One week after the VIX (ChicagoOptions:^VIX) spiked to 30, Wall Street’s Kool-Aid drunks are back to saying that stock market volatility is over. It’s done. And it’s never returning.

The Santa Claus rally in small cap stocks (NYSEARCA:IWM) and technology shares (NYSEARCA:XLK) smack dab in the middle of October, now has Sand Hill road (Silicon Valley) meditating it’s next round of IPO (NYSEARCA:IPO) money losers.

On September 11, my video titled “Has Stock Market Gone Completely Away” was published when the VIX traded under 13. At that time, Wall Street’s message about fading stock market volatility (NYSEARCA:SPLV) was exactly the same as it is today. Wrong again!

(Audio) GTAT Blows Up + Ron does a Portfolio Report Card on a $569,000 investment account

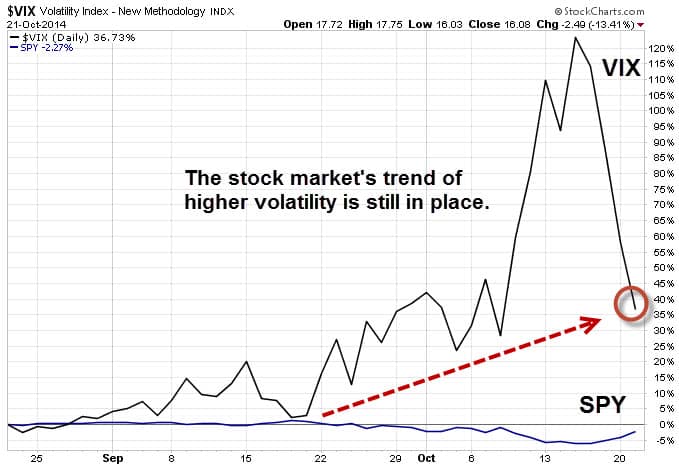

The chart below shows how the VIX – even after factoring in its current slide – is still outperforming the S&P 500 (^GSPC) over the past 2 months by a healthy +36.73% compared to a -2.27% decline for U.S. stocks (NYSEARCA:IVV).

Even before my Sept. 11 video was published, here’s what we wrote to ETFguide’s subscribers via our Weekly Picks on Sept. 3 when the VIX (NYSEARCA:VXX) traded near 12.

“Increasing volatility when stocks are up is just another one of the countless market dislocations within this particular bull cycle. We also think it’s a prelude of even higher volatility yet to come. We’re buying the ProShares VIX Short-Term Futures ETF (NYSEARCA:VIXY) at around $18.62 per share. Our tandem options trade is to buy the VIXY DEC 2014 19 calls (VIXY141220C00019000) at around $210 per contract.”

How did this volatility trade – which lasted just over one month – turn out? We bagged a 90% gain on the VIXY DEC 2014 19 call options and a 20% gain on our VIXY shares.

The right time to prepare for higher market volatility is before it happens. And if you’re correctly positioned, you can cash in your chips and have enough money to surprise the spouse with wine and roses. How many more times are you going to miss the next big move in volatility?

The ETF Profit Strategy Newsletter is your volatility HQ. We use technical analysis, market history along with common sense to keep investors on the right side of the market. All readers get email and text alerts.

Follow us on Twitter @ ETFguide