Close the Knowledge Gap

Since 2011, MFS has kept tabs on investor attitudes and behaviors, sharing the findings with advisors to support their work with clients. Our latest round of research keyed on investors’ understanding of time horizons and investment risk, as well as their use of active and passive investments. The results show a striking, persistent knowledge gap that, left unchecked, could prevent them from reaching their long-term financial goals.

Four key findings

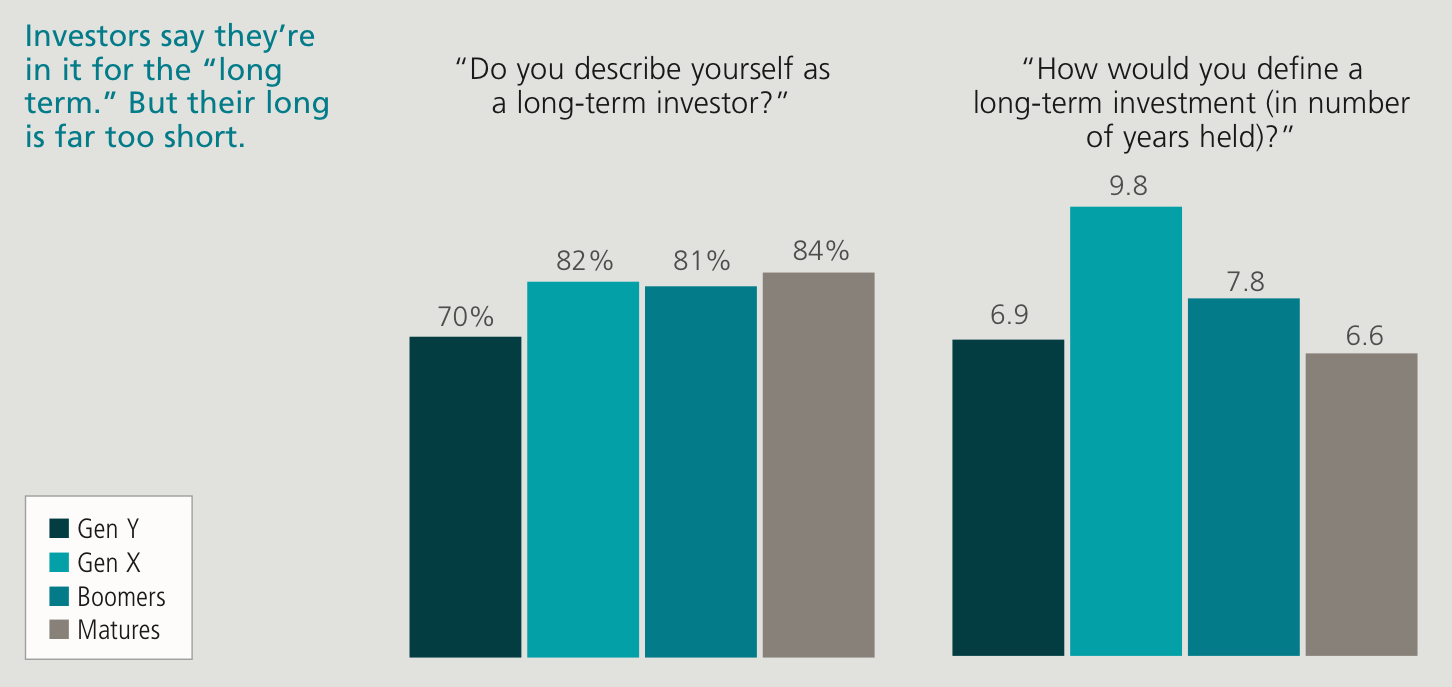

• Most investors, regardless of generation, declare themselves to be “long-term” investors.

• Investors’ think “long-term” is shorter than expected.

• Most respondents who own passive investments are unable to accurately define those investments.

• The perceived benefits of owning passive and active investments are misunderstood, especially when it comes to risk and diversification.

Implications for Advisors

Advisors now have an opportunity to help their clients focus on appropriate time horizons and provide a factual understanding of active and passive investments.

