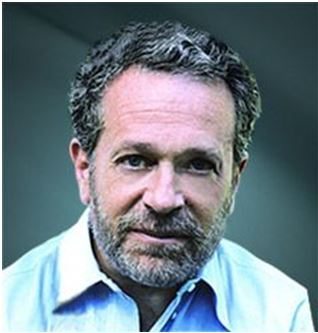

The commencement speaker at this week’s graduation ceremonies at the University of California at Berkeley just so happened to be Robert Reich, Bill Clinton’s Secretary of Labor, and an old friend of mine, who now a distinguished professor at the Goldman School of Public Policy. I attended a couple of Bob’s economics classes, and his grasp of the subject is mind-boggling. Never get into a debate with Bob over labor issues. You will lose.

A Rhodes Scholar who dated Hillary Clinton at Yale, ran for governor of Massachusetts, and authored 14 books, Bob is never without an original thought, nor a stranger to controversy. Reich, who is slightly over four feet tall, never skips an opportunity to joke about his diminutive stature. He warned the grads of the risks of overdependence on raw statistics, pointing out that the average height of himself and Shaquille O’Neal is six feet. He later said that he was over six feet before the Great Recession beat him down.

After the ceremony I managed to plow my way through the crowds and found Bob shipping a celebratory flute of Champagne. He thinks that globalization has become a dirty word. While it has generated immense wealth over the last 30 years, it has accrued only to those who were in position to take advantage of it. Those would be multinationals, technology firms, and emerging nations. If you are not one of those, or a shareholder in them, then you have been basically screwed by globalization.

Corporate profits are now at record highs. CEO pay this year us up 11%. Food and energy prices are rocketing. Those without the skills to benefit from these trends are being bounced out of the economy. As a result, the income, wealth, and power gap in the US are growing, creating a “barbell” economy where the rich are getting richer and the poor are getting poorer at an accelerating rate. Virtually all of the wealth creation over the past three decades has accrued to the top 1% of income earners. The net worth of this top 1% has tripled over the same time frame.

Bob worries about the future of our country. A substantial portion of this wealth is now entering politics. Look no further that the vast expansion of the lobbying industry in Washington. There has been a massive profusion in “independent” research firms that start with a conclusion and work backwards to string together a set of facts to support it.

This is how we hear that that US has the highest tax rates in the world, even though everyone cashes in on loopholes to avoid them, like General Electric (GE), which paid a 3% tax rate last year. We are informed that the oil and agriculture industries are in desperate need of tax subsidies, despite making record profits.

It is also how many have been instructed to believe that spending cuts leads to job creation, that all unions are bad, and that public school teachers are a bunch of lazy, money grubbing opportunists. I belong to the San Francisco Yacht Club, and as far as I know, the only boat that is owned by a teacher is married to a hedge fund manager. Never, ever raise taxes under any circumstances, even though the only ones that will be harmed will be the top 1%.

Bob left his graduates with two final pieces of advice. Grasp every opportunity for leadership. And know the difference between tenacity and martyrdom. As usual, Bob did not disappoint.