What’s a telltale sign of a poorly designed investment portfolio? Answer: A portfolio that underperforms indexed yardsticks. Is it reasonable to expect this type of portfolio which is unable to deliver satisfactory results during a favorable stock market climate to miraculously thrive during an uncooperative market? Answer: Absolutely not!

This is one of the reasons why identifying the strengths and weaknesses of your portfolio is so important: because it gives you an immediate point of reference by telling us whether you are progressing or digressing financially. Fixing a misaligned portfolio is easier to do when markets are up versus later when they are down.

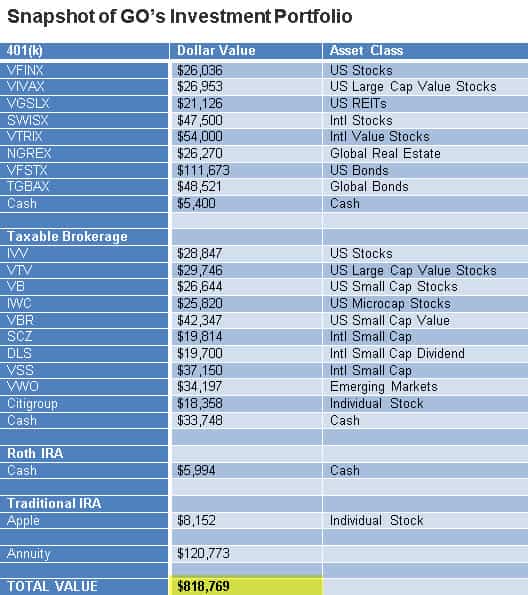

My latest Portfolio Report Card is for GO in Swarthmore, PA. He’s 66 years old, his wife is 57 and he asked me to analyze and grade his $818,000 investment portfolio. It consists of four accounts – a traditional IRA, Roth IRA, 401(k) plan, and a taxable brokerage account. The bulk of his money is divided between his 401(k) plan ($367,479) and taxable brokerage account ($316,371).

(VIDEO) 4 Symptoms of a Sick Investment Portfolio

He owns 9 ETFs, 8 mutual funds, and two individual stocks. GO told me moderate growth is his investing style and his goal is to have his current portfolio to grow to $1.6 million over the next six years after which he plans to retire. If he doesn’t add any new money to his existing portfolio, I estimate he’ll need to average an 11% return to achieve that goal.

What kind Portfolio Report Card grade will GO’s combined portfolios get? A, B, C, D, or F? Let’s analyze and grade his investments together.

Cost

What is the standard for a low cost portfolio? I always compare the cost of a portfolio against a blended mix of index ETFs that match up with the person’s asset allocation. This kind of yardstick gives us a robust yardstick for judging whether a portfolio’s cost is excessive or not.

Many of GO’s mutual fund and ETF holdings charge less than 0.40% annually and a few like the iShares S&P 500 Fund (NYSEARCA:IVV), Vanguard Small Cap (NYSEARCA:VB), and Vanguard Value (NYSEARCA:VTV) charge under 0.10%, which is outstanding. His most expensive funds are (Nasdaq:NGREX) (0.50%) and (Nasdaq:TGBAX) (0.64%) in his 401k, along with iShares MSCI EAFE Small Cap Fund (NYSEARCA:SCZ) and iShares MSCI EAFE Value Fund (NYSEARCA:EFV) (both charge 0.40%) which are located in his taxable account. His trading activity is deliberate, disciplined and limited. His combined portfolios do an excellent job at containing investment costs.

Diversification

Investment portfolios that lack exposure to all the major asset classes including stocks, bonds, commodities, real estate, and cash are not truly diversified.

GO’s combined portfolios have exposure to US, international, and emerging markets stocks, U.S. and international bonds, global real estate, and cash. Moreover, the majority of mutual funds and ETFs being used by GO are acceptable diversified proxies for the asset classes they’re tracking. They don’t engage in any style drift whatsoever and are true to their investment objective.

A small shortcoming of GO’s portfolios is that they miss exposure to commodities (a major asset class).

Risk

GO told me his goal is to retire in six years and to grow his $818,000 portfolio to $1.6 million. Can he do it?

(AUDIO) Ron Does a Portfolio Report Card on a $2 Million Account for DC in Florida

GO’s combined portfolios asset mix: 29% US stocks, 29% international and emerging market stocks, 39% bonds and cash, and 3% individual stocks (AAPL and C). GO’s overall asset mix corresponds very well to a “moderate” investor age 60. The risk level of his portfolio is compatible with both his age and risk capacity.

Tax Efficiency

All well-built investment portfolio deliberately minimize the negative impact of taxes by positioning money in tax-efficient vehicles like ETFs and through smart asset location. The latter means putting tax inefficient assets like bonds and REITs into tax-deferred accounts while stock funds can generally be kept in taxable accounts.

GO’s combined portfolios grade well reducing the threat of taxes. He owns tax-efficient ETFs and as a long-term investor, he’ll be taxed at the more favorable and lower long-term capital gains rate.

Performance

The correct standard of performance aren’t distorted peer groups, which are common in the mutual fund industry, but rather how a person’s portfolio performs relative to a blended mix of passive index ETFs that correspond to the person’s asset mix.

GO’s one-year performance gain for combined portfolios was 13.7% ($74,626) while a blended passive benchmark replicating the same asset mix gained +5.18%. His outperformance of the benchmark by +8.52%, validates that his investment portfolio’s architecture is on target. Horse feathers to those who erroneously claim that diversified portfolios lack performance sizzle!

The Final Grade

GO’s final Portfolio Report Card is a “B.” This is an outstanding grade and the risk level of his portfolio is compatible with his age, goals, and risk capacity. Also, his portfolio graded well at minimizing investment cost, it’s a tax-efficient portfolio, and his one-year performance beat our blended benchmark that corresponds to his asset mix.

Why didn’t GO’s portfolio get an “A”? By missing exposure a major asset class (commodities), his portfolio came up short of perfect on diversification. Aside from that, GO’s portfolio is a definite “A” if it has commodities exposure.

In summary, GO’s combined portfolios are well organized and he has a disciplined system is in place for asset allocation and trading. And if he maintains what he’s doing, there’s no reason to think he can’t reach is goal of $1.6 million in six years.

Ron DeLegge is the Founder and Chief Portfolio Strategist at ETFguide. He’s inventor of the Portfolio Report Card which helps people to identify the strengths and weaknesses of their investment account, IRA, and 401(k) plan.