A good investment plan today is better than a perfect plan tomorrow. Unfortunately, most people don’t have either. What about you?

Building a healthy portfolio with sustainable and satisfactory performance doesn’t happen by accident. It takes planning and having the proper framework.

Phase 1

The process of assembling and managing your investments is comparable to the construction of a building. Before the construction work can start, an architect must first draft a blueprint. Thereafter, the construction process happens over a prescribed period beginning with the very first phase; the pouring of the building’s foundation. How illogical it would be to ignore this first phase by skipping to the latter phases of construction!

(Audio) Portfolio Report Card: A Doctor with a Sick $503,929 Retirement Plan

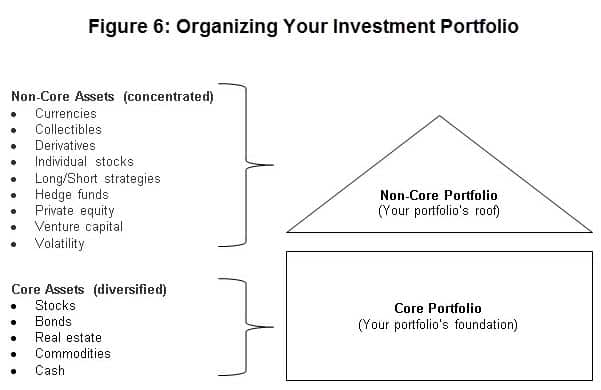

Similarly, building an investment portfolio on a solid foundation of core asset classes is always the first phase and absolute priority of every prudent investor. There is no other way. A person, for example, cannot begin building their investment portfolio by first investing in non-core asset classes like individual stocks, currencies, private equity, venture capital, and volatility (NYSEARCA:VXX). Doing so without first building the portfolio’s core (foundation), is like trying to build the second and third story of a building without first completing the building’s foundation. It’s poor engineering!

Portfolio Re-Construction?

What if you already built your investment portfolio around non-core assets and forgot to first build the core? For instance, let’s say you have 100% of your assets spread across individual stocks, hedge funds, private equity (NYSEARCA:PSP), derivatives, and other non-core assets. Then what?

The right course of action would be re-construct your portfolio by liquidating non-core assets and funneling the proceeds into broadly diversified core asset classes like U.S. stocks (NYSEARCA:SCHB), international stocks (NYSEARCA:VEA), emerging markets (NYSEARCA:EEM), bonds (NYSEARCA:AGG), commodities (NYSEARCA:GCC), real estate (NYSEARCA:RWO), and cash. You don’t necessarily have to sell all your non-core assets, but the bulk of your portfolio’s value should be invested in core assets.

Figure 6 shown above is taken from my upcoming book about the Portfolio Report Card grading system I invented. The illustration shows how a person’s investment portfolio is divided into two parts: A core and a non-core. The core always holds core asset classes that are broadly diversified, whereas the non-core portion can hold concentrated or undiversified assets. The ultimate goal is to help individual investors to have the right investment framework for successfully building and managing money.

Without a solid foundation, no physical structure can survive a storm. And your investment nest egg is no different.

Follow us on Twitter @ ETFguide