Every once and a while you read articles suggesting that the reform process in China has stopped. Tyler Cowen discussed a book on China by Joe Zhang that makes 5 very dubious claims about reform. This one seems more than “dubious”:

In the past decade, China has erased most (if not all) of the liberalization of the previous two decades.

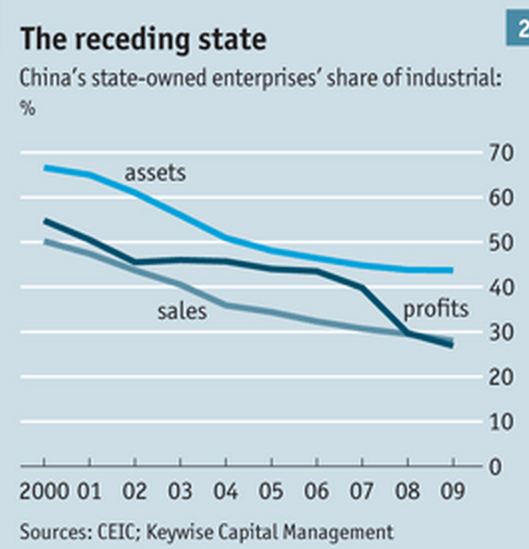

Thirty years ago China wasn’t much more advanced than North Korea. The SOE share of the Chinese economy fell from 80% in 1978 to 18% today. Here’s a graph showing the first decade of the 21st century:

That graph is from a 2011 article in The Economist. But how about more recently? Has the reform process stopped?

Last year the FT reported that Xi Jinping was initially focusing on making the SOEs more efficient:

Reforms in train in China amount to a significant, albeit indirect, challenge to state companies across a range of industries, chipping away at their privileges. The government does not want to eliminate them. Instead, it wants to make them more efficient and more profit-focused – in short, more like private companies.

. . .

Private companies complain that they are struggling to compete against state companies and cannot access the same investment or funding opportunities as them. Moreover, the productivity gains at state companies have stalled, with their equity returns lagging behind private rivals by about 10 percentage points.

These problems form the basis of Mr Xi’s new round of SOE reforms. First, the government has promised to open up protected industries, including finance and energy, to more private capital – giving entrepreneurs capital opportunities that they lacked before. These openings, though, are expected to be modest.

The second and crucial part of Mr Xi’s push is to make existing SOEs more like private companies in their operations, if not their ultimate ownership. The reforms “will mainly focus on improving the operational efficiency of the SOE sector”, said Zhu Haibin, an economist with JPMorgan.

The government will allow state companies to introduce employee stock ownership plans, a way of encouraging managers to target profits. Bringing more private investors on board will also increase the portion of state companies in the hands of performance-minded shareholders, a disciplining force.

Even more important are the reforms that will change their operating environment. Shifts to market-based pricing for energy inputs and interest rates are, over time, undermining the advantages that state companies have over their private rivals.

An example of that was seen last week when China Development Bank, a state-owned lender that is one of the biggest creditors to local governments, had to scale back a planned bond issue because of tight monetary conditions. It was a case of an increasingly liberalised interest rate market forcing a state-owned company to weigh its investment plans more carefully.

“They know that if they issued the bond, the yield will be pretty high, probably higher than their returns,” said a credit trader with a European bank in Shanghai.

The industrials sector has also thrown up multiple examples this year of how market forces are impinging on state companies. The listed arms of Cosco, a shipbuilder, and Yunwei, a chemicals company, are among those that have announced assets sales in recent months to repair their balance sheets after big losses.

In 2014 things are moving even faster. The Economist recently reported that privatization is back on the table:

The temptations to branch out have been too great: relative to their private-sector peers, they have benefited from cheaper financing from state-owned banks, favouritism from local governments in land sales and a lighter touch from regulators.

Second, despite these advantages, SOEs have given progressively less bang for their buck. Faced with mounting losses in the 1990s, China undertook a first round of drastic reforms of its state-owned companies. There were mass closures of the weakest firms, tens of millions of lay-offs and stockmarket listings for many of the biggest which made them run a little more like private companies. That initially paid dividends. SOEs’ return on assets, a gauge of their productivity, rose from barely higher than zero in 1998 to nearly 7% a decade later, just shy of the private-sector average. But over the past five years, their fortunes have ebbed. Profitability of state companies has fallen, even as private firms have grown in strength. SOE returns are now about half those of their non-state peers. For an economy that, inevitably, is slowing as it matures, inefficient state companies are a dangerous extra drag. Jian Chang of Barclays says that putting SOEs right is “the most critical reform area for China in the coming decade”.

