indices are ranked against funds of that respective category. Rankings are subject to change. The S&P 500 Index is a broad-based measure of domestic stock market performance. The Russell 2000 Index measures the performance of small-capitalization stocks. The MSCI World Index is designed to measure global developed market equity performance. Indices are unmanaged and cannot be purchased directly by investors. Index performance is shown for illustrative purposes only and does not predict or depict the performance of any investment. Past performance does not guarantee future results.

As long-term propositions, passive funds tracking these widely emulated benchmarks were frankly unremarkable, and in some cases, downright poor. And the table does not perfectly compare apples-to-apples as it fails to account for the fees that, while not applying to the benchmarks, will apply to the passive strategies.

Many people will actively manage their Health and Career but hesitate with taking an active approach to investing. We believe that high conviction active managers who are willing to be truly different from the benchmark are well positioned to outperform over the long term. So with some deference to Ronald Reagan, will you be better off 15 years from now by owning passive investments instead of actively managed strategies? The debate will go on but history would suggest otherwise.

Past performance does not guarantee future results.

Foreign investments may be volatile and involve additional expenses and special risks including currency fluctuations, foreign taxes and political and economic uncertainties. Emerging and developing market investments may be especially volatile. Small and mid-sized company stock is typically more volatile than that of larger, more established businesses, as these stocks tend to be more sensitive to changes in earnings expectations. It may take a substantial period of time to realize a gain on an investment in a small or mid-sized company, if any gain is realized at all.

Mutual funds are subject to market risk and volatility. Shares may gain or lose value.

These views represent the opinions of OppenheimerFunds, Inc. and are not intended as investment advice or to predict or depict the performance of any investment. These views are as of the open of business on October 3, 2013, and are subject to change based on subsequent developments.

Carefully consider fund investment objectives, risks, charges and expenses. Visit oppenheimerfunds.com, call your advisor or 1.800.225.5677 (CALL-OPP) for a prospectus with this and other fund information. Read it carefully before investing.

Oppenheimer funds are distributed by OppenheimerFunds Distributor, Inc. Oppenheimer funds are distributed by OppenheimerFunds Distributor, Inc. OppenheimerFunds Distributor, Inc. is not affiliated with InvestingChannel.

© 2013 OppenheimerFunds Distributor, Inc. All rights reserved.