Cyber-attacks on governments and corporations has become a routine part of the daily news.

For instance, the highly publicized cyber-attack on Sony Pictures Entertainment last year underscored the type of greatly feared computerized threat that exists. Besides financial losses, cyber attacks have the ability to disrupt financial markets, invade business privacy, and shut down or manipulate energy infrastructure, weapons defense systems, medical devices, and transportation systems. As a result, defense against cyber-attacks has become a very big business.

(Audio) Portfolio Report Card: Analyzing a $420,000 Account + Decluttering Your Portfolio

Picking which stocks within the fast moving cyber-security sector that will be the winners is like looking for a needle in a haystack. And that’s why on Dec. 10, 2014 we wrote to via our Weekly ETF Picks:

“What we’re witnessing is the unfolding of a major investment theme and we’re buying the PureFunds ISE Cyber Security ETF (NYSEARCA:HACK) at $26 as a direct way to capitalize. HACK owns a small basket of 30 global stocks focused on software systems and other solutions that defend against cyber-attacks.”

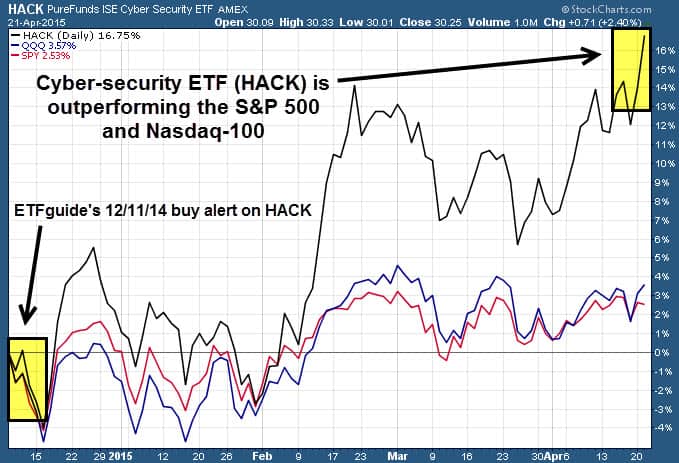

On 4/21, HACK broke above $30 per share and is now among the top performing sector ETFs this year.

The chart below shows how HACK has outperformed both the SPDR S&P 500 ETF (NYSEARCA:SPY) and Nasdaq-100 (NasdaqGM:QQQ) by more than 13% over the past four months alone. And HACK has gained almost 17% since our 12/10/14 time stamped buy alert.

Among HACK’s top 10 holdings are Infoblox (NYSE:BLOX), KEYW Holding Corp. (NasdaqGS:KEYW), Proofpoint (NasdaqGM:PFPT), and FireEye (NasdaqGS:FEYE). These companies offer cyber security solutions including hardware, software and services.

HACK is linked to the ISE Cyber Security Index and is rebalanced semi-annually. The index uses a modified equal weighting method which means that no single stock represents more than 20% of the weight of the index. Additionally, the cumulative weight of all components with an individual weight of 5% or greater do not in the aggregate account for more than 50% of the weight of the index.

The U.S. accounts for almost 70% of HACK’s country exposure with Israel (13%) and the Netherlands (4.95%) just behind.

As the globe becomes ever more interconnected and reliant on computerized networks, the frequency and scale of cyber-attacks is likely to increase.

Follow us on Twitter @ ETFguide