Until recently, however, few analysts thought that China had the desire or the ability to get back into the muck of SOE reform. Companies under the central government, such as PetroChina, the country’s biggest oil producer, were believed to be strong enough to resist the changes that would erode their privileges. At the provincial and municipal levels, local officials were thought bound to government-owned companies by ties of power, patronage and money. China was not expected to sit entirely still: gradual deregulation of interest rates and energy pricing was placing indirect pressure on state companies to operate more efficiently. But a direct, frontal assault on them of the kind waged by Zhu Rongji, then prime minister, in the 1990s seemed out of the question. Even when the party unveiled a much-ballyhooed reform plan last November and vowed to target SOEs, there were doubts about how far Xi Jinping, China’s president, could go. People close to the State-owned Assets Supervision and Administration Commission (SASAC), the agency that oversees China’s biggest SOEs, say that it was still dragging its feet at the start of this year.

But a flurry of announcements in the past few months shows that reforms are getting on track. There is no one-size-fits-all approach. Sinopec, Asia’s biggest refiner, is close to selling a $16 billion stake in its retail unit, a potentially lucrative opening for private investors. CITIC Group, China’s biggest conglomerate, is poised to become a publicly traded company by injecting its assets into a subsidiary on the Hong Kong stock exchange, for $37 billion. After its initial reluctance, SASAC announced reforms at six companies. They are to experiment with larger private stakes and greater independence for directors.

Although generating fewer headlines, moves by local governments to sell their companies could be even more significant for the Chinese economy. Local SOEs have performed worse than their central counterparts, meaning there is plenty of scope for improvement. They are more accessible to private investors since they are concentrated in non-strategic sectors. “It’s opening wide up. There is a ridiculous amount of deal flow coming our way,” says a manager with an international private-equity firm. The southern province of Guangdong recently held a meeting at which it offered stakes in 50 different SOEs, according to people present. Shanghai has also been at the forefront. In June it sold a 12% stake in a subsidiary of the Jin Jiang hotel group to Hony Capital, a local private-equity firm. Analysts say that this will encourage better management practices at Jin Jiang, including stock-option incentives for executives, and that it could serve as a template for future such deals.

The received wisdom in China used to be that “vested interests”, namely SOEs themselves, would thwart reform. Few believe that any more. With more than 100 officials from PetroChina, the biggest SOE of all, now under investigation for corruption, Mr Xi has flexed his muscles.

I often get commenters making very strange claims. They’ll assert that the success of the 4 East Asian “tigers” was due to mercantilist policies and the failures of Latin America were due to free market neoliberal policies. That’s of course the exact opposite of the conventional wisdom. They always cite a couple economists whose names I forget (one American and one South Korean.) While I haven’t read the original papers, my guess is they make the common mistake of forgetting that all economies are very complex. You can find market reforms everywhere, even in North Korea. You can find lots of government intervention everywhere, even in Hong Kong much of the real estate is owned by the state. The trick is to get an overall view of the situation. Was East Asia or South America more open to trade? (The two most successful tigers were completely open, the other two fairly open.) Which South American economies did the least bad? (The neoliberal ones like Chile did best, the highly statist ones did the worst.) Perhaps some people believe intervention is good, and then look for examples of intervention in a successful economy. You can always find some, but were they the decisive factor in the success? Almost never.

I haven’t read the book Tyler discusses, so I can’t comment on the specifics. But I’d love to see someone provide a short summary of how someone could claim China today is roughly as illiberal as 30 years ago. That seems preposterous at first glance. Is it possible the author made the same mistake as those who claim Latin America is a test of free markets, and East Asia a test of statist policies?

On the other hand my claim that tight money by the Fed caused the Great Recession also seems “preposterous at first glance.” 🙂

PS. I’d recommend Coase’s book on China (written with Ning Wang) for those who are interested in how they reformed their economy.