All Generations Think of Themselves as Long-Term Investors

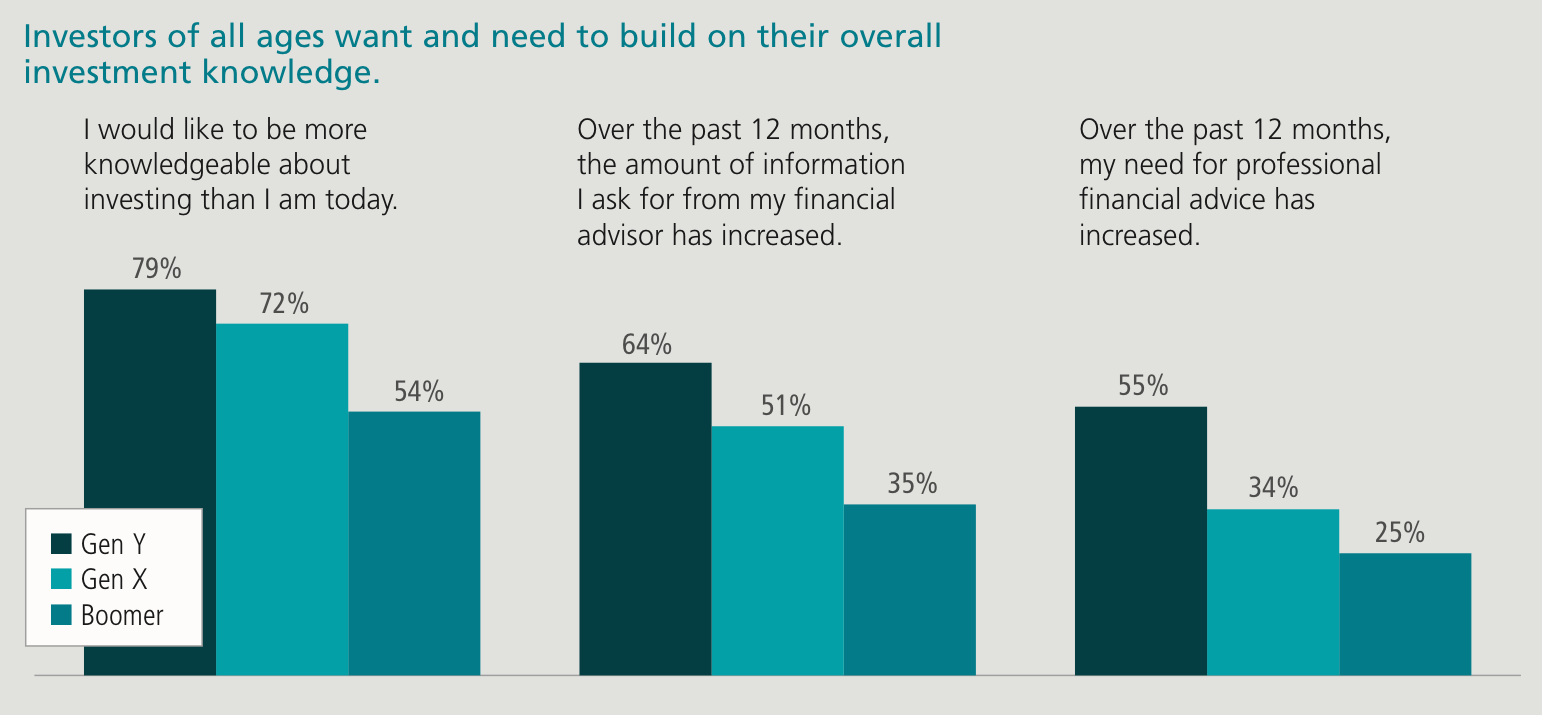

The Need For Advice

Advisors play a critical role in presenting the relevant choices, informed education and guidance investors crave as they move to, through and past retirement.

Millennial investors, adults under age 34, say they’re in it for the long-term, yet they define “long-term investing” as less than seven years. Millennials also continue to hold larger-than-expected cash allocations and fewer US equities than older generations, trading growth potential for perceived safety. They hold a mix of active and passive investments in their portfolios, but lack a strong understanding of what they are, how they work and why they own them.

Are they a “lost generation” of investors? Data from this latest MFS Investing Sentiment Insights survey shows that while the Great Recession of 2008 has had the greatest, longest-lasting impact on millennials, they are not alone in their need for the insight and guidance of professional advisors. These survey results reveal opportunities for you to educate investors across generations. Help them better understand their time horizons, risk tolerances and investment options so they can make sound long-term investment choices.