How did market participants react to the ECB’s 1.1 trillion euro QE-styled asset purchase plan? By pouring money into European stocks.

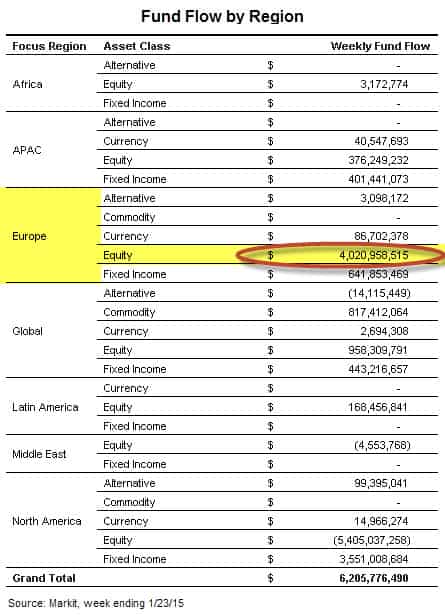

Europe focused stock ETFs (NYSEARCA:VGK) collectively raked in 65% of all global ETP asset flow last week, gaining just over $4 billion in new assets.

(Audio) Portfolio Report Card: Analyzing & Grading a $668,000 Retirement Plan

Despite reluctance by Germany (NYSEARCA:EWG), the ECB pledged to buy 60 billion euros of EU assets every month through September 2016. The monthly breakdown will consist of 45 billion euros of sovereign debt, 5 billion euros of corporate and agency bonds, and 10 billion euros for asset backed securities.

Over the past year, European stocks have lagged by falling around 2% in value while Asian stocks (NYSEARCA:VPL) have increased almost 3% and the total U.S. stock market (NYSEARCA:SCHB) has jumped 15.69%.

On August 4, we published a video “Why the Euro Has Made a Major Top” when the Euro CurrencyShares (NYSEARCA:FXE) traded near $132. Since then, euro has fallen 16% while certain ETFs that gain when euro falls (NYSEARCA:EUO) have jumped almost 40%.

Meanwhile, weekly asset outflows topped $5.4 billion in North America, with most outflows exiting the SPDR S&P 500 (NYSEARCA:SPY) and the Nasdaq-100 (NasdaqGM:QQQ).

On the fixed income side, assets in short-term bond ETFs like the First Trust Enhanced Short Maturity ETF (NasdaqGM:FTSM) jumped 345% while assets in the iShares Short Treasury Bond ETF (NYSEARCA:SHV) rose 21%.

Aggregate global asset flow totaled $6.2 billion for the week ending Jan. 23, 2015, according to Markit.

Follow us on Twitter @ ETFguide