Looking at leading or lagging sectors can provide clues about the overall health of a bull market.

This article will look at three leading sectors.

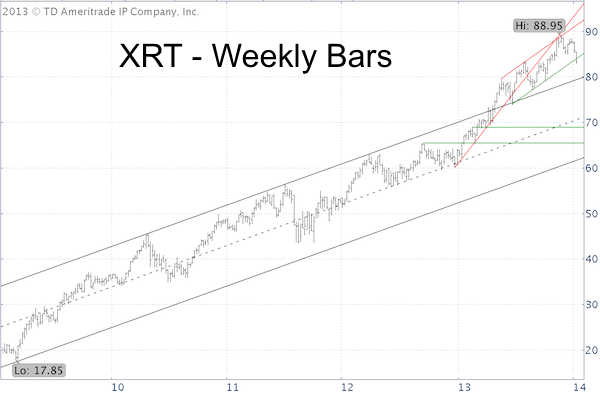

Retail Sector – SPDR S&P Retail ETF

The SPDR S&P Retail ETF (NYSEArca: XRT) soared 42.29% in 2013 and was heading for a strong finish (many thought). Retailers love the holidays (November/December), but the 2013 holiday period wasn’t kind to retailers.

As the XRT chart shows, retailers topped in the last week of November and are threatening to break below green support.

A breakdown around 83.50 and 80 for XRT would spell trouble.

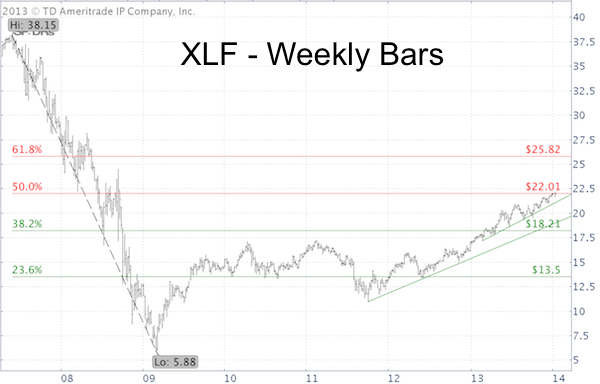

Financial Sector – Financial Select Sector SPDR ETF

The financial sector has been leading the S&P 500 (SNP: ^GSPC) for much of 2013 and confirmed Wednesday’s new S&P 500 high (XLF closed 2013 with a 35.52% gain).

Unlike the S&P 500, the financial select sector SPDR (NYSEArca: XLF) is trading well below its all-time high. In fact, it is bumping against 50% Fibonacci retracement resistance at 22.01.

It will take sustained trade above 22.01 to unlock higher up side targets.

Small Cap Stocks – iShares Russell 2000 ETF

Small cap stocks tend to outperform large cap stocks in December/January, but the iShares Russell 2000 ETF (NYSEArca: IWM) has been on fire almost non-stop, up 38.69% in 2013.

Next notable resistance for IWM is around 119 (2002 Fibonacci projection).

Corresponding resistance for the Russell 2000 Index is at 1,166. Unlike IWM, the Russell 2000 Index is already trading above this resistance.

Summary

It’s said that a fractured market is a sick market. We are certainly seeing some ‘unhealthy’ divergences between the various leading sectors (this doesn’t even take into consideration the most recent Dow Theory divergence).

However, XLF and the Russell 2000 Index are at the verge of overcoming their resistance levels. A strong financial sector and small cap segment could also buoy the S&P 500.

The strong 2013 performance of all three leading sectors begs the question if there’s any ‘gas left’ for 2014. The following articles takes a look at how much up side is left:

Did the Strong 2013 Market Cannibalize 2014?

Simon Maierhofer is the publisher of the Profit Radar Report. The Profit Radar Report presents complex market analysis (stocks, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.