Your investment portfolio is nothing more than a reflection of you. Put another way, it’s a personal statement about how you view risk, taxes, diversification, and investment cost. If you’re negligent in building an investment portfolio that fails to corretly address these key areas, your performance results are likely to suffer.

My latest Portfolio Report Card is for DP in Los Angeles, CA. He’s 54 years old, married and he’s an engineer.

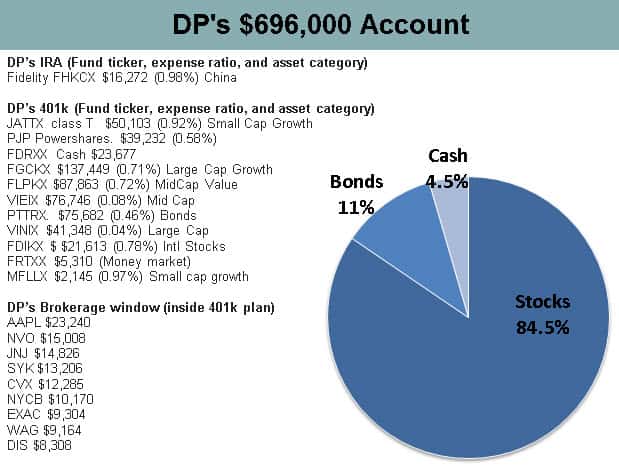

He asked me to analyze his $696,000 portfolio which is divided among a self-directed IRA and 401(k) plan. Among this is around $16,272 invested in his IRA, so the bulk of his money is in his 401(k) plan.

(Audio) Portfolio Report Card: A $2 Million Portfolio that Costs Way Too Much

Altogether DP owns 10 mutual funds, 9 individual stocks, and one ETF. He told me his goal is to retire by age 60 and although he considers himself an aggressive investor, he wants to start getting more conservative.

Does his Portfolio Report Card get a passing grade? Before I assign DP a final grade, let’s examine the five key areas of his portfolio together.

Cost

Keeping the tyranny of compounding investment costs to an absolute minimum is every investor’s job. And the investment portfolios that deliberately reduce trading commissions, fund fees, and other costs always win.

DP told me he executes two stock trades or less per month and pays a $7.95 brokerage commission.

For his mutual fund holdings I found no real attempt by DP to minimize fund costs. Around $388,982 is invested in funds with elevated fund expenses. For instance, he pays 0.46% in Pimco Total Return Fund (Nasdaq:PTTRX), 0.78% to own international stocks (Nasdaq:FDIKX) via a Fidelity fund, and 0.92% in Janus Triton (Nasdaq:JATTX) along with the 0.97% in the Morgan Stanley Small Cap Growth Fund (Nasdaq:MFLLX) to own small cap stocks. Although low cost funds like VINIX and VIEIX are owned, they unfortunately represent a small part of the overall portfolio.

Diversification

A properly diversified portfolio is never about how many securities you own, but rather, distributing your holdings across a variety of different asset classes.

Both DP’s IRA and 401(k) have exposure to most major asset classes minus commodities and real estate. Yet, he’s got exposure to non-core assets like individual stocks such as Apple (AAPL) and Disney (NYSE:DIS). Why?

Making sure your portfolio is fully diversified to core asset classes always comes first and before investing in individual stocks. Put another way, owning individual stocks shouldn’t be happening until portfolio first has exposure to all the major asset classes. DP’s diversification is sloppy.

Risk

A portfolio with the correct risk level always matches the risk limits and character of the investor. Is your portfolio compatible with your age, temperament, life circumstances, goals and liquidity needs?

DP’s overall asset mix is 84.4% stocks, 11% bonds, and 4.5% cash. While stocks have behaved well over the past few years, this is a hyper-aggressive asset mix – even for a 54-yr old “aggressive” investor.

A stock market decline between 20%-40% exposes DP’s retirement plan to potential losses of $116,000 to $233,000. Being just six years away from retiring, I doubt those are the types of losses he can afford.

Tax Efficiency

I was glad to find that DP hasn’t demolished the tax benefits of his tax deferred retirement plans by taking out premature distributions. Furthermore, he has no outstanding 401(k) loans which could pose a tax threat to his money if he suddenly leaves his job. Overall, DP’s portfolio grades well on tax-efficiency.

Performance

What’s the right standard of performance? It’s most certainly not distorted peer groups, which are common in the mutual fund industry. Rather, it’s how a person’s portfolio performs relative to a blended mix of passive index ETFs that correspond to the person’s asset allocation.

Last year DP had a combined portfolio value of $577,173 and one-year later, his balance has increased to $696,000. After adjusting his performance for the $17,060 he contributed to his retirement plan over the past year, he gained 17.6% vs. our benchmark of 7.73%. Well done!

The Final Grade

DP’s final Portfolio Report Card is a B. While this is a very good score it doesn’t mean DP’s retirement plan is without flaws.

His portfolio’s biggest weak spots are cost, diversification and risk. Simply put, 84.4% exposure to stocks for a 54 year old aggressive investor is way too high. Although it’s helped his performance in a rising market, it’s likely to hurt in a declining market.

DP has done a great job at accumulating a nest egg, now it’s up to him to protect it. Hopefully DP can tweak his portfolio and avoid pitfalls that could derail his future.

Ron DeLegge is the Founder and Chief Portfolio Strategist at ETFguide. He’s inventor of the Portfolio Report Card which helps people to identify the strengths and weaknesses of their investment account, IRA, and 401(k) plan.