2013 was an excellent year, but what goes up must come down, right? Not so fast. Strong annual returns, like in 2013, usually appear in clusters. This pattern suggests 2014 will be an up year, but other facts disagree.

The S&P 500 (SNP: ^GSPC) will finish the year with a gain of around 29%.

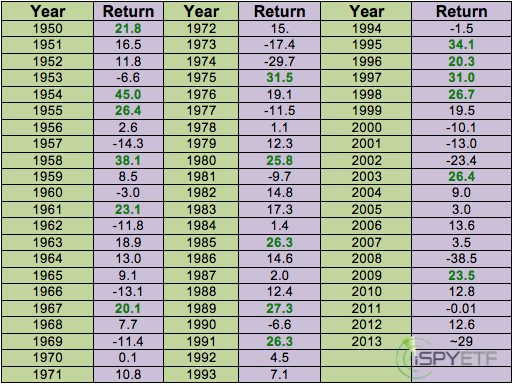

Since 1950, there have been 17 other years when the S&P 500 finished the year with a gain of more than 20%.

Only three of the years were followed by a full-year loss (1962, 1981, 1989). 14 out of 17 years (82.35%) were followed by continued S&P 500 gains the next year.

Based on this simple pattern, there’s an 82% chance that 2014 will be an up year.

Unfortunately things aren’t always that simple.

As far as investing goes, an 82% success rate is excellent, however, this 20%+ gain barometer doesn’t consider any of the following facts:

- – The S&P 500 has already been in ‘QE bull’ mode for 51 months. The average length of a bull market is 39 months.

- – By some measures investors are more bullish today than at any other time in history.

- – QE has inflated stocks against all odds. There’s no precedent for that.

Considering those facts, the odds of 2014 being an up year for the S&P 500 and S&P 500 ETF (NYSEArca: SPY) are less likely than 82%.

Interestingly, the months of December and January are rich with performance patterns that may set the tone for the entire year.

In fact, one of those patterns, when it triggers, has a 100% success rate. It is much more narrow than the 20%+ barometer mentioned above and has been correct 17 out of 17 times.

Here’s a full rundown on this remarkable forecasting tool for the year ahead:

Waiting on What the 100% Accurate Barometer Forecasts for 2014

Simon Maierhofer is the publisher of the Profit Radar Report. The Profit Radar Report uses technical analysis, dozens of investor sentiment gauges, seasonal patterns and a healthy portion of common sense to spot low-risk, high probability trades (see track record below).

Follow Simon on Twitter @ iSPYETF or sign up for the iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.

Access All Your ETF Market Indicators in a single, comprehensive report – FREE for a Limited Time!