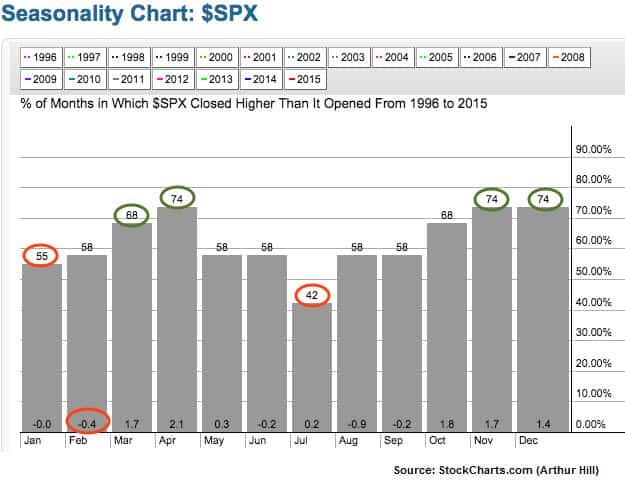

Although we know market prices always trump seasonality in terms of importance, we shouldn’t completely ignore the significance of historical seasonal trends.

Since 1996, the S&P 500 (SNP:^GSPC) has ended higher during the month of January 55% of the time but with a flat return. This particular January appears to be an obvious divergence from this trend. But looking ahead to February, the chart below shows how the S&P 500 has ended that particular month up 58% of the time. You’ll also notice some seasonal weakness during February because U.S. stocks have posted a modest loss of -0.4%.

(Audio) Portfolio Report Card: Ron DeLegge Analyzes and Grades a $668,000 Retirement Plan

Beyond next month, March and April have been extremely bullish based upon recently history.

Seasonality hasn’t been much of an issue over the past year for U.S. stocks (NYSEARCA:IWB). Leveraged long ETFs that double (NYSEARCA:SSO) and triple (NYSEARCA:SPXL) the S&P 500’s daily performance have been star performers. Over the past year, SSO (aims for 2x daily performance to the S&P 500) has jumped +26.49% and SPXL (3x daily to S&P 500) has soared +38.85%. Meanwhile, the unleveraged SPDR S&P 500 ETF (NYSEARCA:SPY) has gained +13.95%.

Follow us on Twitter @ ETFguide