When measuring the investment performance of a portfolio, the biggest mistakes people make are 1) not tracking performance at all, or 2) comparing a portfolio’s performance to flawed yardsticks. The first point should be self-explanatory, so let’s focus on the second point.

If a certain portfolio holds an asset mix of 25% U.S. stocks (NYSEARCA:SCHB), 25% bonds (NYSEARCA:BOND), 10% international stocks (NYSEARCA:EFA), 10% real estate (NYSEARCA:VNQ), and 30% cash, how does comparing its performance to an irrelevant 100% all stock benchmark like the S&P 500 (NYSEARCA:VOO) lead us to a relevant conclusion? The answer is it doesn’t!

(Audio) Why the 60/40 portfolio comes up short on diversification

The right way to measure the previous mentioned portfolio’s performance is by using a blended benchmark. How is this done? By comparing how each portfolio’s overall asset exposure performed against its relevant passive benchmark over an identical time frame. Taking the sum performance of the portfolio’s various assets versus the sum performance against a corresponding blended benchmark renders a precise and accurate picture of investment performance.

Why don’t hedge funds, mutual funds, and the rest of Wall Street measure performance using blended benchmarks? Is it to purposely distort investment track records to make themselves look better by comparing apples with oranges? Why do financial regulators like the Securities and Exchange Commission tolerate Wall Street’s subversive and illicit practice of rogue benchmarking?

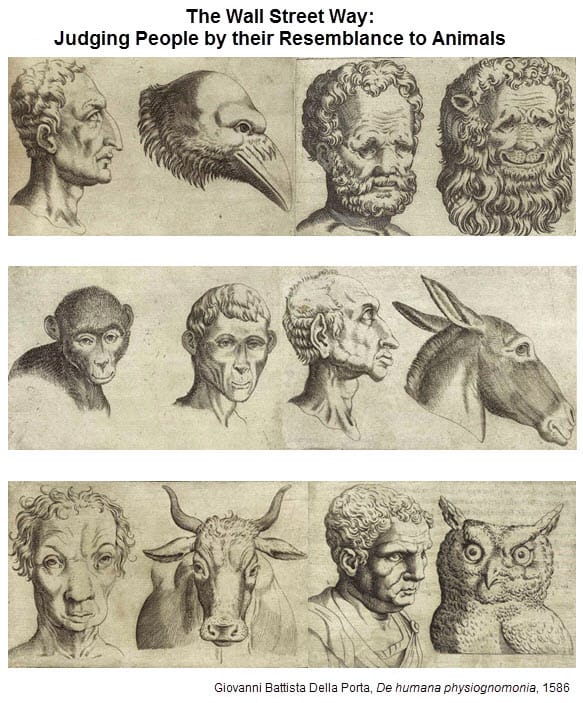

The flawed tactics for measuring investment performance is a widespread problem. Today’s financial services industry is a mirror of the medical field in the 16th century. Back then, they tried to categorize people according to their faces and which animals they most resembled. The bizarre (and creepy) outcome is illustrated in the figure below.

If you’re still confused, don’t be. Ron DeLegge’s Portfolio Report Card that you receive always judges your portfolio’s performance against the right yardstick and over the same corresponding time period. Remember: Blended passive benchmarks that approximate your portfolio’s asset allocation aren’t just the right way to measure investment performance – it’s the only way.

Follow us on Twitter @ ETFguide