Remember back in January when I was buying oil, SLCA under $25, and told you the seasonal trends were forever in our favor? Well, most of you spit at me, like camels, siding with Dennis Gartman’s brain-dead philosophy that dictated oil was heading back to pre-industrial era pricing of a nickel per barrel. Here we are with Q1 in the books and you’re all slobbering over yourselves, trying to get back into oil.

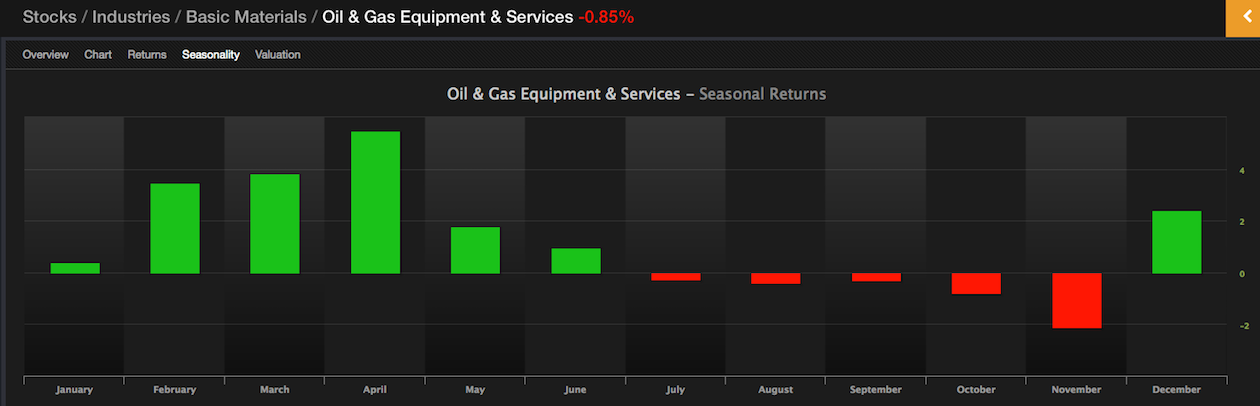

Let’s not be reactionary, ok? Have a look at the season trends again, courtesy of Exodus.

Even an infant can see that oil is a highly seasonal commodity, pertaining to the performance of equities. Do yourselves a favor and avoid it for now. That doesn’t mean to short it or wait for a dip to buy it. That means avoid it. Do you hear me, fuckheads?

Moving on, markets should trade higher today. The weather is a bit gloomy and Blustar is a bit doomy; but the Sun Also Rises and before you know it, speculative fervor will be back in the tape, pushing halfway retarded, dim-witted, money managers back into the fray–chasing performance. It is my belief there is vast under-investment in this country, particularly with persons under 35 years old.

Let’s see how the market responds by 10am before making wild assumptions.