The ECB tightened monetary policy sharply in 2011. This caused NGDP growth to plunge, and the eurozone fell into a double-dip recession.

Whenever you have a demand-side recession, some people will look at specific industries, and/or specific regions, to see what caused it. This is mistake. The US housing industry was hit hard in the recent recession, but didn’t cause it. The PIIGs were hit especially hard after 2011, but did not cause the eurozone recession. In any recession, there will be regional and industry variation in intensity, due to supply-side factors. But those specific factors cannot explain a generalized decline in NGDP growth for an entire currency zone. Only monetary policy can explain that.

Here’s something from a Mario Draghi speech that Vaidas Urba sent me:

From 2011 onwards, however, developments in the two regions diverge. Unemployment in the US continues to fall at more or less the same rate. In the euro area, on the other hand, it begins a second rise that does not peak until April 2013. This divergence reflects a second, euro area-specific shock emanating from the sovereign debt crisis, which resulted in a six quarter recession for the euro area economy. Unlike the post-Lehman shock, however, which affected all euro area economies, virtually all of the job losses observed in this second period were concentrated in countries that were adversely affected by government bond market tensions (Figure 2).

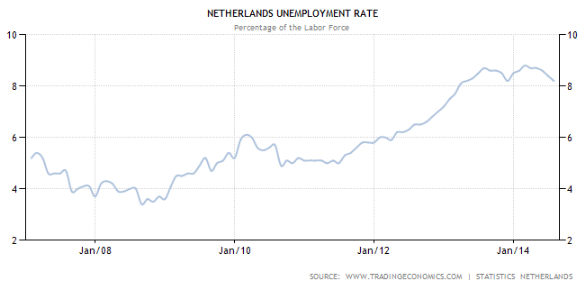

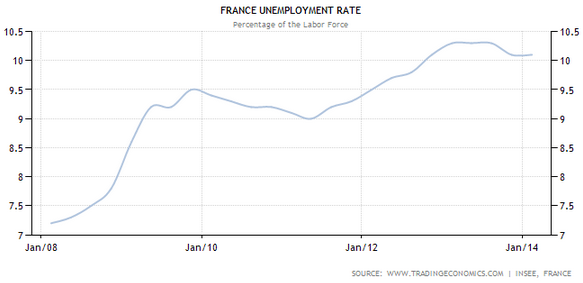

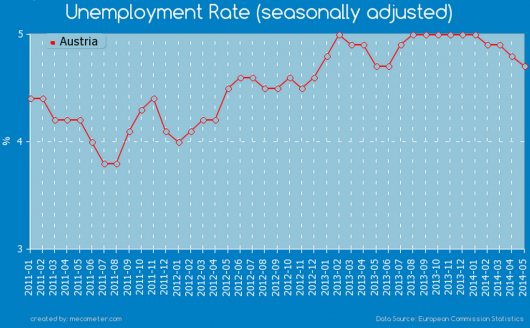

Is this true? Consider these graphs, showing that it wasn’t just the PIIGS that experienced a double dip:

So the Netherlands, France, Belgium and Austria also had double-dips. The Dutch double-dip was worse than the first dip. The ECB caused the double-dip recession—even new Keynesian models will tell you that. (After all, the ECB raised rates twice in 2011, so this wasn’t one of those zero bound issues.) Odd that Draghi doesn’t understand that the ECB caused the NGDP growth collapse, and that debt crises are the result of NGDP growth crashes. That doesn’t make me very hopeful that the eurozone’s long nightmare will end anytime soon.

So the Netherlands, France, Belgium and Austria also had double-dips. The Dutch double-dip was worse than the first dip. The ECB caused the double-dip recession—even new Keynesian models will tell you that. (After all, the ECB raised rates twice in 2011, so this wasn’t one of those zero bound issues.) Odd that Draghi doesn’t understand that the ECB caused the NGDP growth collapse, and that debt crises are the result of NGDP growth crashes. That doesn’t make me very hopeful that the eurozone’s long nightmare will end anytime soon.