The Federal Reserve is the most powerful financial institution in the world and yet it is like the emperor without clothes. Ironically, the very force the Federal Reserve is most afraid of may be the only thing to save the Treasury.

Mirror mirror on the wall, what is the most powerful financial institution of them all?

The S&P 500, Dow Jones and pretty much all other markets seem to dance to the tune of the QE rhythm … and yet the Federal Reserve resembles the vain king portrayed in Christian Andersen’s “The Emperor’s New Clothes.” How so?

Rogue Interest Rates

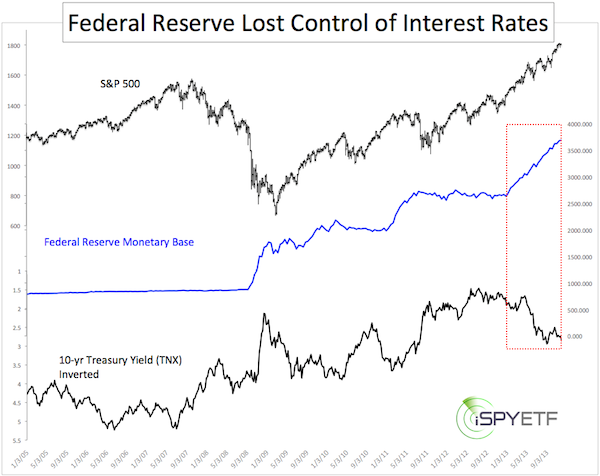

The chart below shows the Federal Reserve’s monetary base sandwiched by the S&P 500 and the inverted 10-year Treasury Yield (Chicago Options: ^TNX).

The purpose of the chart is to show QE’s effect (or lack thereof) on stocks (represented by the S&P 500) and bonds (represented by the 10-year Treasury yield).

The 10-year Treasury yield has been inverted to express the correlation better.

I’ll leave the big picture interpretation of the chart up to the reader, but I have to address the elephant in the room.

Since the Federal Reserve stepped up its bond buying in January, the 10-year yield hasn’t responded as it ‘should’ and that’s very odd (the chart below shows the actual 10-year yield performance along with forecasts provided by the Profit Radar Report).

As of December 5, 2013, the Federal Reserve literally owns 12% of all U.S. Treasury securities and by some estimates 30% of 10-year Treasuries.

Icahn More Powerful Than Fed?

The Federal Reserve basically keeps jumping into the Treasury liquidity pool without even making a splash. If Carl Icahn can allegedly drive up Apple shares (with a 0.5% stake), why can’t the Fed manipulate interest rates at will? This is just one of the many phenomena that makes investing interesting and keeps the financial media in business.

Conclusion

We do know why the Fed wants low interest rates. Rising yields translate into higher mortgage rates, and a drag on real estate prices. Eventually higher yields make Treasury Bonds (NYSEArca: IEF) a more attractive investment compared to the S&P 500 (NYSEArca: SPY) and stocks in general.

Ironically, what the Fed is trying to avoid (higher yields) may be the only force to save the U.S. Treasury. How can the Federal Reserve ever unload its ginormous Treasury position without the help of rising interest rates?

The emperor without clothes maintained his dignity (at least in his mind) as long as everyone pretended to admire his imaginary outfit. Perhaps a market wide realization that the Federal Reserve isn’t as powerful as it seems may ‘undress the scam.’

Regardless, the Fed’s exit from bonds would likely be at the expense of stocks, a market the Federal Reserve has been able to manipulate more effectively than bonds.

The Federal Reserve owns 12 – 30% of the U.S. Treasury market, but how much of the U.S. stock market has the Federal Reserve financed?

This stunning thought is explored here: Federal Reserve ‘Financed’ XX% of all U.S. Stock Purchases

Simon Maierhofer is the publisher of the Profit Radar Report. The Profit Radar Report uses technical analysis, dozens of investor sentiment gauges, seasonal patterns and a healthy portion of common sense to spot low-risk, high probability trades (see track record below).

Follow Simon on Twitter @ iSPYETF or sign up for the iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.

Access All Your ETF Market Indicators in a single, comprehensive report – FREE for a Limited Time!