Commenter Nick directed me to this FT story:

Mr Williams spoke amid speculation about when the Fed will pull the trigger following more than six years of rates at near-zero levels. Economists including Lawrence Summers, a former US Treasury secretary, have urged the Fed to leave rates unchanged until there is clear evidence that inflation, and inflation expectations, are set to breach its 2 per cent target.

However Mr Williams dismissed such calls, warning of the risk that the Fed gets behind the curve on inflation and that it could end up being forced to hike rates “much more dramatically” to rein in inflation, provoking market turmoil. Given the trails with which monetary policy operates it was better to start raising interest rates “gradually, thoughtfully”, he said.

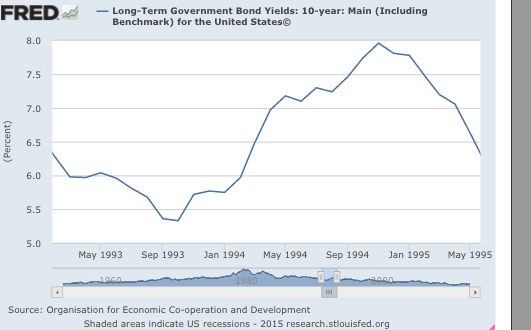

When I hear Wall Street types talk about the danger of a sudden and dramatic tightening of interest rates, they often refer to the awful 1994 “bloodbath” in the bond market, triggered by the Fed’s decision to tighten monetary policy after a period of low rates during the 1991 recession and weak recovery. Here’s a graph showing the rise in 10-year bond yields, which sharply depressed bond prices in 1994.

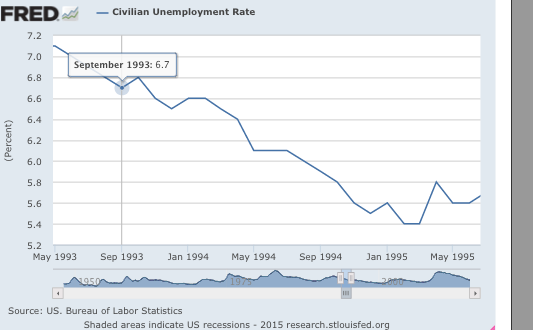

Fortunately, there was no “bloodbath” in the labor market, which is the market I care about:

Nor was there a bloodbath in the stock market. The 1994 move was an example of highly effective stabilization policy by the Fed, despite all the gnashing of teeth in the bond market. I wonder if the Fed is overly concerned about the impact of its policies on the bond market, and insufficiently concerned about the impact on the labor market.

In contrast, during April to September 2008 the labor market was deteriorating rapidly—clearly headed into a recession—while the Fed twiddled its thumbs. Unemployment rose from 5.0% in April to 6.1% in August, which was 1.7% above the low point reached at the cyclical peak (4.4%.) In the past, a recession has occurred 100% of the time when unemployment rose by more than 0.8% above the cyclical low, so the 1.7% rise was a completely unambiguous signal. How did the Fed respond? They did nothing at their September 2008 meeting, 2 days after Lehman failed.