It’s not obvious (at least to me) that volatility theoretically scales with the square root of time (sqrt[t]). For example if the market’s daily volatility is 0.5%, then the volatility for two days should be the square root of 2 times the daily volatility (0.5% * 1.414 = 0.707%), or for a 5 day stretch 0.5% * sqrt(5) = 1.118%.

This relationship holds for ATM option prices too. With the Black and Scholes model if an option due to expire in 30 days has a price of $1, then the 60 day option with the same strike price and implied volatility should be priced at sqrt (60/30) = $1 * 1.4142 = $1.4142 (assuming zero interest rates and no dividends).

Underlying the sqrt[t] relationship of time and volatility is the assumption that stock market returns follow a Gaussian distribution (lognormal to be precise). This assumption is flawed (Taleb, Derman, and Mandelbrot lecture us on this), but general practice is to assume that the sqrt[t] relationship is close enough.

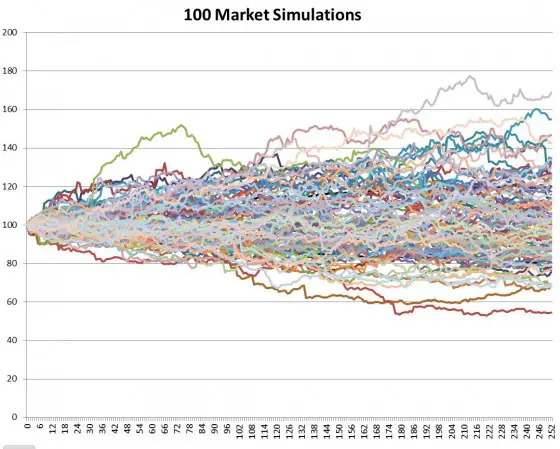

I decided to test this relationship using actual S&P 500 data. Using an Excel based Monte-Carlo simulation1 I modeled 700 independent stock markets, each starting with their index at 100 and trading continuously for 252 days (the typical number of USA trading days in a year). For each day and for each market I randomly picked an S&P 500 return for a day somewhere between Jan 2, 1950 and May 30, 2014 and multiplied that return plus one times the previous day’s market result. I then made a small correction by subtracting the average daily return for the entire 1950 to 2014 period (0.0286%) to compensate for the upward climb of the market over that time span. Plotting 100 of those markets on a chart looks like this:

Notice the outliers above 160 and below 60.

Volatility is usually defined as being one standard deviation of the data set, which translates into a plus/minus percentage range that includes 68% of the cases. I used two handy Excel functions: large(array,count) and small(array,count) to return the boundary result between the upper 16% and the rest of the results and the lowest 16% for the full 700 markets being simulated. The 16% comes from splitting the remaining 32% outside the boundaries into a symmetrical upper and lower half. Those results are plotted as the black lines below.

The next chart compares those two lines to the theoretical result which takes the annualized standard deviation of the S&P 500 daily returns from 1950 to 2014 and divides it by the square root of time.

Standard Deviation (N) = Annualized Standard Deviation/ sqrt (252/N)

Where N is the Nth day of the simulation.

Impressively close.

Since the simulated boundaries vary some from run to run I collected 32 runs and determined the mean

Very, very close.

So, in spite of the S&P 500’s distribution of results not being particularly normally distributed (see chart below), the general assumption that volatility scales with the square root of time is very appropriate.

Notes:

- Returns are expressed as the natural log of the current day’s close divided by the previous day’s close. The specific daily return used is selected by randomly choosing a number between 0 and 16204 (Trunc(Rand()*16205)) and then using that number to index into the table of SPX returns. The 16205 constant is the number of trading days from 3-Jan-1950 to 30-May-2014. As mentioned in the post, the overall daily mean for that period (0.0286%) is subtracted from the result to compensate for the general upward bias of the market over that period.