Energy names are leading the day today with the $OIH and $XLE leading the way. I’m eying a possible position in $DNR, and also like $SM, $REXX, & $OAS.

The action in the overall market looks terrible, but I’m still seeing pockets of strength which prevents me from hitting the panic sell on current positions.

When in a bull market such as this, I find it (most of the time) beneficial to wait for the close before making any rash decisions on swing trades– so I will do just that.

If this selloff does indeed turn south or the speed changes, I may trim down a few positions. It always helps to have a hedge in the portfolio, mine is $BIS. We are long from 31.92, and I have no intentions of selling it.

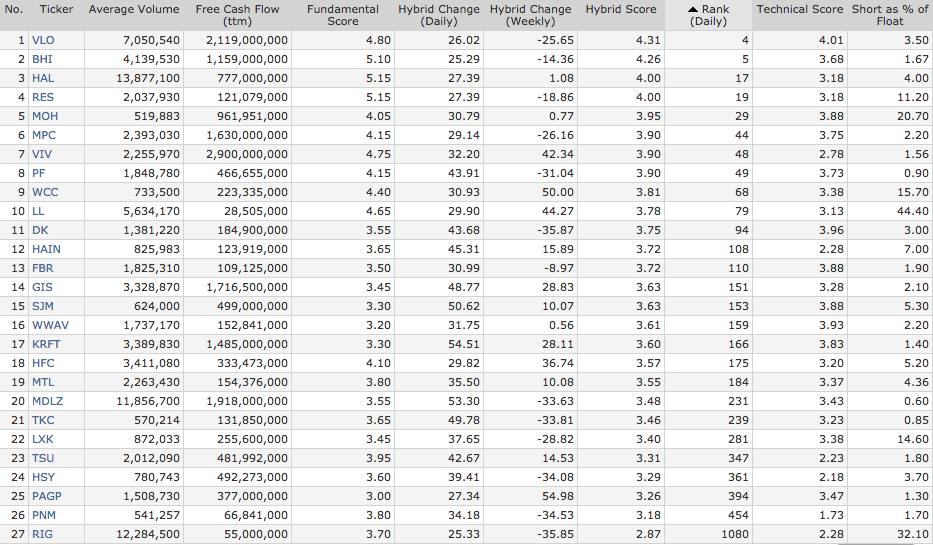

Here’s a look at today’s hybrid movers, however only those with positive free cash flow: