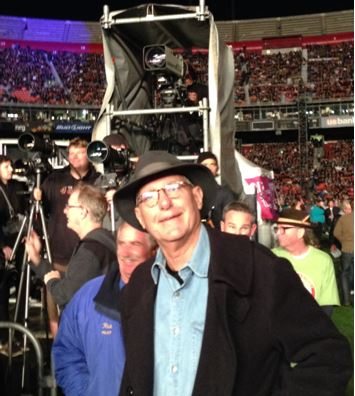

If you think this letter is being written by someone who is stoned, you’d be at least partially right this morning. For that is the after effect of my attending the Paul McCartney concert at Candlestick Park in San Francisco last night.

I was sitting in the infield in the most expensive $1,000 seats, well attended by Silicon Valley royalty. Excuse me Mr. Cook, can I please get by Mr. Ellison, hey, Sergei, love the service. I calculated that there was at least $1 trillion in market capitalization in my row, alone.

All that meant was that the second hand smoke in my section was more expensive, and more potent. And there was always the risk that the gyrating figure in the aisle on LSD might crash into you.

This was not a sit back in your seat and listen to the tunes concert. Some 70,000 people were on their feet for the duration, rocking out, dancing, and tapping their feet. McCartney, who appears immune to ageing, delivered in spades.

While he played, the fog rolled in from the bay, hit the high intensity lights, and vaporized, creating a surreal, magical effect.

Candlestick Park, which Paul pronounced in his drawn out Liverpudlian (scousian) accent, holds a special place in the hearts of Beatles fans. They first played there when the stadium was new in 1966. They last played together there in 1969. After tonight’s concert, it will be torn down.

Candlestick was originally built in 1959 to lure the Giants baseball team from Brooklyn. Structurally, it never recovered from the 1989 Loma Prieta earthquake, which occurred when a World Series was in play. The damp, freezing cold, the lack of mass transit connections, and the terrible parking have been perennial complaints about The Stick.

Last night, loyal fans could be seen digging up tufts of grass, or tearing down signs to take home. The San Francisco Giants moved downtown to play at AT&T Park more than a decade ago, and the 49ers relocated to a new stadium in San Jose this year.

To watch a video of McCartney’s blockbuster opening number, “Eight Days a Week,” please click here.

This diversion aside, I am happy to report that I have been rocking out in my own way. The total return for my followers so far in 2014 has reached 27.1%, compared to a far more arthritic 2% for the Dow Average during the same period.

In August, followers have earned a welcome 3.2%, making it one of my best months of the year. Did I just hear someone shout at me to “take more vacations?”

The three and a half year return is now at an amazing 149.6%, compared to a far more modest increase for the Dow Average during the same period of only 36%.

That brings my averaged annualized return up to 41%. Not bad in this zero interest rate world. It appears better to reach for capital gains than the paltry yields out there.

This has been the profit since my groundbreaking trade mentoring service was first launched in 2010. Thousands of followers now earn a full time living solely from my Trade Alerts, a development of which I am immensely proud.

This has been a real trader’s market this year, with plenty of volatility in the past month, but little net movement in the overall indexes. I played the S&P 500 from both the long and short side, selling the peak within minutes and buying the bottom 5% lower.

I managed to eke out some small profits shorting the Treasury bond market (TLT), stopping out before the real carnage began.

A short position in the Euro (FXE), (EU) is the gift that keeps on giving. I am on my third roll-down in strikes over the past month. It also helps that I went into Russia’s latest incursions into the Ukraine with a tiny book, and 80% cash. Thus I have plenty of dry powder to act opportunistically going forward.

I am ready to use the next microdip to jump back in. It is just a matter of time before Apple breaks $100 a share and hits a new, split adjusted all time high.

In the meantime, the world is waiting to see whether the US can deliver a second half GDP growth rate of 4% per annum…or not. We might have to settle for 3%, given the new sanctions against Russia.

Quite a few followers were able to move fast enough to cash in on the move. To read the plaudits yourself, please go to my testimonials page by clicking here. They are all real, and new ones come in almost every day.

My esteemed colleague, Mad Day Trader Jim Parker, was no slouch either, dodging in an out of the raindrops to make money on an intra day basis.

What would you expect with a combined 85 years of market experience between the two of us? Followers are laughing all the way to the bank.

Don’t forget that Jim clocked an amazing 2013 with a staggering 374% trading profit. That was just for an eight-month year!

The Opening Bell with Jim Parker, a quickie but insightful webinar giving followers an instant snapshot of the market opening every day, has been an overwhelming success. Many customers have already reported dramatic improvements in their trading results.

Watch this space, because the crack team at Mad Hedge Fund Trader has more new products and services cooking in the oven. You’ll hear about them as soon as they are out of beta testing.

Our business is booming, so I am plowing profits back in to enhance our added value for you. The latest is the Mad Hedge Fund Trader Channel on YouTube that enables me to post videos from my frequent travels around the world.

The coming year promises to deliver a harvest of new trading opportunities. The big driver will be a global synchronized recovery that promises to drive markets into the stratosphere by the end of 2014.

Global Trading Dispatch, my highly innovative and successful trade-mentoring program, earned a net return for readers of 40.17% in 2011, 14.87% in 2012, and 67.45% in 2013.

Our flagship product, Mad Hedge Fund Trader Pro, costs $4,500 a year. It includesGlobal Trading Dispatch (my trade alert service and daily newsletter). You get a real-time trading portfolio, an enormous research database and live biweekly strategy webinars. You also get Jim Parker’s Mad Day Trader service and The Opening Bell with Jim Parker.

To subscribe, please go to my website at www.madhedgefundtrader.com, find the “Mad hedge Fund Trader PRO” or “Global Trading Dispatch” box on the right, and click on the blue “SUBSCRIBE NOW” button.