The Bank of Canadasurprised markets last week when they lowered the overnight rate 0.75% on Wednesday. The bank cited low oil prices, which have rendered much of Canada’s oil production unprofitable and resulted in downward pressure on growth and inflation expectations.

|

| Source: National Post |

|

| Source: Bank of Canada |

As we discussed last month, this relief was much needed to reverse these trends and support Canada’s faltering housing market.

|

| Source: The Canadian Real Estate Association |

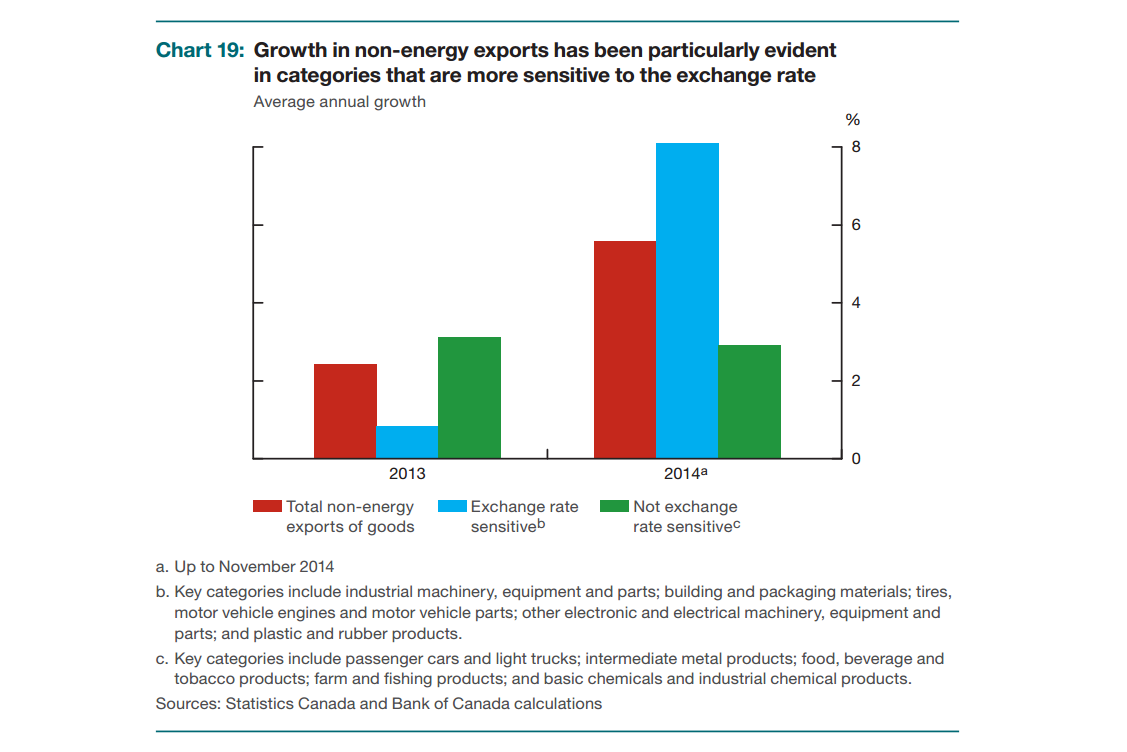

Some are raising concerns that the Bank of Canada focused too narrowly on oil production by ignoring recent growth in manufacturing, stable employment, and potential adverse effects of increased lending amid high household debt levels.

|

| Source: Bank of Canada |

|

| Source: Trading Economics |

|

| Source: FRED |

Financial Post: Toronto-Dominion Bank, Canada’s largest lender, says it has no plans to cut its prime rate to match the central bank’s move, keeping the rate linked to variable mortgages, car loans and other securities, at 3%. Other banks, including Royal Bank of Canada, are also holding off.

“Our decision not to change our prime rate at this time was carefully considered and is based on a number of factors, with the Bank of Canada’s overnight rate only being one of them,” spokesman Mohammed Nakhooda said in an e-mail statement.

|

| Source: Bank of Canada |

|

| Source: Bank of Canada |

_________________________________________________________________________

Sign up for our daily newsletter called the Daily Shot. It’s a quick graphical summary of topics covered here and on Twitter (see overview). Emails are distributed via Freelists.org and are NEVER sold or otherwise shared with anyone.