Tyler Cowen has a new post offering opinions on a wide range of issues. In many cases I agree with his views. For instance, this one:

5. We are still in the great stagnation, for the most part. But with nominal gdp well, well above its pre-crash peak, it is not demand-based “secular stagnation.” It just isn’t, I don’t know how else to put it. And the liquidity trap is still irrelevant and has been since about 2009.

The reasoning used is not very persuasive. Could you imagine him making that argument in late 1982, when NGDP was above the pre-recession peak? But Tyler’s conclusion seems sound.

However I take issue with this claim:

4. During the upward phase of the recovery, monetary policy just doesn’t matter that much.

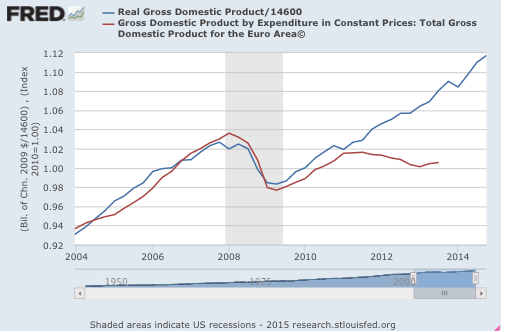

I can’t even imagine what a model would look like where that claim was true. To see why it is not true, compare the post mid-2009 recoveries in the US and Europe. If monetary policy in the US and Europe did not matter very much during the recovery, then the tightening of monetary policy in mid-2011 in the eurozone ought to have had little effect. What does it look like to you?

I think the problem here is that the US recovery looks fairly smooth, and also disappointing, despite various actions by the Fed. It’s tempting to conclude that Fed policy didn’t matter very much. But all you have to do is to look across the pond and you’ll see that it mattered a great deal.

PS. I’m not sure why the Fred’s eurozone RGDP data is not updated. I believe there’s been a very anemic recovery in the past year.