Back from a long vacation—it will take me a while to catch up on what I missed.

I notice that 5-year Treasuries are currently yielding 1.56% and 10-year yields are 2.04%. I was taught two theories of the yield curve:

1. Expectations hypothesis—> Long term yields are an average of expected future short term yields.

2. Term premium hypothesis—> Long term yields are an average of expected future S-T yields, plus a term premium.

The first hypothesis implies the 5-year, 5-year forward yield is expected to be 2.52%. The second predicts a somewhat lower expected yield. Are these two theories still the state of the art, or is it possible that investors expect higher than 2.52% yields in 2020?

If I am correct, then investors are predicting stunningly low 5-year yields in 2020. Why do I say 2.52% is stunningly low? Very young readers that are used to low rates might find that claim to be odd. But recall that the market cannot predict business cycles 5 years out in the future. Thus investor forecasts for yields at that date essentially represent estimates of what rates will look like once they have been “normalized.” (And by the way, I hate it when central bankers use that term; it does more harm than good. There is no such thing as “normal” in an ever-changing world.)

Theories:

1. Slightly lower expected inflation. Although the Fed’s been targeting inflation at about 2% since 1990; during 1990-2008 the market probably thought they’d err a bit on the high side, now they’re expected to err a bit on the low side.

2. Low real interest rates. The 5-year TIPS yield is 0.29% and the 10-year is 0.38%, implying a 5-year, 5-year forward real rate of 0.47%. That seems low to me—the Great Stagnation?

I’m looking for feedback from people who know more finance than I do (like David Beckworth.)

PS. Speaking of blegs, our family will probably end up in Southern California when we retire (although the way things are going I’ll never really “retire.”) We explored the entire area and sort of liked North Tustin in Orange County. But our favorite was Glendale in LA County. Anyone have any opinions on either place? Also Woodland Hills/Sherman Oaks. I’d like a house high enough up to have a view, but can’t afford west LA. I like LA itself, but am too old for the gritty urban lifestyle of more central locations. But I want to be close.

And I’ve always wanted a single family home.

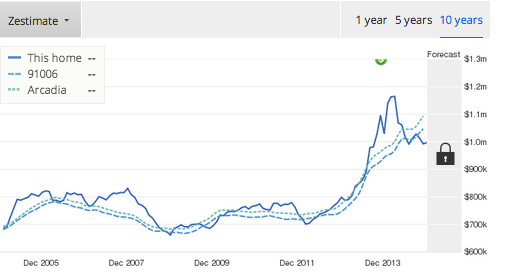

PPS. Did you know that Arcadia is considered the Chinese Beverly Hills? This suburb is far from the coast, in the hot, flat, smoggy San Gabriel valley. We ate lunch there. This ad shows a 2100 sq. foot ranch for $1,680,000. That’s the power of Chinese money. In 2005 and 2006 Bush was expected to enact immigration reform that would have led to many more Asian and Hispanic immigrants to southern California. You all know what happened when that reform failed. But the Chinese immigrants will come, it’s just a matter of time. In Arcadia house prices have already soared far above the 2006 “bubble” peaks:

Low rates as far as the eye can see and 1.4 billion Chinese who covet the SoCal lifestyle. Bubbles? You ain’t seen nuthin yet.

Low rates as far as the eye can see and 1.4 billion Chinese who covet the SoCal lifestyle. Bubbles? You ain’t seen nuthin yet.