After gaining five consecutive years and gaining nine out the past 10 years, the U.S. stock market is on a roll. And while it’s easy to become complacent, warning signs are already showing up in the bond market.

(Audio) Which of these 3 investors is you? + the Most Accurate Stock Market Indicator Since 1939

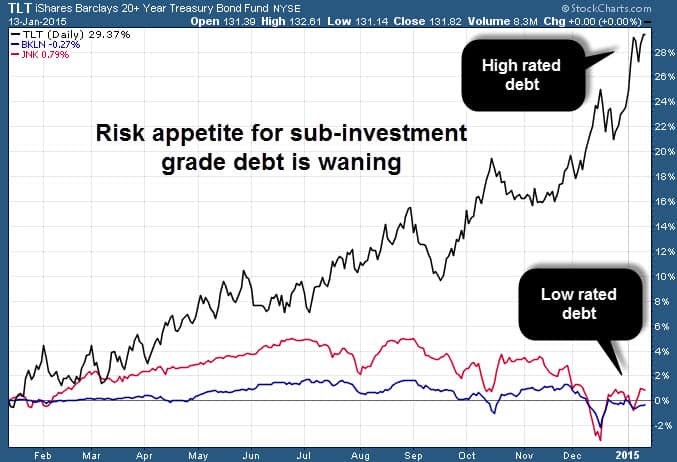

The chart below illustrates how risk appetite in the bond market is shifting away from high risk to safety by favoring top credit graded U.S. Treasury debt (NYSEARCA:TLT) versus lower rated and speculative debt. The PowerShares Senior Loan ETF (NYSEARCA:BKLN) has an average credit rating of BB and the SPDR Barclays High Yield Bond ETF (NYSEARCA:JNK) has an average rating of B while the iShares Barclays 20+ Year Treasury ETF has an average credit quality of AA.

The message couldn’t be more clear: bond investors are becoming more defensive.

For now, the overall U.S. stock market (NYSEARCA:VTI) is ignoring the major retraction in risk appetite happening in the bond market (NYSEARCA:AGG). But in time, this too shall pass.

Follow us on Twitter @ ETFguide